Cava (NYSE: CAVA) is the Next Chipotle, But It’s the Chipotle of 2015

Cava is headstrong on storefront growth at the cost of health and food safety standards, a combination that did not end well for Chipotle…

Cava is headstrong on storefront growth at the cost of health and food safety standards, a combination that did not end well for Chipotle in 2015. Cava will face heavy pressures from labor unions in expansion geographies, which Cava has not faced with its red state-driven expansion of the past few years. I am short the equity of Cava.

Background

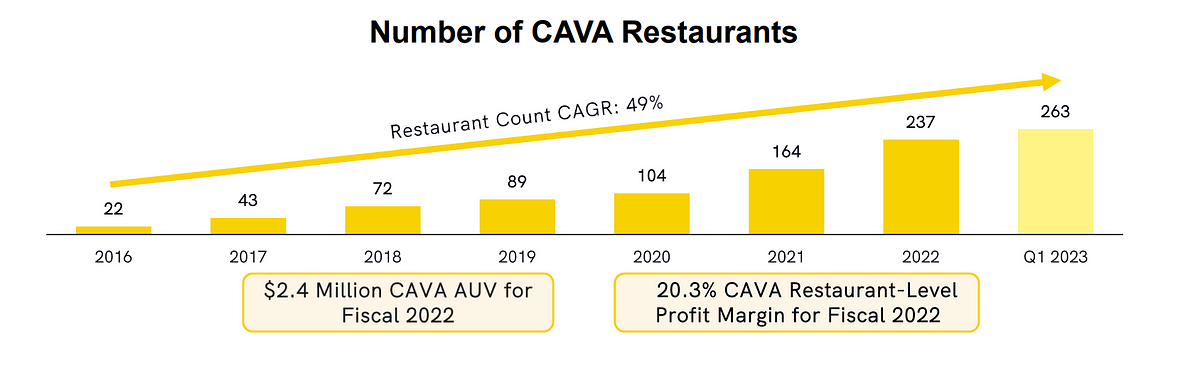

Cava (NYSE: CAVA) is a Greek-style fast casual restaurant chain of 290 storefronts per Cava’s latest 10-Q, quickly growing to 300+ storefronts at present time. Leading up to and after Cava’s June, 2023 IPO, Cava has been compared to Chipotle (NYSE: CMG) by consumers, stock promoters, and equity analysts.

The bull narrative is based on:

a) Chipotle’s stock market success over the past five years, from 2018 to date

b) The fact that both restaurants serve assembly line, build-a-bowl-or-wrap offerings

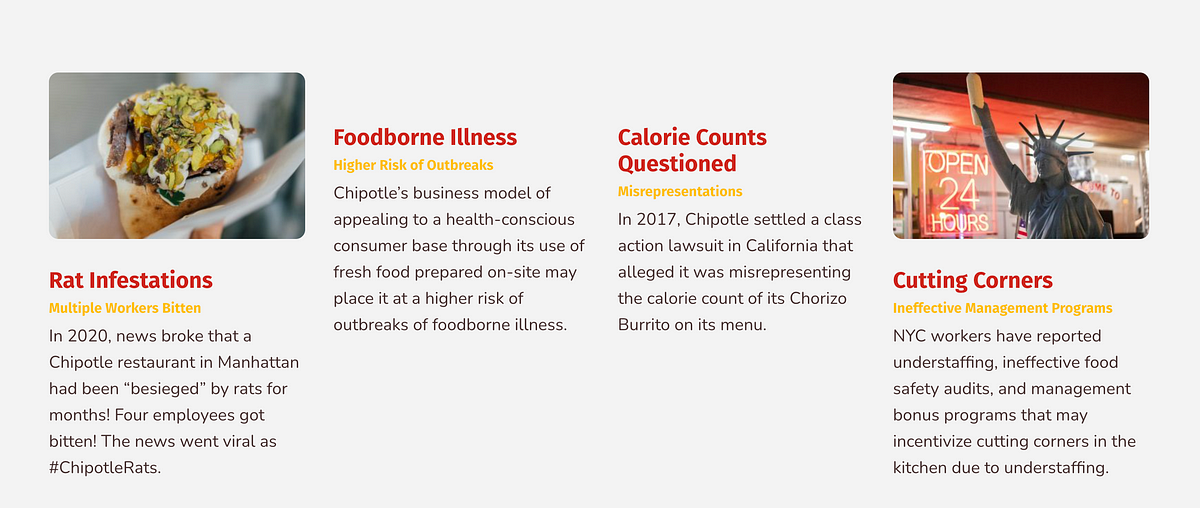

This cursory, often-parroted pattern-match misses the dark period of Chipotle from 2015–2018, when Chipotle’s stock was in the tank due to a series of food safety health crises due to E. coli, salmonella, and norovirus outbreaks.

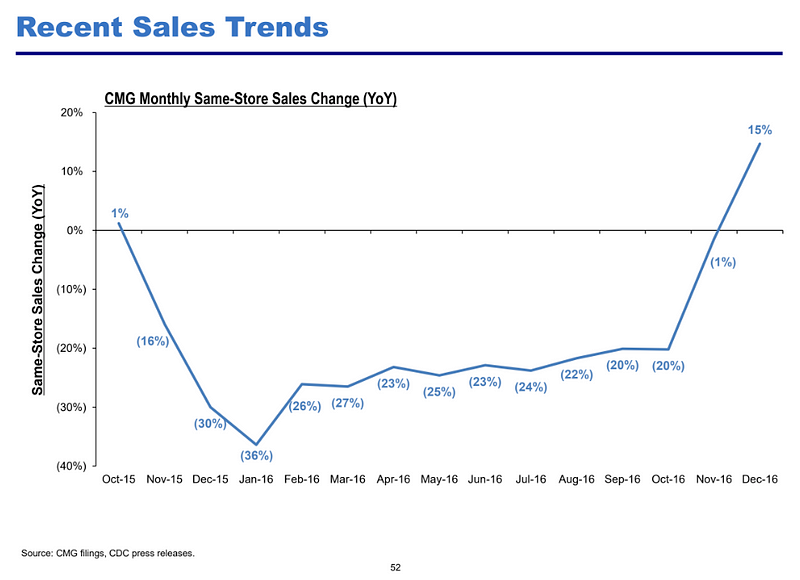

In 2015 to early 2016, Chipotle experienced numerous health crises that made the national news.

- August, 2015: over 200 cases of norovirus were linked to a Chipotle in Simi Valley, CA, including several Chipotle employees testing positive for norovirus. (link)

- August-September, 2015: 64 people in Minnesota across 22 Chipotle restaurants were sickened by Salmonella thought to have been caused by tomatoes at Chipotle. (link)

- October, 2015: 43 Chipotle locations in Oregon and Washington were closed after an E. coli outbreak that sickened 50 people was linked to several area Chipotle locations. (link)

- December, 2015: 140 people were struck with norovirus after eating at a Boston-area Chipotle, after an employee was allowed to work while sick. (link)

- Additionally, several other smaller outbreaks occurred around this time period.

Chipotle’s stock dropped around 40% in late 2015 to early 2016 given the health crisis and loss of investor confidence due to lost sales and projected future lost sales. Activist investor Bill Ackman of Pershing Square Capital came on in 2016, bought up about 10% of the stock, took board seats, and within a year co-CEO Monty Moran was out, soon to be followed by co-CEO and Founder Steve Ells.

It took Chipotle over three years for equity valuation to recover.

I believe that Cava is playing with fire when it comes to food safety, and I believe Cava is too focused on new store growth at the cost of in-store operations at existing Cava locations. This tradeoff that Cava management has accepted tells a strong growth narrative that has driven the stock price of Cava since IPO in June, 2023.

I’m betting on a Cava health crisis in 2024.

I. Declining Health Standards at Existing Cava Locations

For the Cava stock to work in the next one-to-two year horizon, everything must go right for Cava. Cava needs to open new stores, reinvest profits, open new stores, reinvest profits, over and over again. This is all buoyed by the $300M+ raised via IPO. Cava needs to expand in new markets and increase its footprint from 24 states + Washington, DC. Most of the US market is not familiar with the Cava brand.

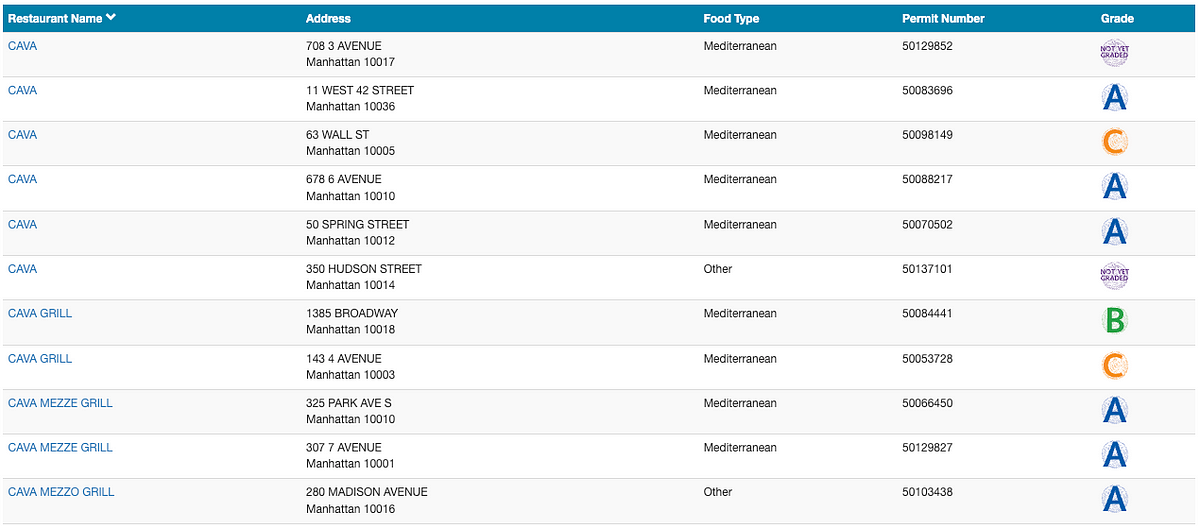

Cava is currently experiencing a decline in health sanitation standards in the New York City market. Given that Cava claims in its filings that the Northeast region and urban stores generate the highest AUV, or average unit volume, of its locations, it’s safe to say these New York City locations are among the chain’s most revenue generating locations overall.

As of January 28, 2024, of Cava’s 11 Manhattan, New York locations, 3 have declined to “B” or “C” health grades.

As of January 28, 2024, 1 of the 2 Brooklyn, New York locations has declined to a “C” health grade.

This public data can be accessed online here.

Discounting the two restaurants with “Not Yet Graded” status, this means 4 of 11 New York City Cava locations are below an “A” health grade, or put another way ~64% have an “A” health grade.

As a comparison:

This 2018 survey of 2017 data by The New York Times found that of graded NYC restaurants (not closed, and not restaurants in a Grade Pending or similar status)

- 22,185 restaurants were “A” graded

- 1,256 restaurants were “B” graded

- 315 restaurants were “C” graded

This means that of all restaurants with a grade across New York City, ~93% had “A” grades per New York Times’ results published in 2018.

New York City historical restaurant health inspection data is available here.

Although this data fluctuates day to day given that restaurant health inspections happen year round, generally around 90% of New York City restaurants have an “A” rating at any given time over the past few years.

Cava is underperforming significantly, and this is embarrassing for a “health conscious” corporate storefront business model.

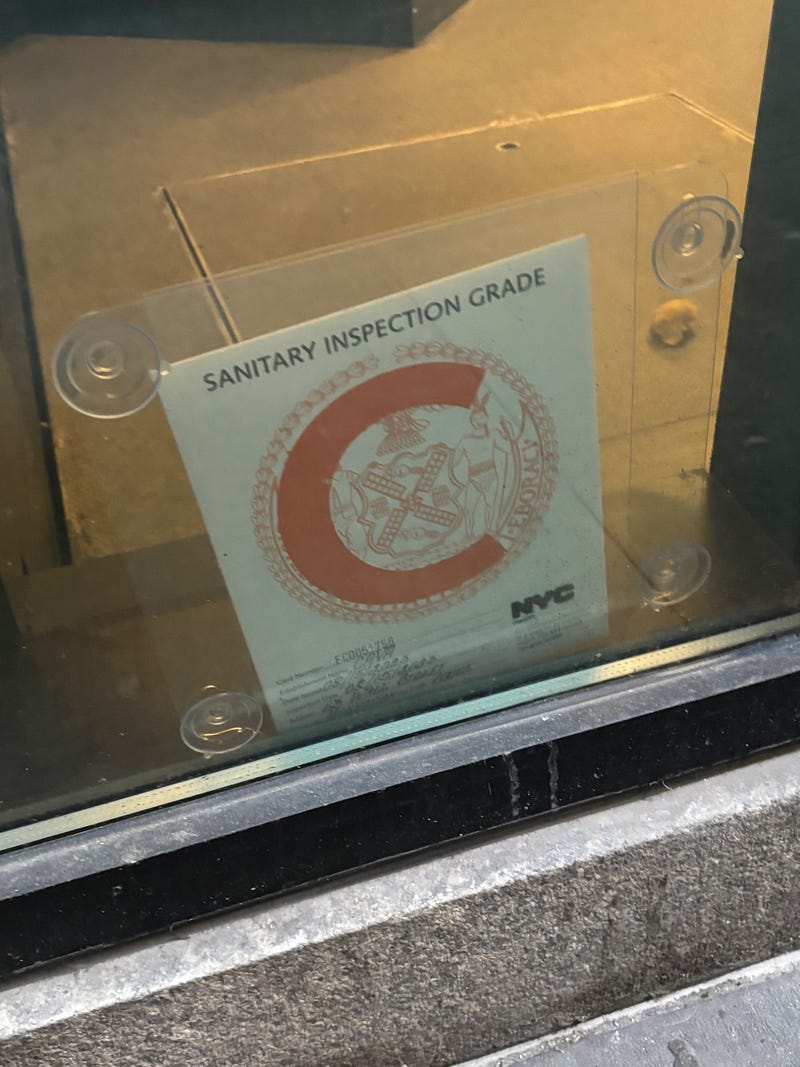

63 Wall Street Cava: Hiding Their “C” Grade Around the Corner in the Bottom of a Window

This Cava location, located a mere two blocks from the New York Stock Exchange where Cava trades, hit a whopping 71 points of health code violations.

For scale and scope, a New York City restaurant earns an “A” with an inspection score of 0 to 13 points, a “B” with 14 to 27 points, and a “C” with 28 or more points.

The 63 Wall Street Cava location was actually shut down by the city in October, 2023 for failing to display their “C” health grade.

Today, their “C” grade can be found not at the front entrance, but around the corner, hidden away from consumers.

The health shenanigans have been going on at this location for eight months now. This is not a one-time issue; inspectors have been back to the location multiple times since the store scored a “C” in May, 2023.

- May 17, 2023: 63 Wall Street Cava scores a “C” with 44 health violation points.

- August 15, 2023: 63 Wall Street Cava scores a “C” with 71 health violation points upon re-inspection, doing even worse.

- October 2, 2023: 63 Wall Street Cava scores a “C” with 52 health violation points upon re-inspection. The restaurant was cited for failing to display their “C” grade and was shut down by health officials.

- October 10, 2023: 63 Wall Street Cava is re-inspected to reopen and passes, but maintains a “C” grade.

To reiterate, a “C” is 28 health violation points and up and roughly 90% of NYC restaurants over the past few years have “A” grades.

This obviously valuable location lost about a week of Q4 revenue due to being shut down on October 2.

The record of inspections is available here. All New York City restaurant health inspection data is on the public record.

143 4th Avenue Cava is a “C” Grade that Racked Up 84 Health Code Violation Points and Currently Has Paint Chipping Off the Front Door

This Union Square location, also previously an “A” graded location, has been a “C” grade since December 2, 2022. Among the issues present upon the “C” graded inspection:

1) No hand washing facility in or adjacent to toilet room or within 25 feet of a food preparation, food service or ware washing area. Hand washing facility not accessible, obstructed or used for non-hand washing purposes. No hot and cold running water or water at inadequate pressure. No soap or acceptable hand-drying device.

2) Food contact surface not properly washed, rinsed and sanitized after each use and following any activity when contamination may have occurred.

3) Filth flies or food/refuse/sewage associated with (FRSA) flies or other nuisance pests in establishment’s food and/or non-food areas. FRSA flies include house flies, blow flies, bottle flies, flesh flies, drain flies, Phorid flies and fruit flies.

4) Wiping cloths not stored clean and dry, or in a sanitizing solution, between uses.

5) Cold TCS food item held above 41 °F; smoked or processed fish held above 38 °F; intact raw eggs held above 45 °F; or reduced oxygen packaged (ROP) TCS foods held above required temperatures except during active necessary preparation.

6) Hot TCS food item not held at or above 140 °F.

7) Dishwashing and ware washing: Cleaning and sanitizing of tableware, including dishes, utensils, and equipment deficient.

8) Establishment is not free of harborage or conditions conducive to rodents, insects or other pests.

9) Non-food contact surface or equipment made of unacceptable material, not kept clean, or not properly sealed, raised, spaced or movable to allow accessibility for cleaning on all sides, above and underneath the unit.

I believe Cava management is letting these high value, urban stores that have been around for several years go to disarray for two primary reasons:

- Cava management is solely focused on pumping new store growth, and this tradeoff comes at the cost of maintaining existing locations with adequate staffing and facilities standards.

- These New York City locations likely trend high in food delivery app and corporate bulk lunch orders. Much of the revenue attributed to these storefronts is likely disproportionately coming from consumers who may not have actually physically visited the location.

If this is where Cava’s hairline “profitability” comes from — reducing staff and ignoring health sanitation standards at existing stores — this is a ticking time bomb for a food poisoning or food allergy outbreak.

Clearly the standards are so low in some locations that these restaurants are scoring more than double the 28 health violation points needed for a “C” grade.

These “B” and “C” Cava stores are in roughly the bottom 10% of all New York City restaurants by health standards.

II. Food Safety Issues in Cava’s Marketing

Cava makes a number of questionable claims about food safety in their corporate marketing.

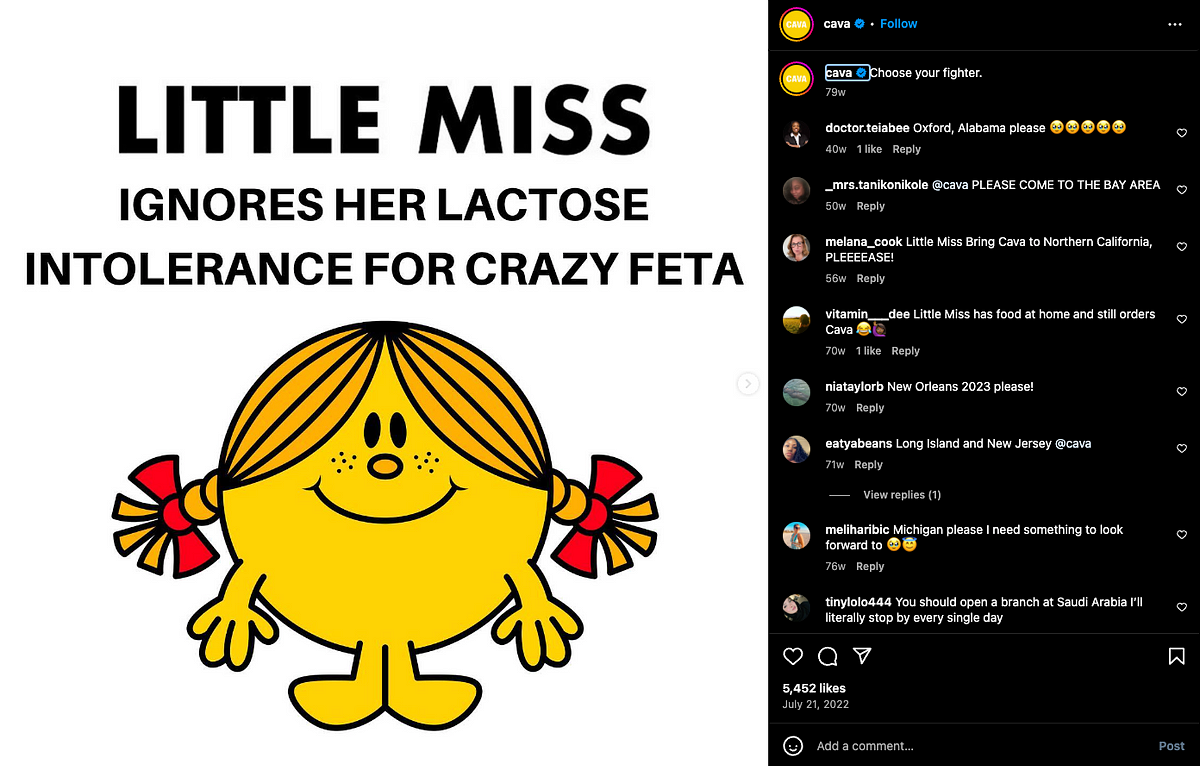

Cava relies heavily on social media and influencers to promote brand awareness, even going so far as noting their Instagram and TikTok metrics as part of their S-1. Additionally, YouTube Gen Z influencer Emma Chamberlain is specifically mentioned eight times in the S-1.

Cava’s corporate Instagram account has repeatedly urged consumers with lactose intolerance to ignore their lactose intolerance and try Cava’s Crazy Feta dip. There are several of these cringy posts going back over a year.

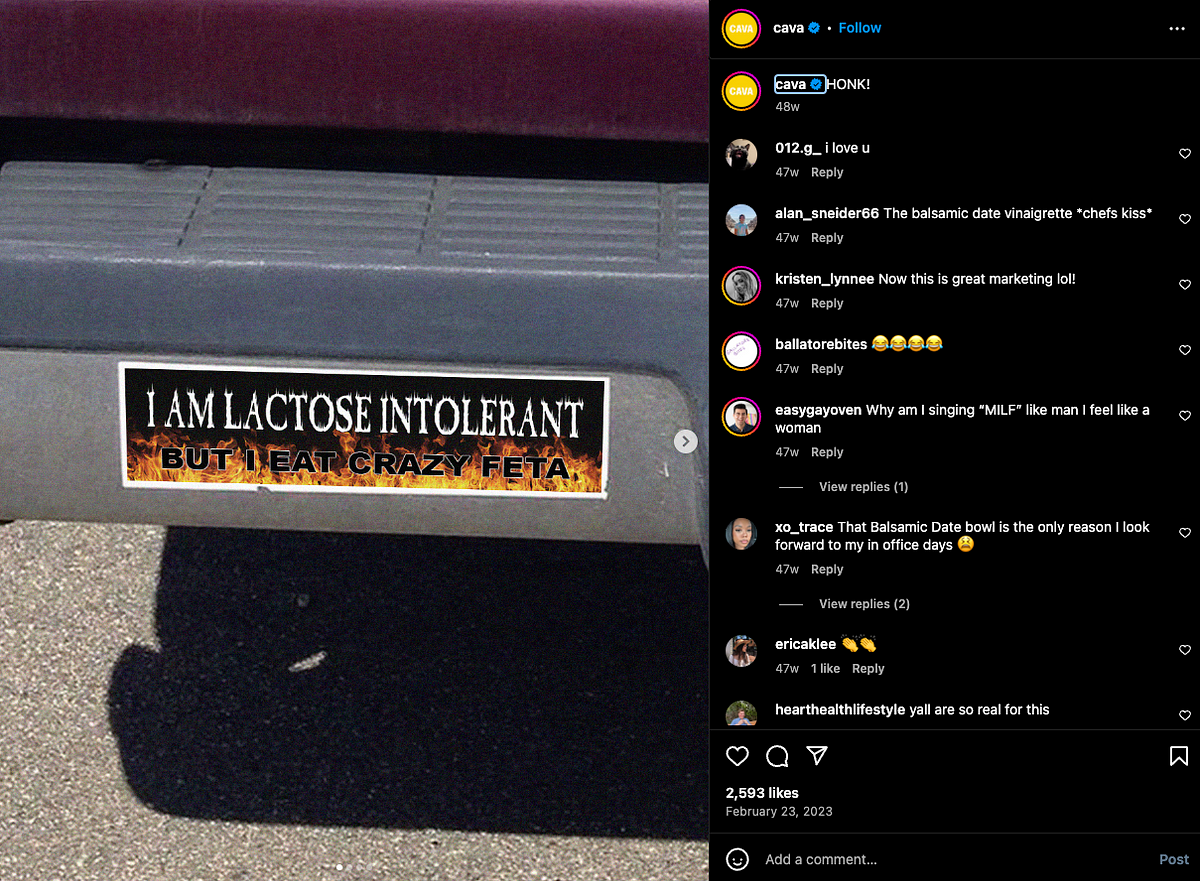

On July 18, 2023 Cava customers were invited to visit Cava locations to pick up “I Am Lactose Intolerant But I Eat Crazy Feta” bumper stickers among other give-aways, again promoting the consumption of Cava’s Crazy Feta among people with lactose intolerance.

Cava even has a paid partnership with social media influencer Nick Trawick promoting the idea of ignoring lactose intolerance to try Cava’s Crazy Feta. Nick has a whole song-and-dance number about eating Cava’s Crazy Feta even though he is lactose intolerant.

There are a number of food safety issues present in this ordeal. You’ll notice in the comments on these social posts that a number of consumers claim that Feta is low in lactose compared with other cheeses, when in fact this is not correct.

The Crazy Feta that Cava serves is not authentic Greek Feta cheese, which is mandated by EU trade law to contain a minimum of 70% sheep’s milk and no more than 30% goat’s milk. Sheep’s and goat’s milk can be naturally lower in lactose than cow’s milk, and sheep’s milk is sometimes cited by people with lactose intolerance as being easier to digest than cow’s milk.

However, the number one ingredient in Cava’s Crazy Feta is cow’s milk. There is absolutely a high lactose content in this product, as this is not authentic Greek Feta but an Americanized version.

I do not believe Cava has an “adult in the room” around any of this bizarre marketing meant to drive incremental sales while risking consumer health.

Cava has made it very clear to investors in their filings and in interviews that they market heavily toward Gen Z, and about half of Gen Z is still teenagers. By using social media influencers with high teenage followings, Cava is not only promoting to adults the idea that their Crazy Feta product is so tasty that lactose intolerant consumers should try it, but also to minors.

Further, having Cava restaurant employees give away bumper stickers that claim “I Am Lactose Intolerant But I Eat Crazy Feta” builds a culture among Cava employees that food allergies and cross-contamination are not to be taken seriously.

This is terrible risk management on the part of Cava leadership, and it speaks volumes to how this business approaches food safety.

III. Food Safety Issues in Cava’s Supply Chain

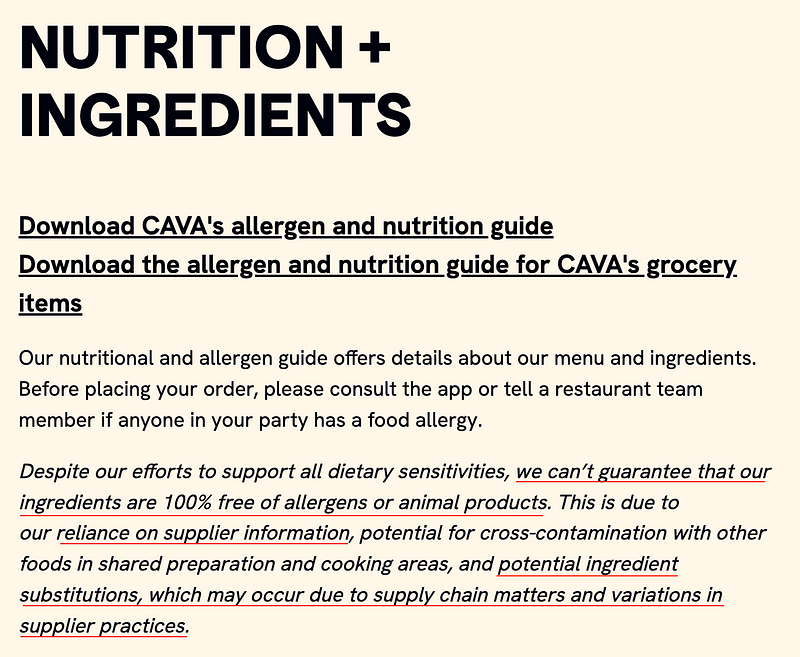

On Cava’s website page for information about nutrition and ingredients, Cava claims that they cannot guarantee food allergy safety, instead blaming potential ingredient substitutions on their suppliers.

While cross-contamination (e.g. a piece of meat falls into a vegetarian dish) can occur in any restaurant, the fact that Cava claims they do not actually have control over ingredients provided by their suppliers is wild. Clearly, Cava does not have strong negotiating power in their supply chain relationships, which is a risk equity investors may wish to note.

On July 17, 2023 Cava issued a recall of its grocery CPG product Spicy Hummus after a retail store notified Cava that packaging lids for Spicy Labneh, which do not declare sesame as an ingredient, were applied to containers of Spicy Hummus, which contains sesame. A third-party supplier had put the wrong lids on the wrong product containers.

The Cava Spicy Hummus recall FDA notice can be read here.

Failing to Label or Mislabeling Sesame and Dairy Products is No Joke for Fast Casual Chains

Mislabeling products containing sesame allergens was a recurring issue at British fast casual chain Pret a Manger in 2015–2016, eventually resulting in the death of a 15 year-old girl. Pret a Manger had been notified several times of customer reactions to unlabeled sesame in their products, which resulted in several hospitalizations leading up to the death of this 15 year-old customer.

In 2017, another Pret a Manger customer died, this time a 42 year-old mother, after she consumed a product labeled as “dairy free” which did, in fact, contain dairy. Pret a Manger blamed their supplier, which did not have adequate testing in place and allegedly relied on “word of mouth” guarantees. The supplier blamed Pret a Manger. The British general public blamed Pret a Manger, which resulted in lost sales and significant negative brand sentiment in the following months.

“Pret a Manger Leaves 5 Children Motherless” is not a headline that plays well in any circumstance, especially when it comes after a string of hospitalizations and another death due to food related allergic reactions due to unlabeled or mislabeled products at the fast casual chain.

Cava is playing with fire with its supply chain standards and lack of control over supplier ingredients. Cava’s behavior around food safety is much closer to Pret a Manger in 2015-2017 and Chipotle of 2015–2016 than to Chipotle of 2024. Cava cannot guarantee the ingredients in the products they serve to consumers and they state this on their website.

IV. Cava’s Expansion Plans Require Locations in Pro-Union Geographies

A number of corporate-owned retail and restaurant chains from Starbucks to Trader Joe’s to Chipotle are experiencing heavy pressure from unions.

A Chipotle restaurant in Lansing, Michigan unionized with the International Brotherhood of Teamsters in late 2022. All it took was the participation of 14 people and an 11–3 vote in favor of unionization.

Currently, there are efforts in New York City soliciting Chipotle employees to unionize under SEIU. Among the chief complaints are not only wages or benefits, but safety and health standards within the restaurants.

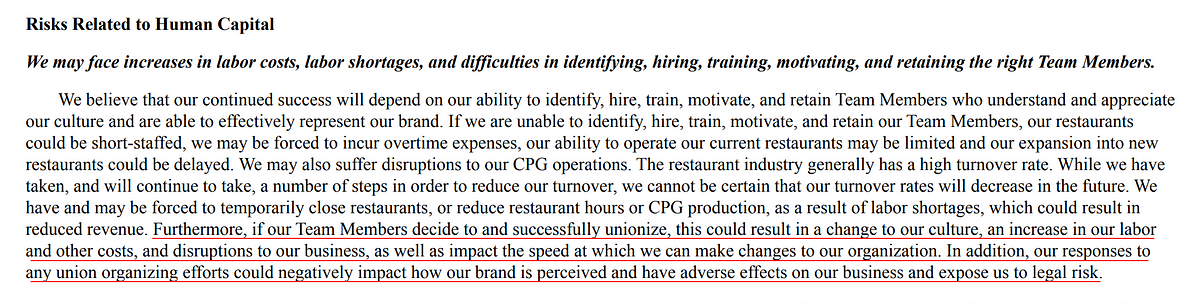

Cava management clearly understands at a high-level the risks that unionization presents for the business, even disclosing this in their S-1.

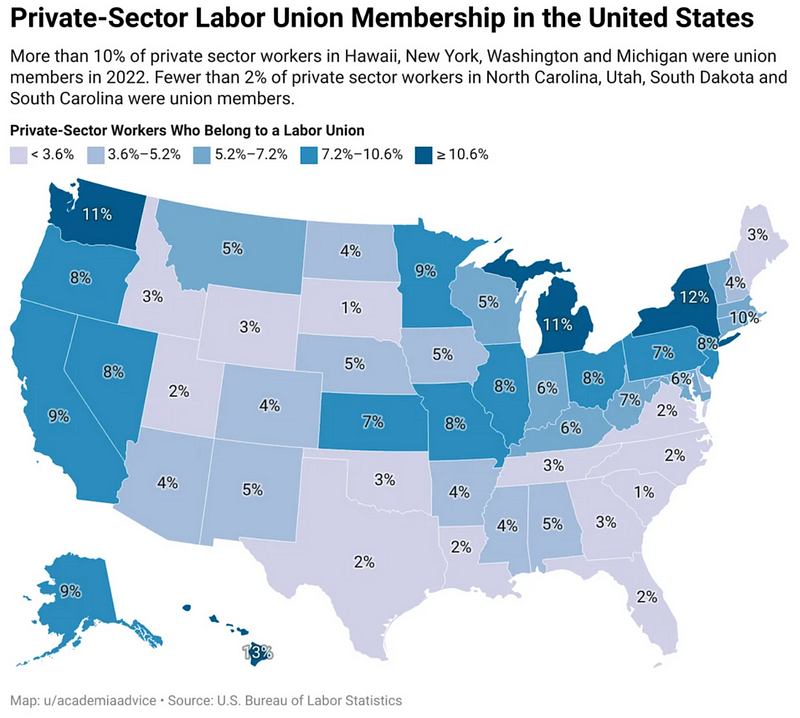

However, Cava’s near-term storefront growth expansion, which drives the primary bull case for Cava investors, is highly exposed to expansion specifically in geographies with strong union presence.

Cava’s storefront growth over the past few years has been primarily driven by Cava’s acquisition of Zoe’s Kitchen, and the conversion of 152 former Zoe’s locations into Cava storefronts.

These former Zoe’s Kitchen locations, however, are primarily located in Republican-dominated, union-unfriendly states in the Southeast and South-Central regions of the United States.

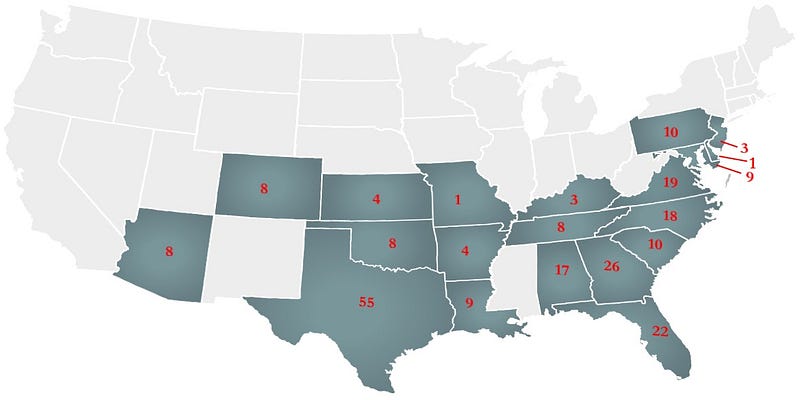

Per Zoe’s Kitchen’s last 10-K report before acquisition, for their fiscal year ending December 25, 2017, their US state level footprint was the below:

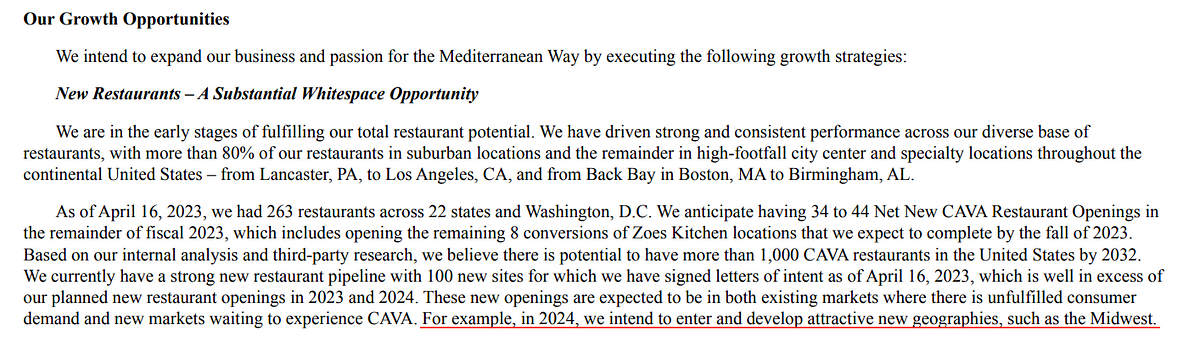

Cava has stated that in 2024 the company plans to open about 45 new locations.

Cava, on January 19, 2024, announced a new opening in Long Beach, CA, an extremely pro-union stronghold, with expectations to employ 30–35 local people.

Cava, on January 20, 2024, announced a new opening in Sherman Oaks, CA, a heavily pro-union stronghold, with expectations to employ 30–35 local people.

Cava plans to enter the heavily pro-union stronghold of Cook County, IL (Chicago) with a new location set to open in Schaumburg, IL in Spring of 2024.

Cava even discloses in its filings that the path to expansion will run through the Midwest.

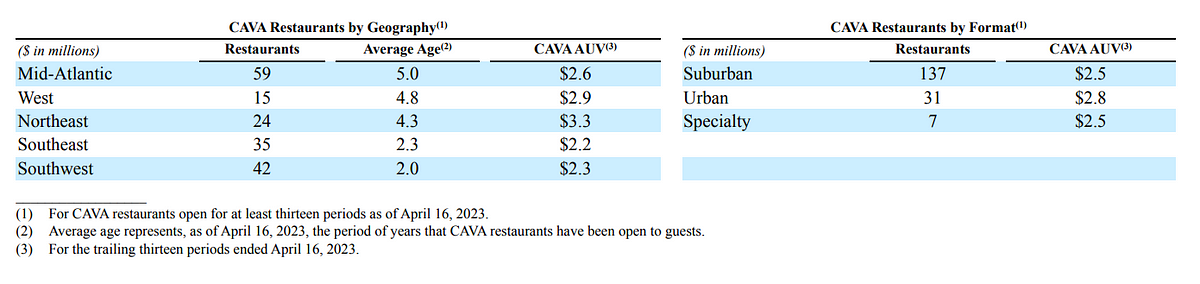

Further, in examining Cava’s geographic results, it becomes clear that Cava has to expand into heavily pro-union geographies as their Southeast and Southwest locations make lower AUVs than Northeast and West region locations.

Cava would say that these Southeast and Southwest locations simply need more time to grow into AUVs, which is why Cava shows average age, however these Southeast and Southwest locations are heavily former Zoe’s Kitchens and were already established in their communities. The Southeast and Southwest markets cannot command the higher prices and corporate card group lunches that drive up AUVs in the West and Northeast.

When recent Chipotle worker union pressure began, it started with a location in Lansing, MI unionizing and there is now increased pressure in New York City.

When recent Starbucks worker union pressure began, it started with a location in Buffalo, NY, then quickly spread across New York State, then nationwide.

When Trader Joe’s worker union pressure began, it started with a location in Hadley, MA, then quickly spread to Minneapolis, MN and Louisville, KY.

When Recreation Equipment, Inc. (REI) worker union pressure began, it started with pressure in Seattle, WA in 2016 and now the location in Soho in Manhattan, NY is unionized.

The Northeast, Upper Midwest/Rust Belt, and West Coast are the biggest labor union strongholds, and as Cava has a corporate store model with no layer of franchisees between Cava and employees, Cava will face additional union pressures as the chain expands in these regions away from their base of converted Zoe’s Kitchens.

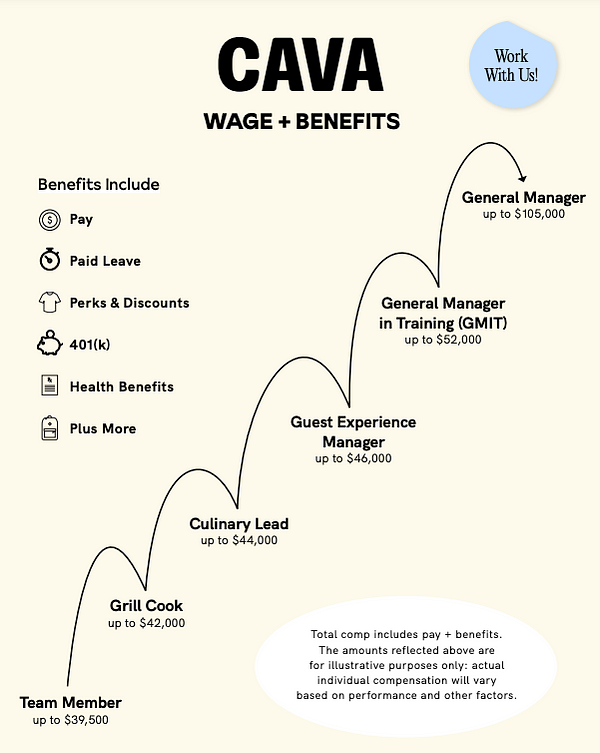

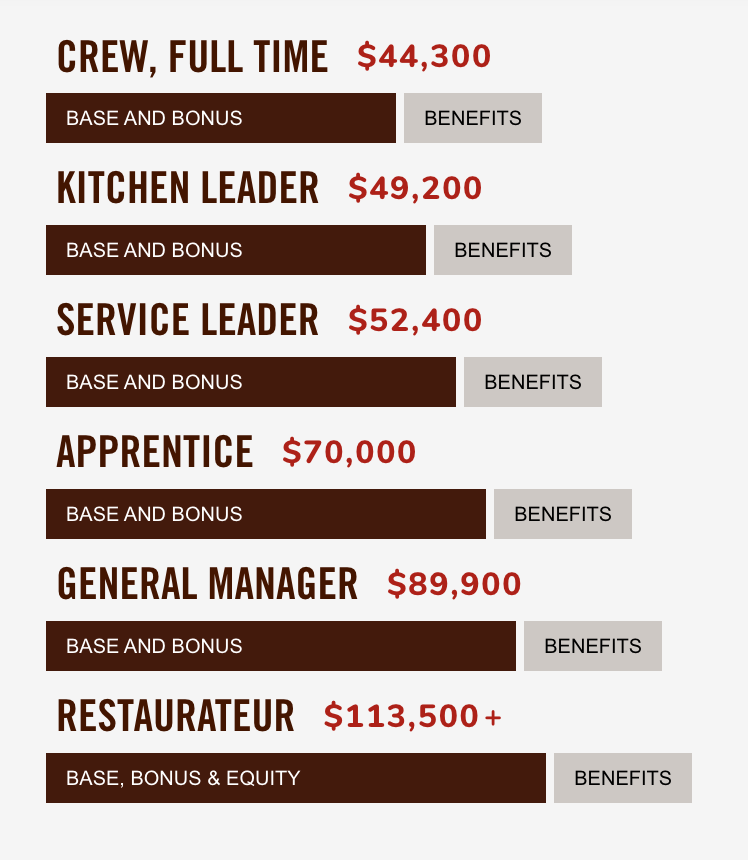

Cava Advertises Lower Wages for Restaurant Employees vs. Chipotle

Cava’s advertised wages for service employees and cooks are significantly lower than Chipotle’s advertised wages for similar positions.

Several items stand out with wage disparities among non-management restaurant employees.

- Team Members/Crew: $39,500 at Cava; $44,300 at Chipotle.

- Culinary/Kitchen Lead: $44,000 at Cava; $49,200 at Chipotle.

- Guest Manager/Service Leader: $46,000 at Cava; $52,400 at Chipotle.

- GM in Training/Apprentice: $52,000 at Cava; $70,000 at Chipotle.

I also note that both Cava and Chipotle already have stores in high minimum wage localities, such as Washington, DC, New York City, and California.

Chipotle has unionization efforts underway and there is no reason to believe that Cava won’t face this same pressure immediately, in the Presidential Election year of 2024, when they expand into pro-union geographies.

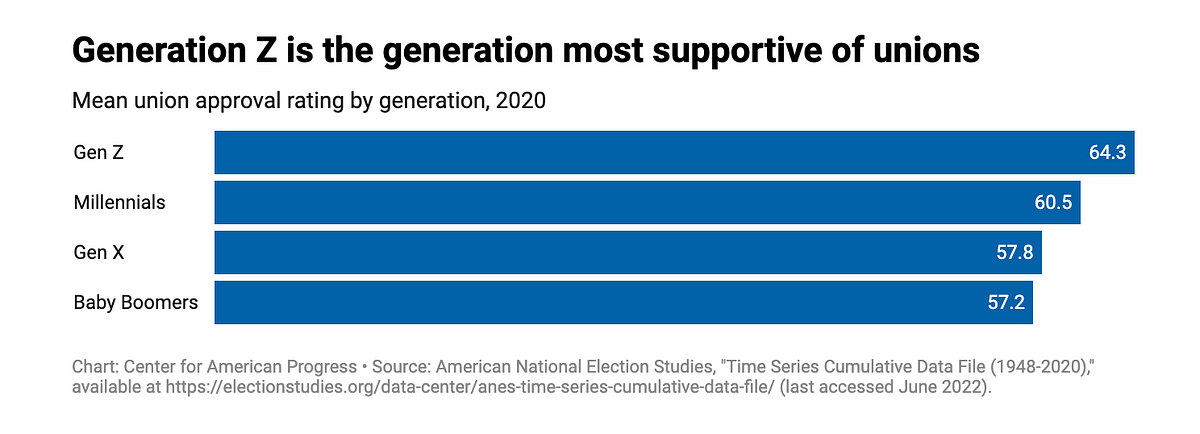

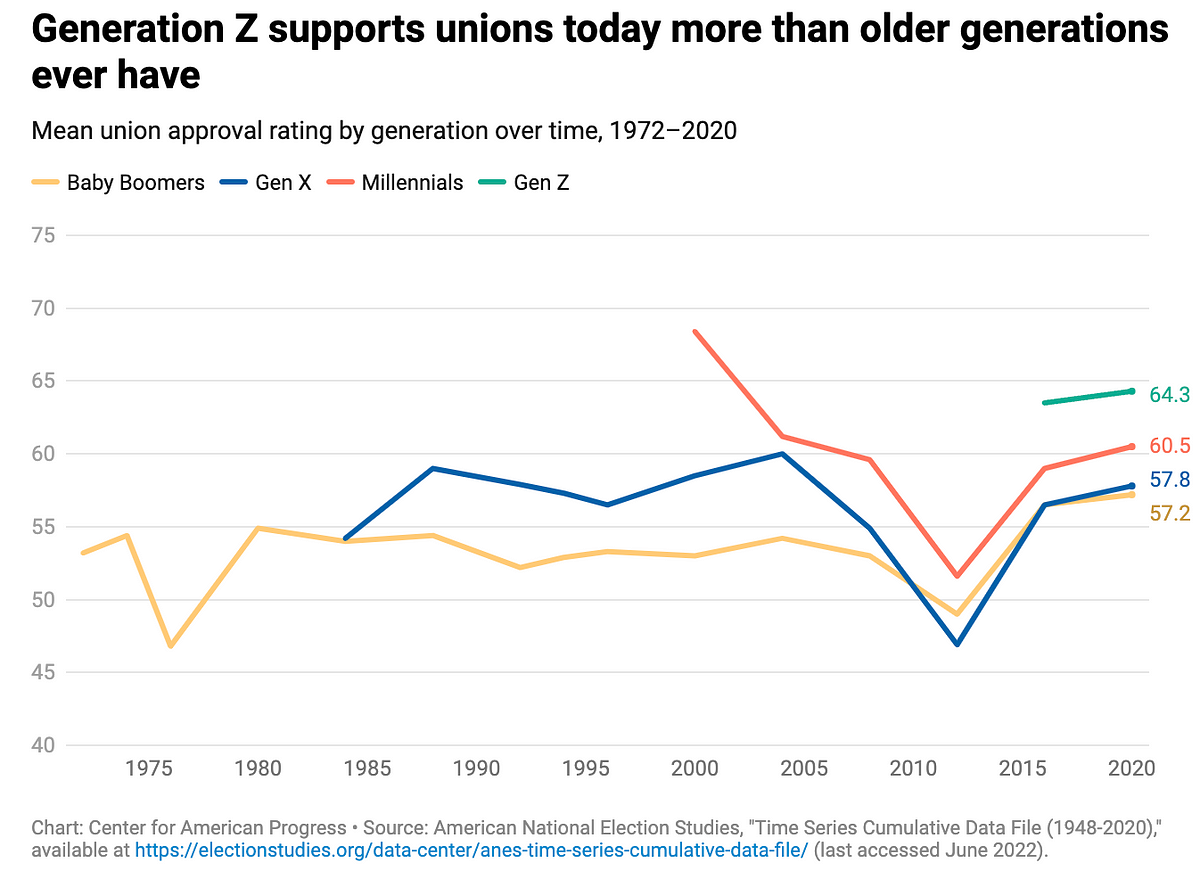

V. Cava’s Positioning as a Progressive and Gen Z Lifestyle Brand is a Liability

I believe Cava’s positioning as a progressive, Gen Z-focused lifestyle brand uniquely exposes it to food safety and labor union concerns. Starbucks and Chipotle have a broader demographic of customers.

When Cava faces increased union pressure, the company will have two options:

- Fight the unions, and risk brand and reputation damage among their progressive, Gen Z, and Millennial customer base

- Cave to the unions, and decrease store-level profitability in expansion locations and potentially across the chain

Gen Z Labor Union Favorability

VI. Trading Health Standards at Existing Storefronts and Ignoring Supply Chain Ingredient Issues In Favor of Focusing on New Storefront Growth Did Not Work for Chipotle in 2015–2016

I fundamentally believe there is a ceiling to how fast any restaurant or retail chain can grow net footprint year over year. The higher YOY storefront growth is, the more corners get cut on operational excellence at existing locations.

Additionally, any food safety or public health PR crisis slows forward growth. Resources become reallocated from expansion efforts to instead fighting PR fires and paying lawyers and communications firms. Additional time, headcount, and capital are reallocated to retrain staff and overhaul middle management. New employees ranging from entry-level restaurant employees to corporate employees become more expensive to hire.

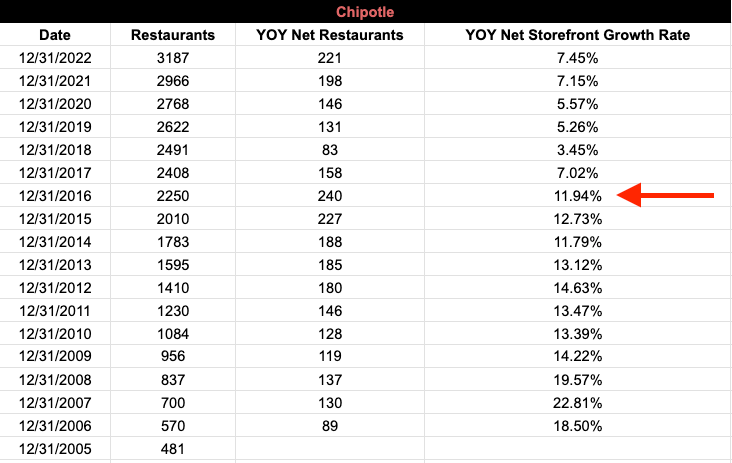

Chipotle’s YOY net storefront growth cratered after 2016, after growing net storefronts between ~12–23% a year each year the previous decade.

Cava disclosed their yearly storefront growth in their S-1. Their final 2023 numbers will be present in upcoming filings, and should come in just over 300, depending on when they count opening date.

I believe Cava is growing too fast and this leaves them exposed on health and sanitation issues. In the event of a food poisoning or food allergy outbreak, Cava will be forced to slow expansion into 2025 and the bull case growth narrative falls apart.

Summary

Not all growth is equal. Cava’s equity valuation is inherently tied to the belief that Cava will efficiently grow both revenue and net storefronts at an increasing clip. This is the existing narrative parroted by Wall Street media and retail investor-focused propaganda sites like The Motley Fool. Equity investors would be wise to ask the following questions of Cava Chief Executive Officer Brett Schulman:

- Where specifically will chain expansion growth occur into 2025? What investors will find is that much of this expansion is in heavily pro-union geographies.

- When is Cava going to address the sorry health state of high value urban locations with sub-par “C” health grades, like 143 4th Avenue in Union Square, 63 Wall Street in Lower Manhattan, and 345 Adams Street in Downtown Brooklyn. These are clearly high value stores to the chain that have gone to disarray. What is the path to getting these high-value urban stores back on track?

- How will Cava specifically address union pressures that are bound to occur as the chain expands in the Northeast, Midwest, and West Coast? Does Cava plan to cave to union demands or will Cava fight the unions and risk alienating the customer base, which clearly trends with pro-union demographics?

- Why does Cava state that they do not guarantee the fidelity of ingredients from their suppliers, and that suppliers may change ingredients without warning? This is major red flag for many with food allergies and it is a significant risk to the business. Consumers don’t want legalese, they want guarantees for themselves and their families when choosing dining options.

- Who is Cava going to attract and retain as restaurant talent, given that their publicly advertised wages for non-management restaurant staff roles are ~10% or more below wages at Chipotle for equivalent roles? Will Cava have to raise wages to compete with Chipotle and similar restaurants as Cava expands into geographies where Chipotles have existed for years? High turnover storefronts become operational nightmares and often become more expensive and riskier to operate.

I believe Cava is extremely exposed to risks that both institutional and retail investors have not considered. As Cava is as an Emerging Growth Company they are not currently held to Sarbanes-Oxley requirements around audits of controls over IT systems feeding their financial results. As such, I personally hold little weight to any non-GAAP numbers or metrics Cava may present in earnings or in other public communications. I also hold little weight to GAAP numbers and metrics. It’s too easy for Emerging Growth Companies to fiddle with their numbers and borrow from tomorrow’s accountability to play games today.

I believe as few as two food poisoning or food allergy related outbreaks would significantly sink the equity and crush expansion plans into new markets. I also believe Cava will face union pressures as Cava expands in 2024, which is bound to be an extremely politically volatile year given Donald Trump’s return as the likely Republican presidential nominee.

I believe the roughly $300M+ raised at IPO will be disproportionately spent on lawyers and PR fighting health crisis issues and negotiating with unions. This is a far cry from the narrative that the IPO is about profitable growth and expansion of storefronts.

When Chipotle faced food poisoning crises in late 2015, it took 14 months to recover same-store sale rates vs. prior year.

I have no reason to believe that Cava would not face a similar pattern in same-store sales decline if Cava were to face a public health crisis. While fast casual chains like Chipotle and Pret a Manger were able to absorb losses given their respective footprint sizes and years of built up brand equity with consumers, I do not see this happening with Cava. One or two health incidents would sink the relatively fragile equity valuation of Cava.

I encourage any readers to go check public health data in their states or local governments to assess the health scores of their local Cava locations.

I encourage any New York readers to visit the “C” graded New York Cava locations at 143 4th Ave, 63 Wall Street, or 345 Adams Street in Brooklyn. I believe most of these store sales are disproportionately driven by digital and corporate lunch orders placed without consumers physically visiting the store locations. Visit the locations. Check out the “C” health grade signs. Go back a day or two later and see whether these “C” health grade signs are moving around because at Cava they’re suction cupped to windows instead of taped to windows like at literally every other restaurant.

I am not kidding around. Cava has their health scores in New York City displayed in easily moveable suction cup contraptions, making it easy to hide and relocate negative health score signs.

Go check out the sanitation and quality standards of the food lines and peek toward the back to see what is going on in the kitchens at these locations.

I believe many institutional investors and people in the New York-area finance community have only ever eaten at Cava through digital and/or corporate lunch orders. I do not believe many understand the consumer experience in these stores, and I believe many have not even stepped foot in a Cava location.

The bull narrative may change.

I have taken positions short the equity of Cava. I believe Cava is likely to face a public health crisis in 2024. I believe Cava is a toxic brand ready to pop and when this pop happens in 2024 Cava will trade near 1.8-1.5x cash on a broken growth narrative into early 2025, then as cash dwindles, ultimately trade near to below cash into mid/late 2025 as Cava posts declining sales results.

This company is playing with food safety fire in their marketing, in their supply chain, and at the restaurant operations level.

Why wouldn’t Cava have a health crisis? They’re doing everything wrong.

________

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. Lauren Balik does not represent the interests of any fund or of any investor other than herself. Past performance is not indicative of future results. This content speaks only as of the date published. Any projections, estimates, forecasts, targets, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.