Groupon Has Become a GLP-1 Affiliate Marketing and Bootleg Microsoft Office Racket

The "turnaround" of Groupon (NASDAQ: GRPN), especially around the key North America Local segment, is one big sham. Groupon has benefitted greatly from two major trends in 2024 into early 2025, which correspond with their recent rise in their stock price from $12.00 to $32.94 year-to-date. The first trend is the proliferation of compounded semaglutide/tirzepatide and the second trend is Microsoft's once-every-three-years new Microsoft Office version release, which came in October 2024 with the release of Office 2024.

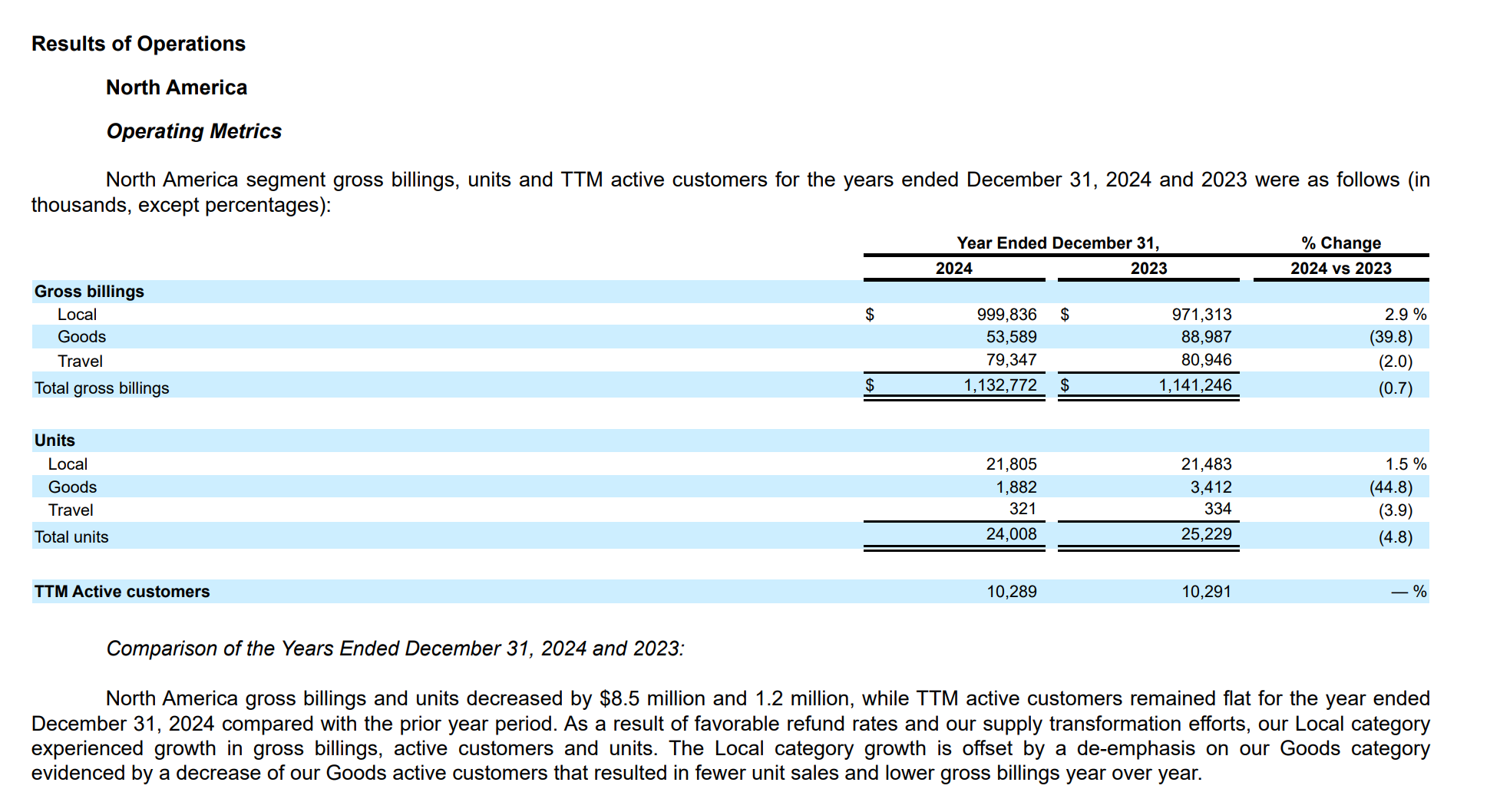

Both trends are now in the rearview mirror and Groupon faces major headwinds. Groupon's segmentation of "Goods" vs. "Local" billings and revenue in their financial reporting is highly questionable, with clear evidence of segments shifting around under Groupon's current management team.

- Groupon is a Chicago-based "deals" platform widely known for providing coupons and discounts for restaurants, escape rooms, massages, and Great Wolf Lodge tickets.

- In 2023 Czech private equity firm Pale Fire Capital installed their team as Groupon management, with Pale Fire's Dusan Senkypl now serving as Groupon Chief Executive Officer and Pale Fire's Jiri Ponrt coming over to serve as Groupon Chief Financial Officer.

- Through June 6, 2025 GRPN is up 174% year-to-date, driven by investor confidence that Groupon is not as much of a "melting ice cube" as believed, with the new Czech management team executing on a turnaround plan focused on expanding Groupon's core North America Local segment that makes up the majority of the business while the company divests from less profitable markets like Italy.

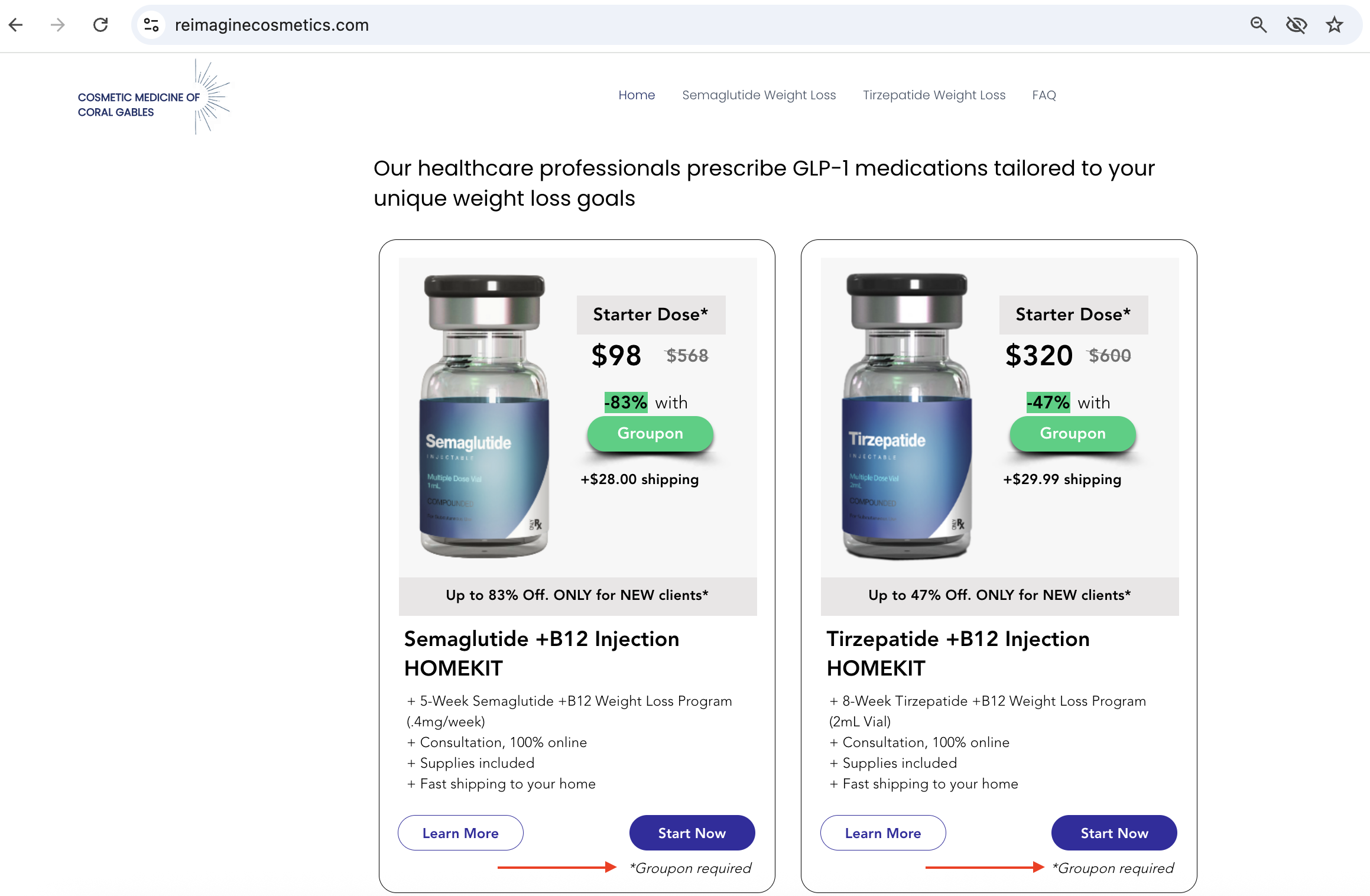

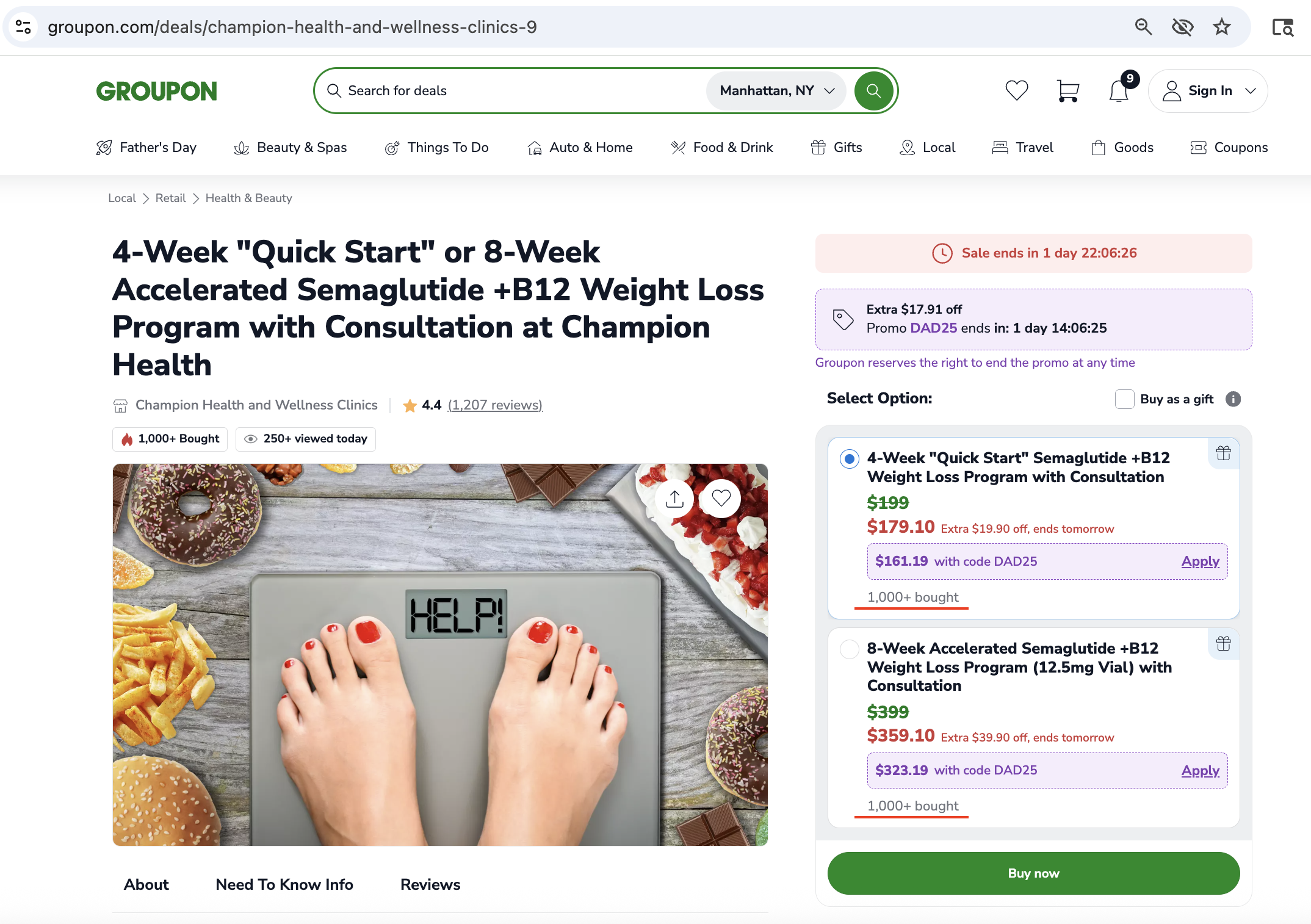

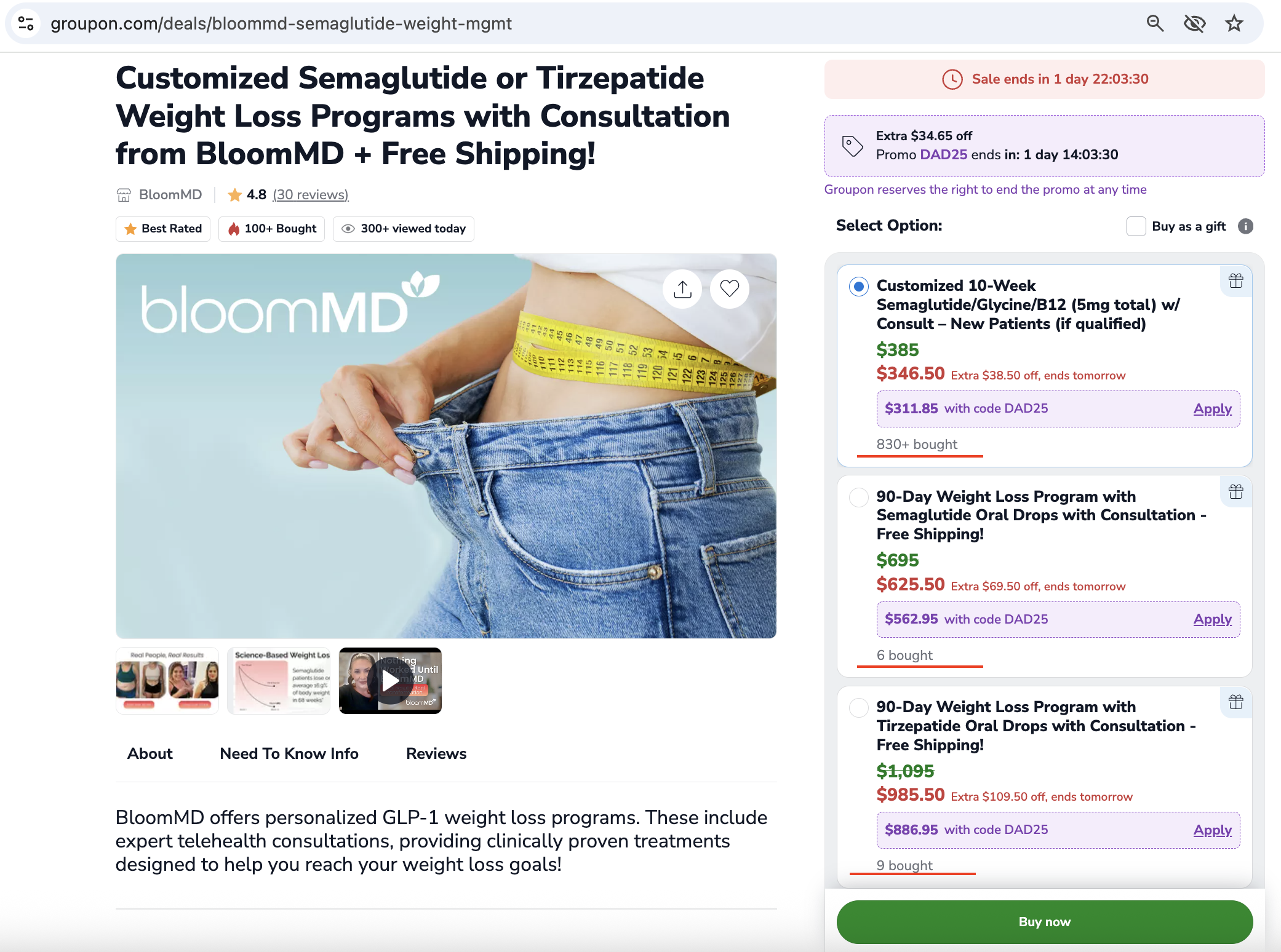

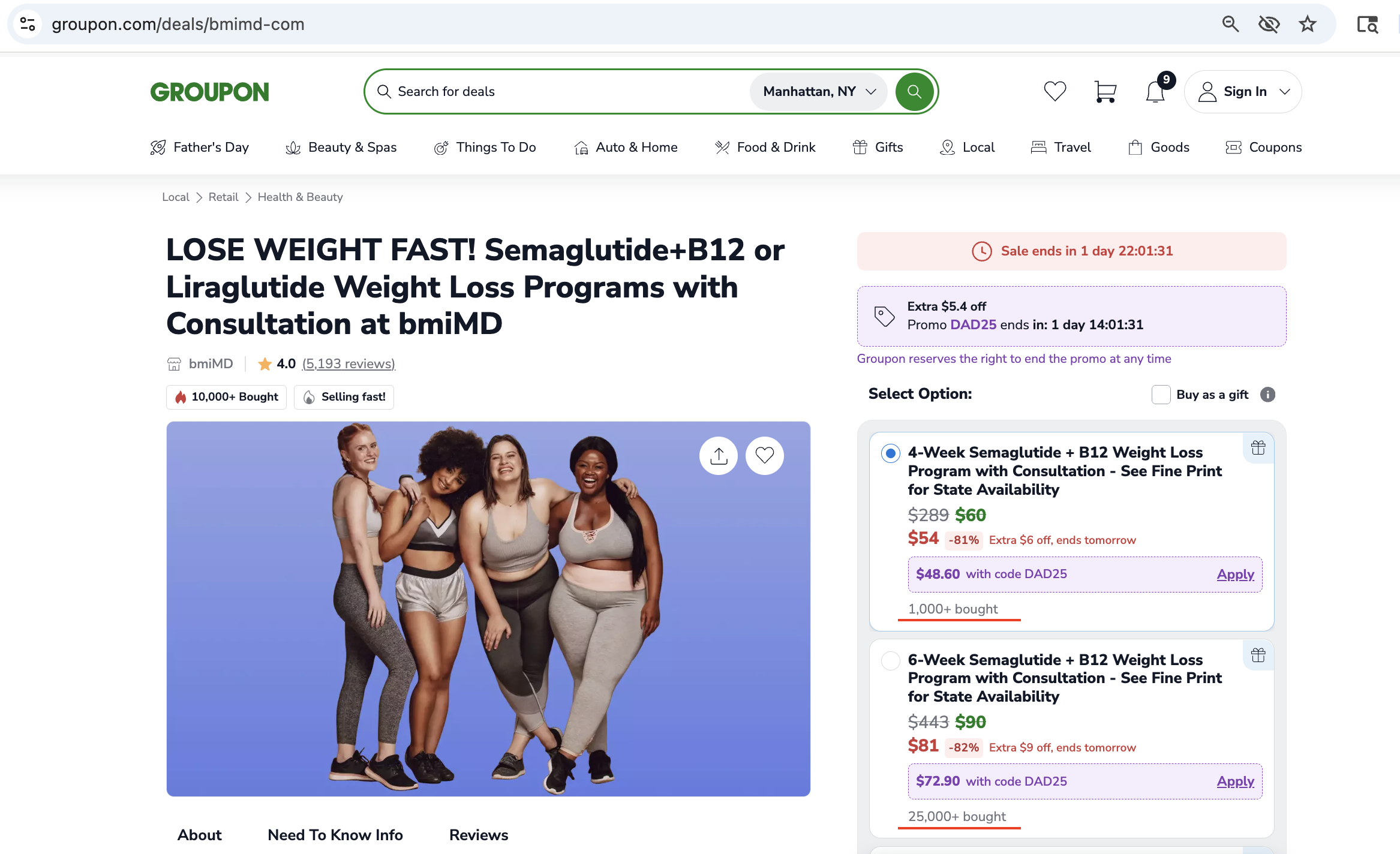

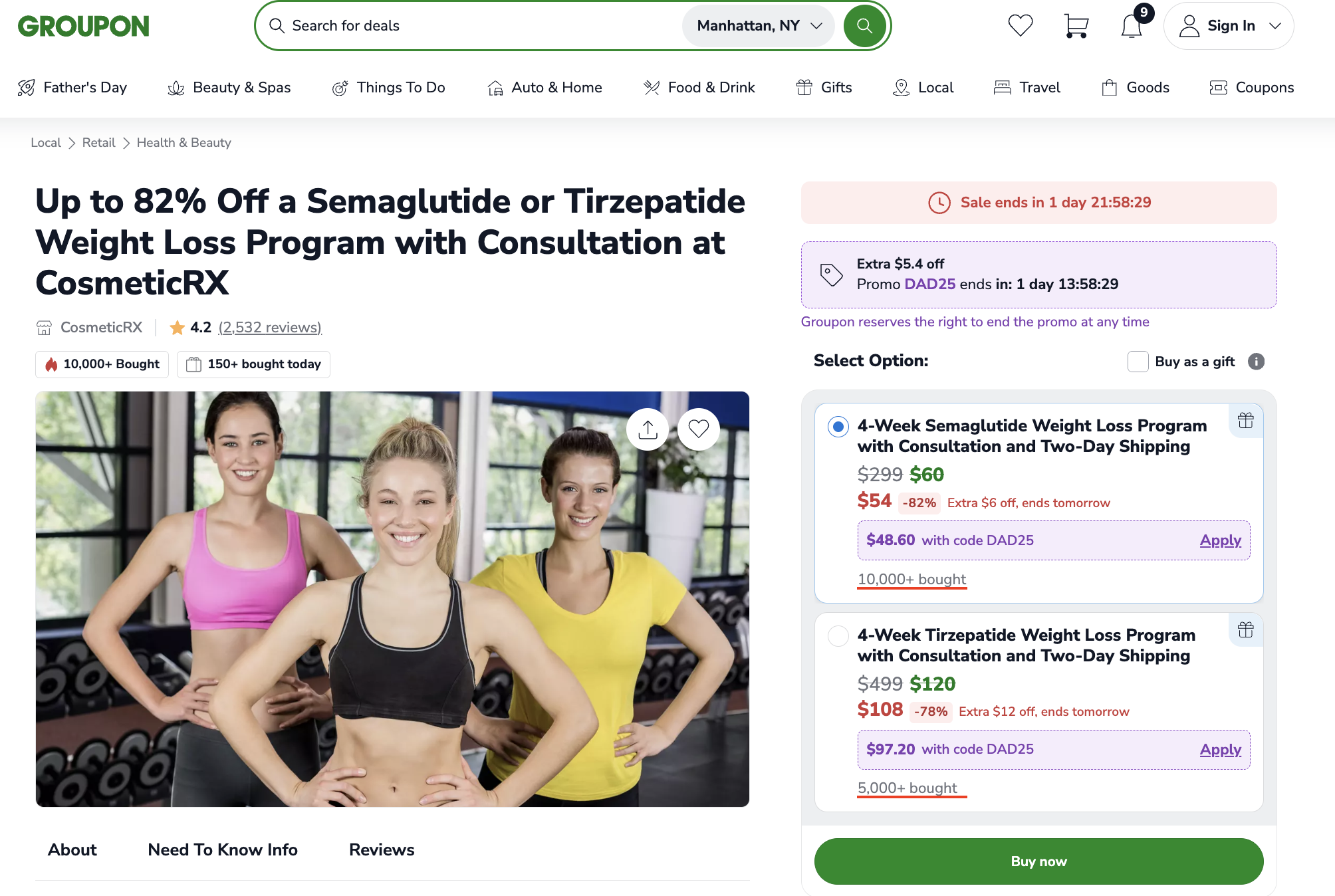

- In reality, Groupon has pivoted its business from selling discounted restaurant deals and Great Wolf Lodge tickets to becoming the United States' leading affiliate marketing solution for long tail med spas and sketchy telehealth services pushing compounded semaglutides and GLP-1 medications in the wake of the semaglutide and tirzepatide shortages from 2023 through early 2025. This shortage was a flash in the pan and short term in nature. Groupon is already shedding these offers which buoyed the stock through late 2024 into early 2025.

- Additionally, investors have been led to believe that Groupon's key North America Local business segment is growing as other areas of the business decline. However, this growth is a semantic trick of accounting which allows Groupon management to categorize semaglutide/GLP-1 telehealth sales not as "Goods" like other supplement and medical products on Groupon, but as "Local" offerings.

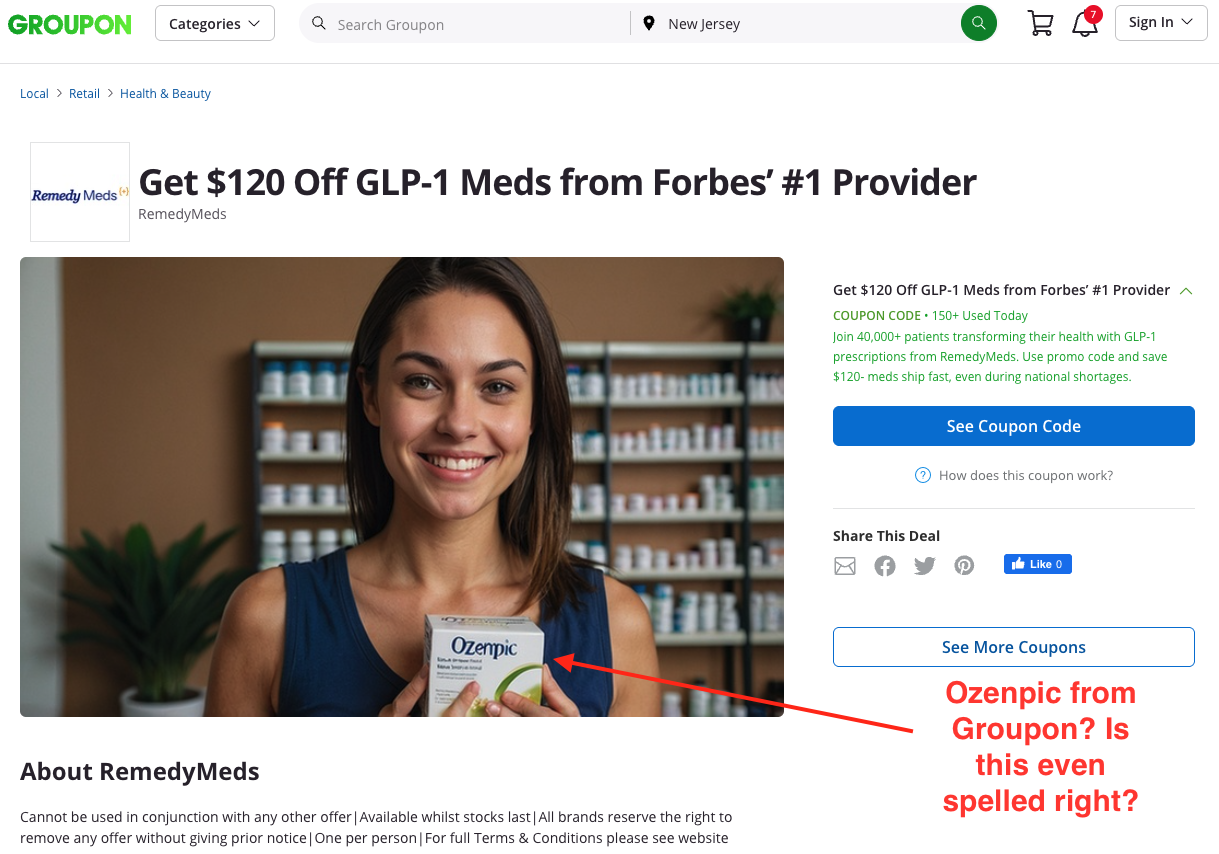

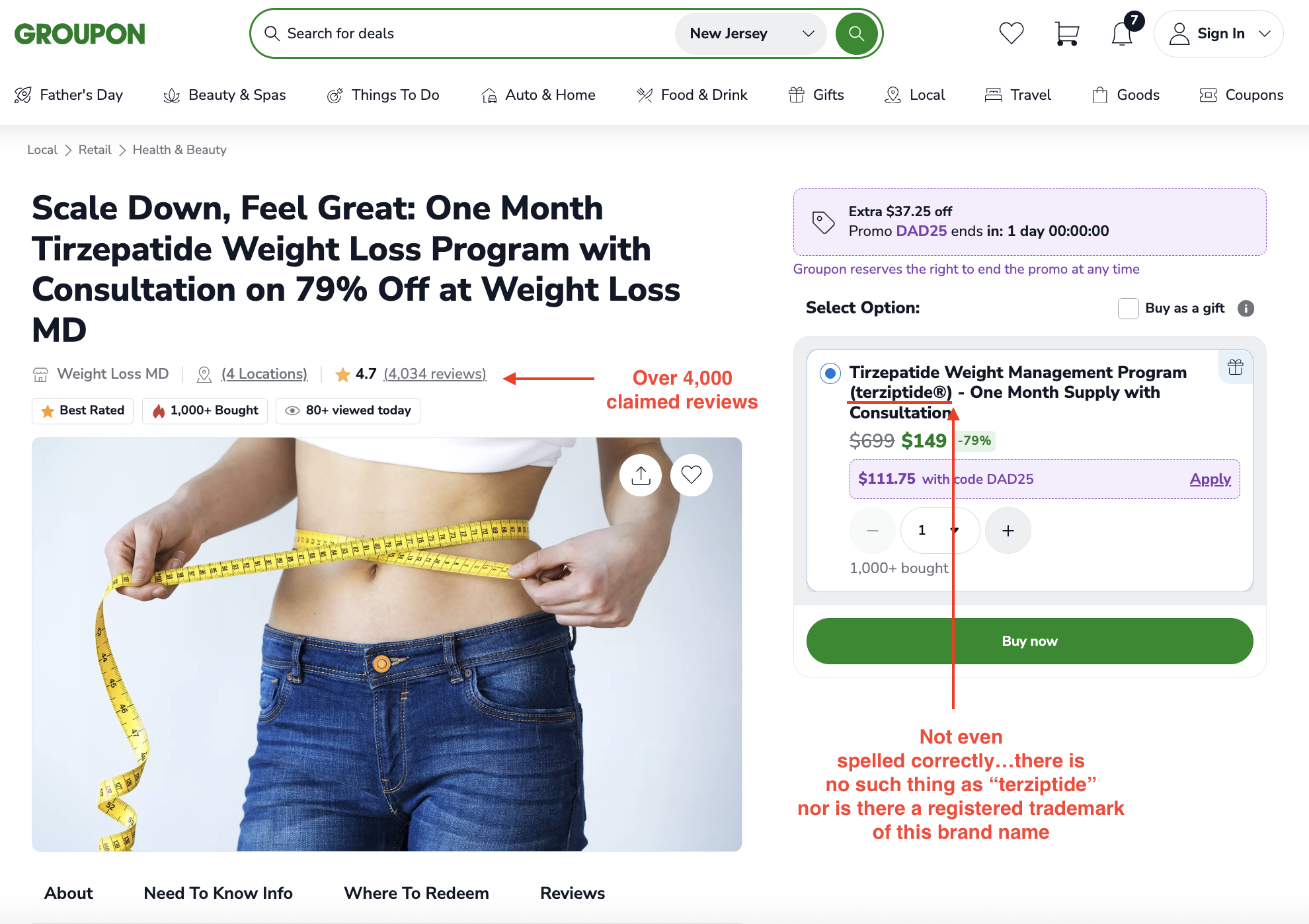

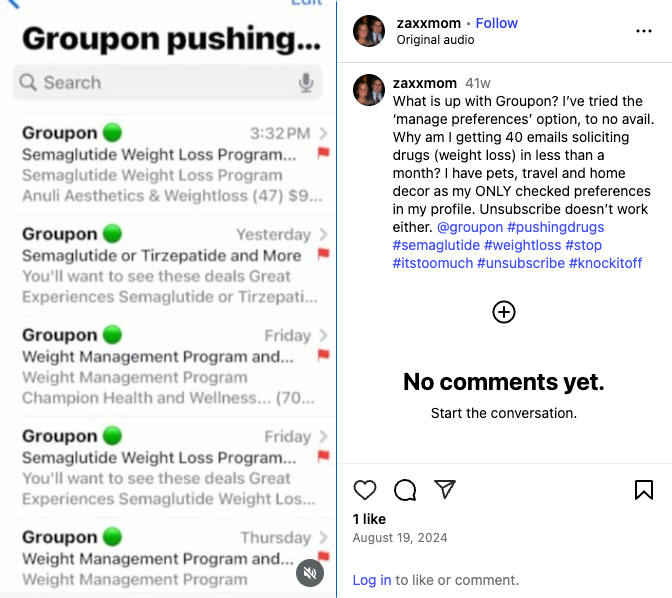

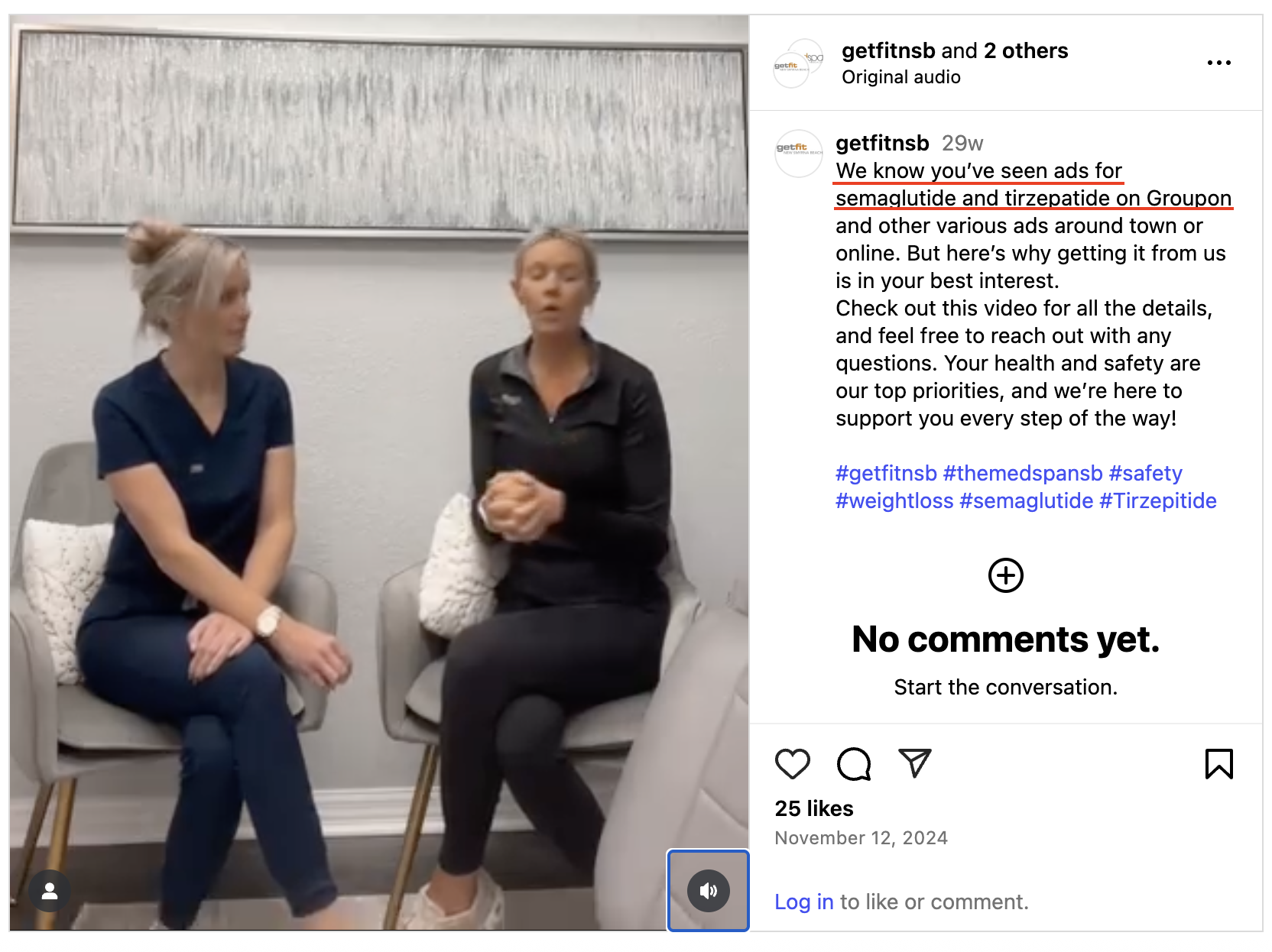

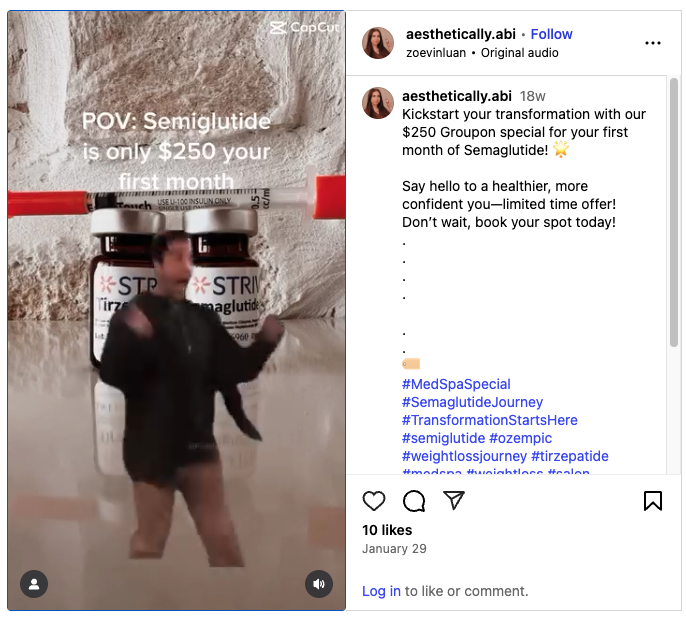

- Groupon aggressively advertises their semaglutide/GLP-1 affiliates through email marketing, yet remains relatively silent on this clear pivot when discussing this with investors. My research shows that many of these providers on Groupon are the absolute bottom of the barrel, featuring misspellings in advertisements, incorrect medical information, and in some cases merely pop-up websites with a Proton Mail account and personal cell phone number.

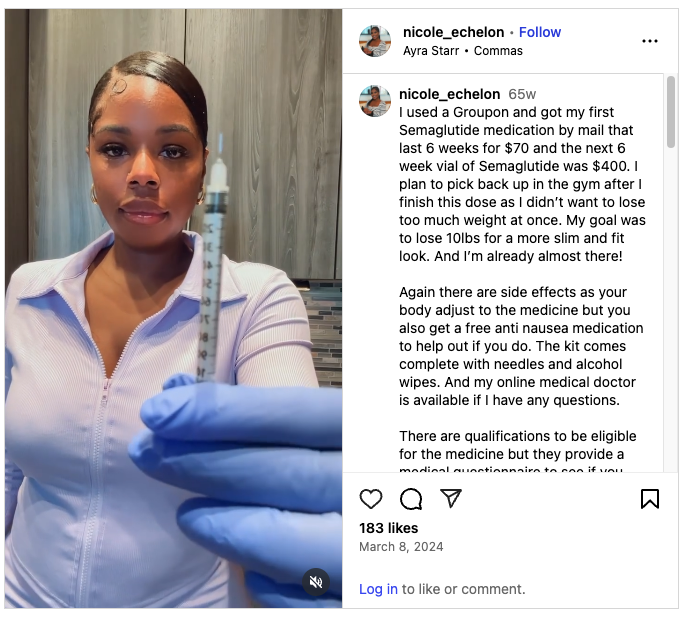

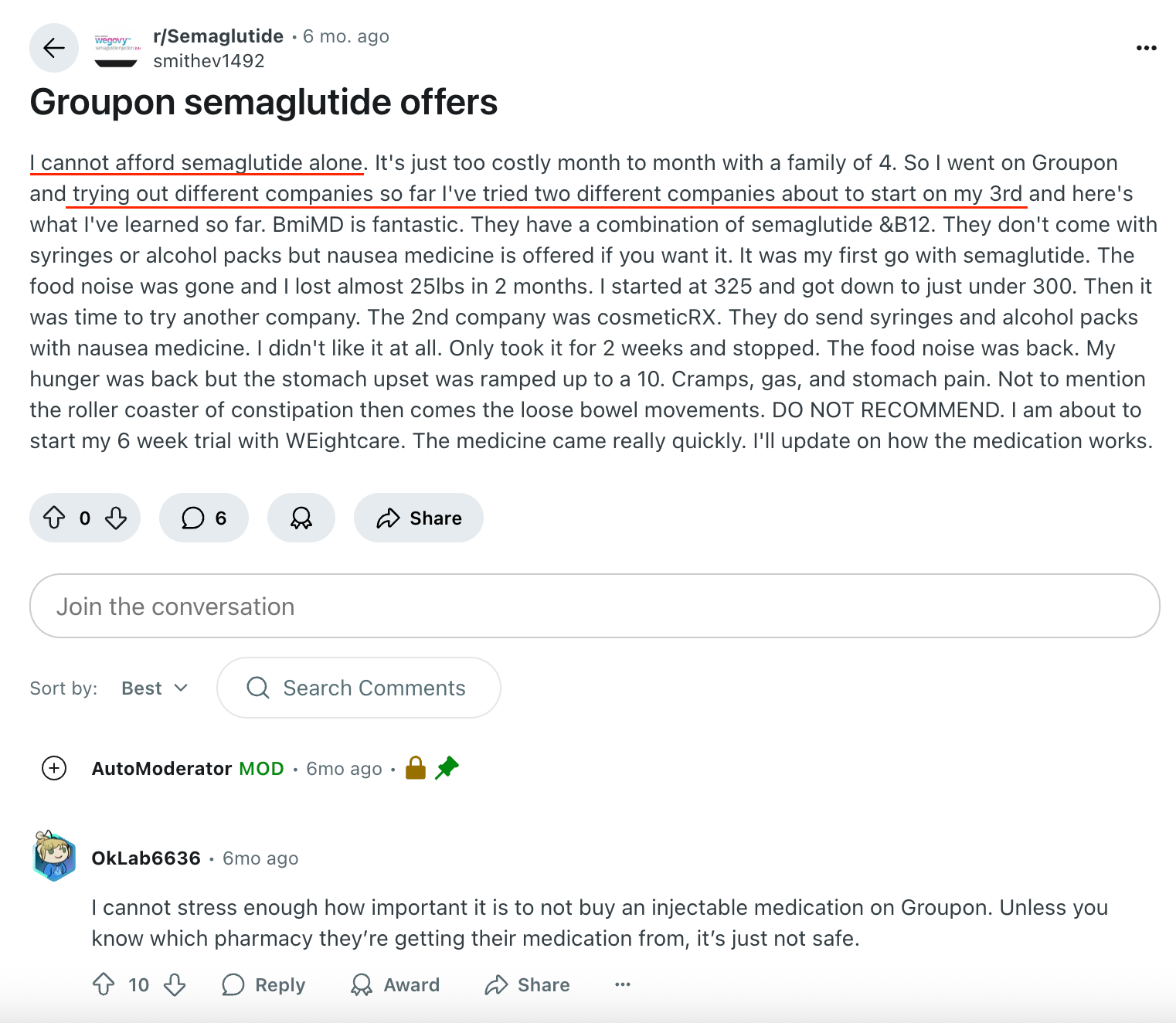

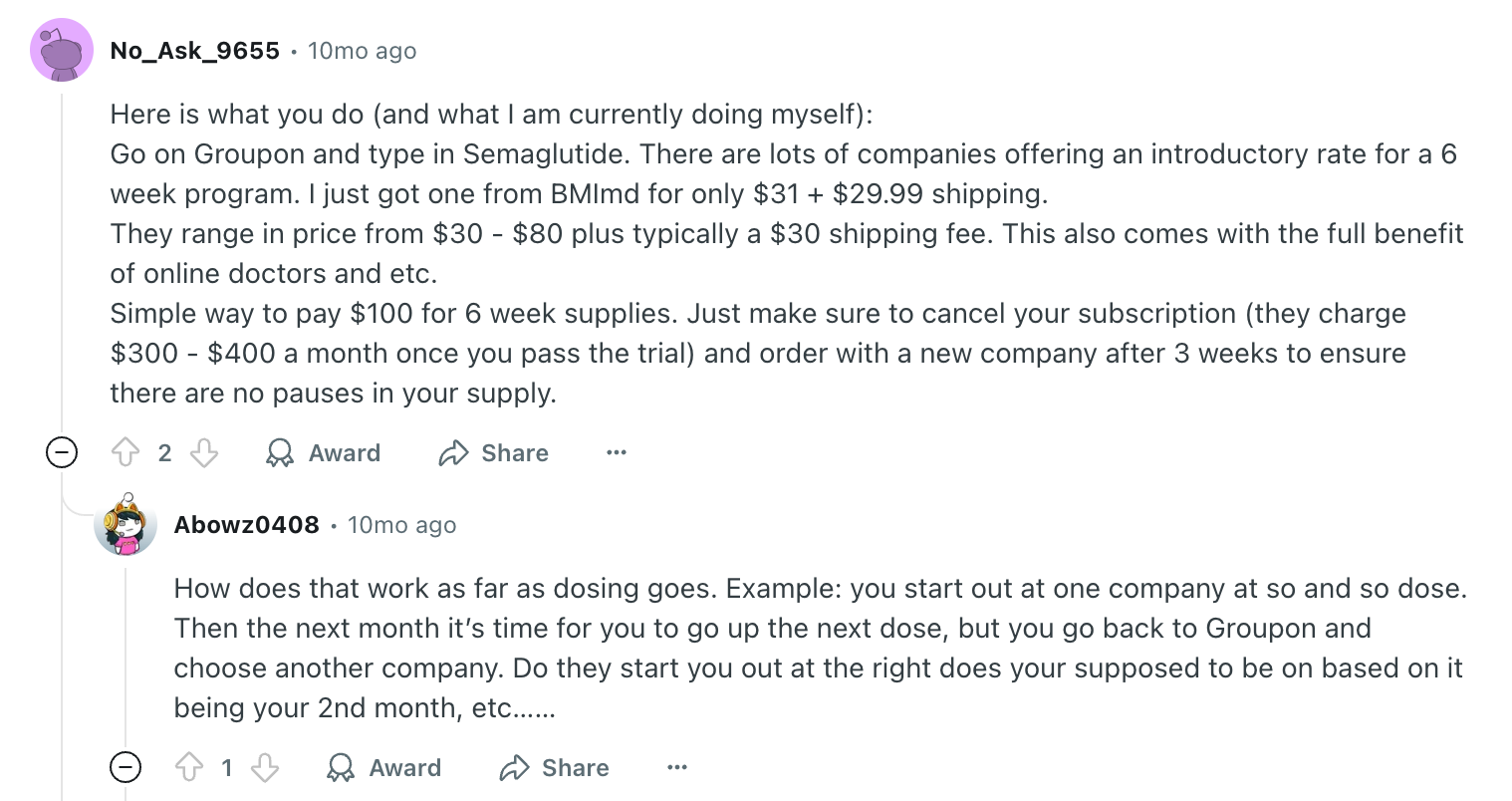

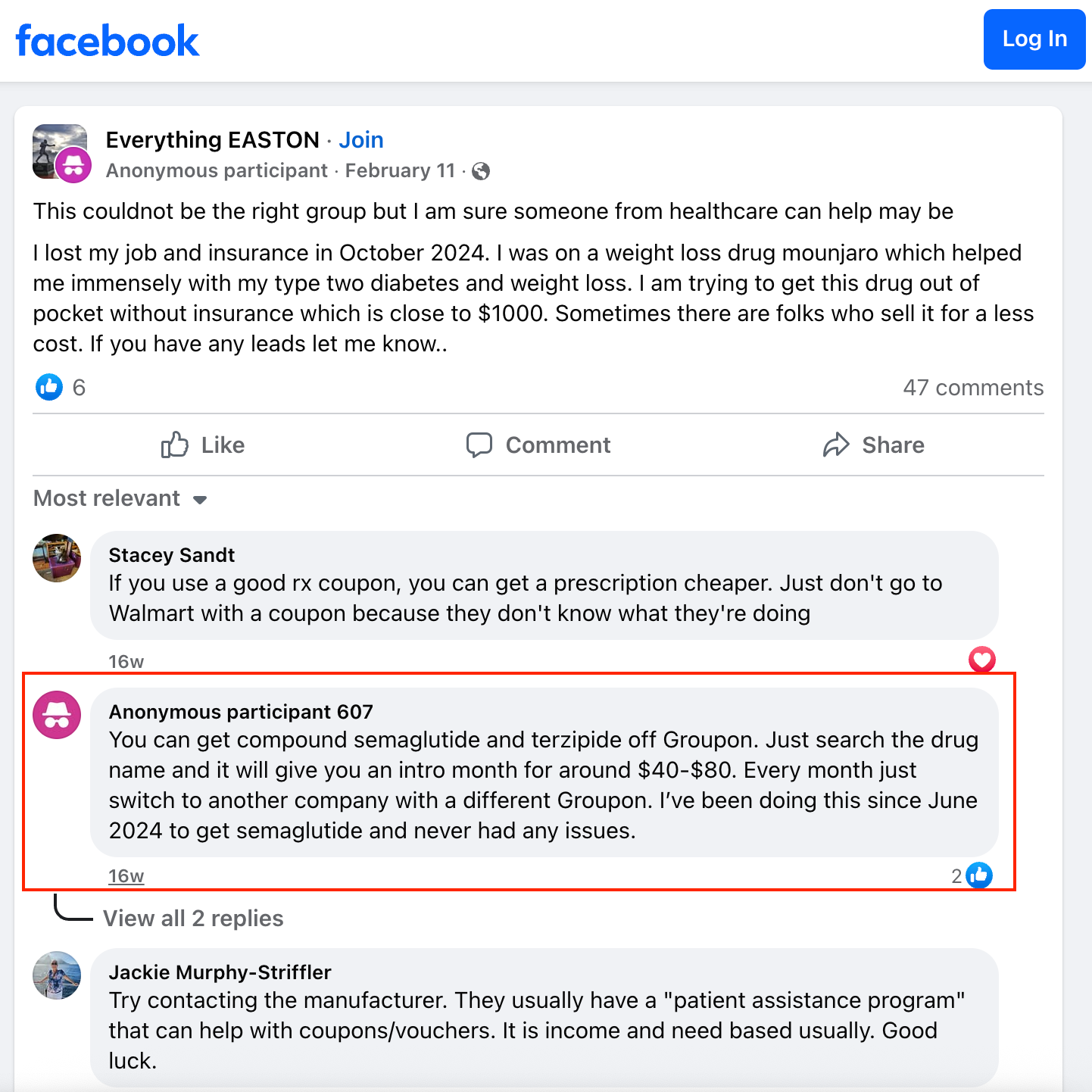

- Further, Groupon's target audience is extremely price sensitive US consumers and my research shows that the behavior that Groupon promotes is consumers signing up for multiple introductory offers for 4 to 6 week semaglutide/GLP-1 trials and then stockpiling these discounted compounded medications trial offers instead of sticking with one provider. Not only is this behavior reckless for consumers, but it is also detrimental to the business models of the med spas and telehealth services that use Groupon for distribution, as these businesses only offer these Groupon trials as lead generation to convert customers into higher margin recurring revenue streams. As semaglutides/GLP-1s from compounder pharmacies are often mixed with other medications such as varying B vitamins, these consumers/patients are not taking the same medications month to month when shopping around and stockpiling through multiple Groupon-affiliated pharmacies.

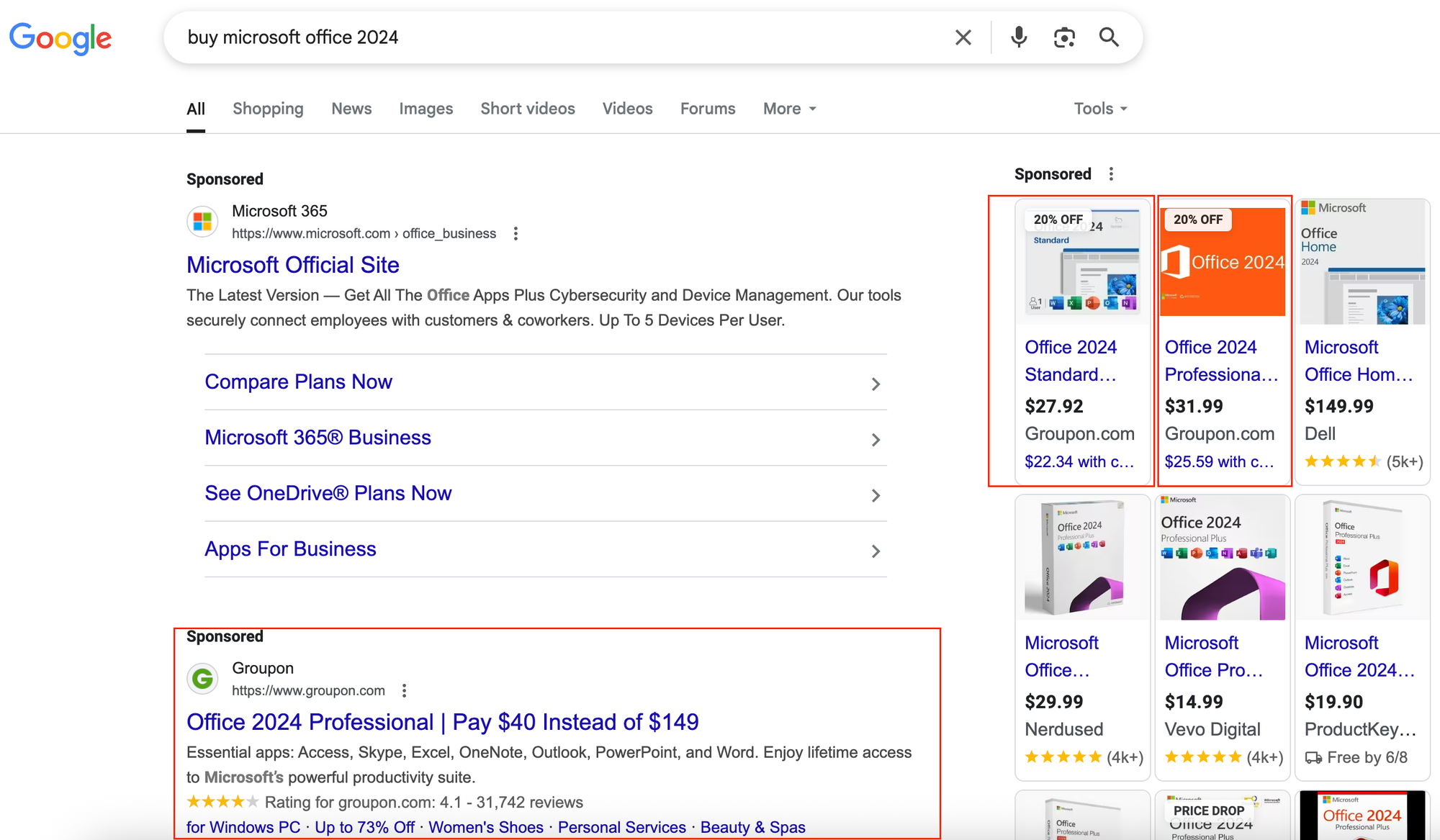

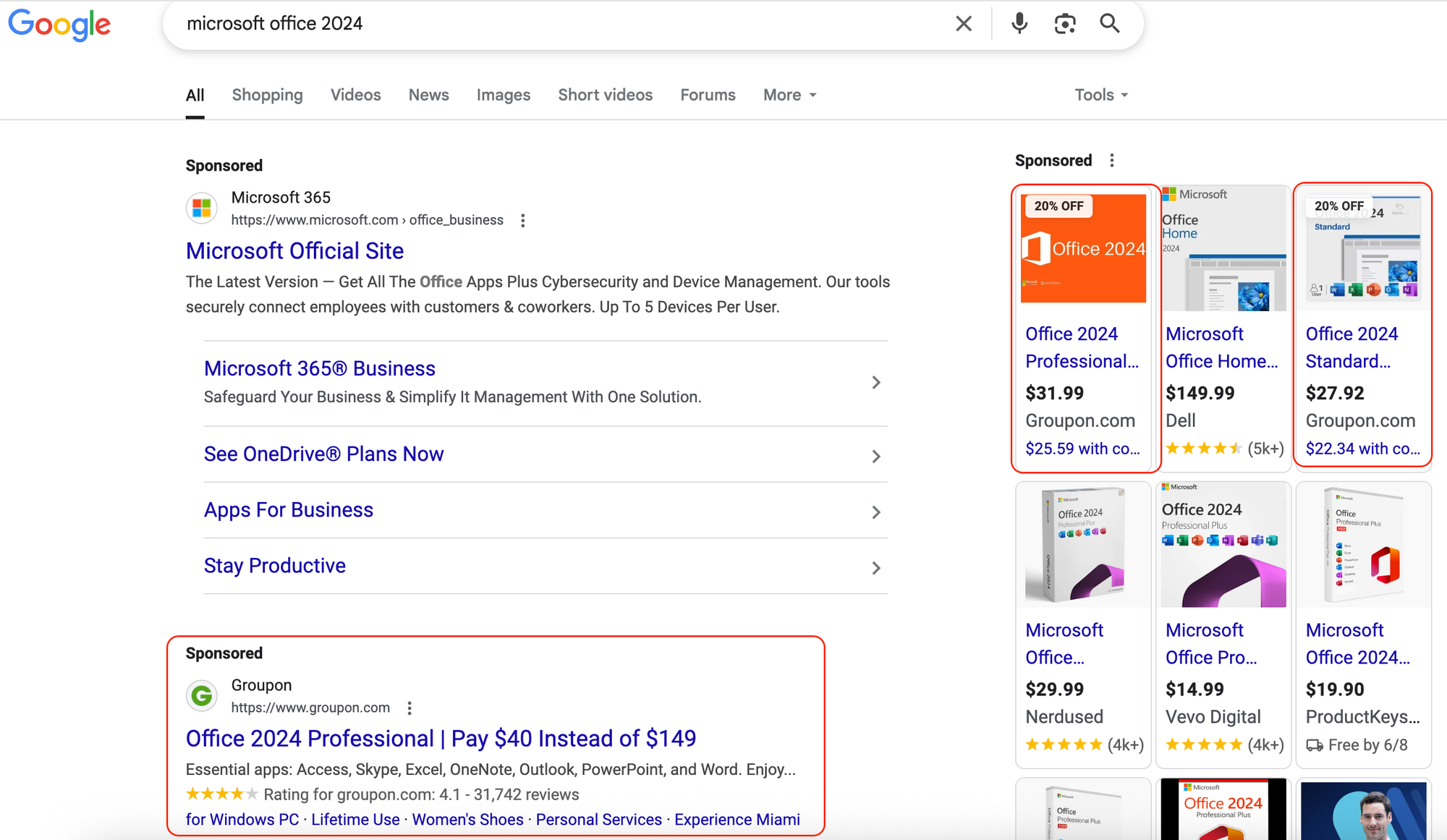

- Groupon is a major beneficiary of Microsoft's consumer product release cycles, with dozens of vendors of varying quality offering heavily discounted product licenses for Microsoft Office/365 via the Groupon platform over the years. This business is extremely cyclical, with Microsoft releasing a new Office version available to consumers on October 1, 2024. Microsoft only releases new Office suite versions every three years, with the most recent consumer version releases on October 1, 2024 (Office 2024), October 5, 2021 (Office 2021), September 24, 2018 (Office 2019), and September 22, 2015 (Office 2016). Groupon's incremental growth in revenue and profitability in Q4 2024 as reported on their March 12, 2025 earnings call largely reflects a short-term, one-off boom in Microsoft Office product license and key offers corresponding with this major software version release.

- Further, Groupon clearly categorizes these Microsoft software keys not under "Goods" but under their "Local" segmentation and disaggregation, even though virtual licenses have absolutely nothing to do with Groupon's "Local" experiences segment of restaurant deals or escape room tickets.

- Groupon CEO Dusan Senkypl avoids answering questions about the nature of billings and revenue growth in Groupon's key North America Local segment when it is obvious that GLP-1s and MS Office 2024 keys are two main growth drivers through 2024 into early 2025. There have been no mentions whatsoever of either trend even as both are pervasive not only on Groupon but in Groupon's marketing materials and outbound efforts.

- This house of cards is set to collapse and I am short GRPN.

Late 2023 Through 2024 and into Early 2025: The Onslaught of GLP-1 Pop-Up Bullshit Takes Hold

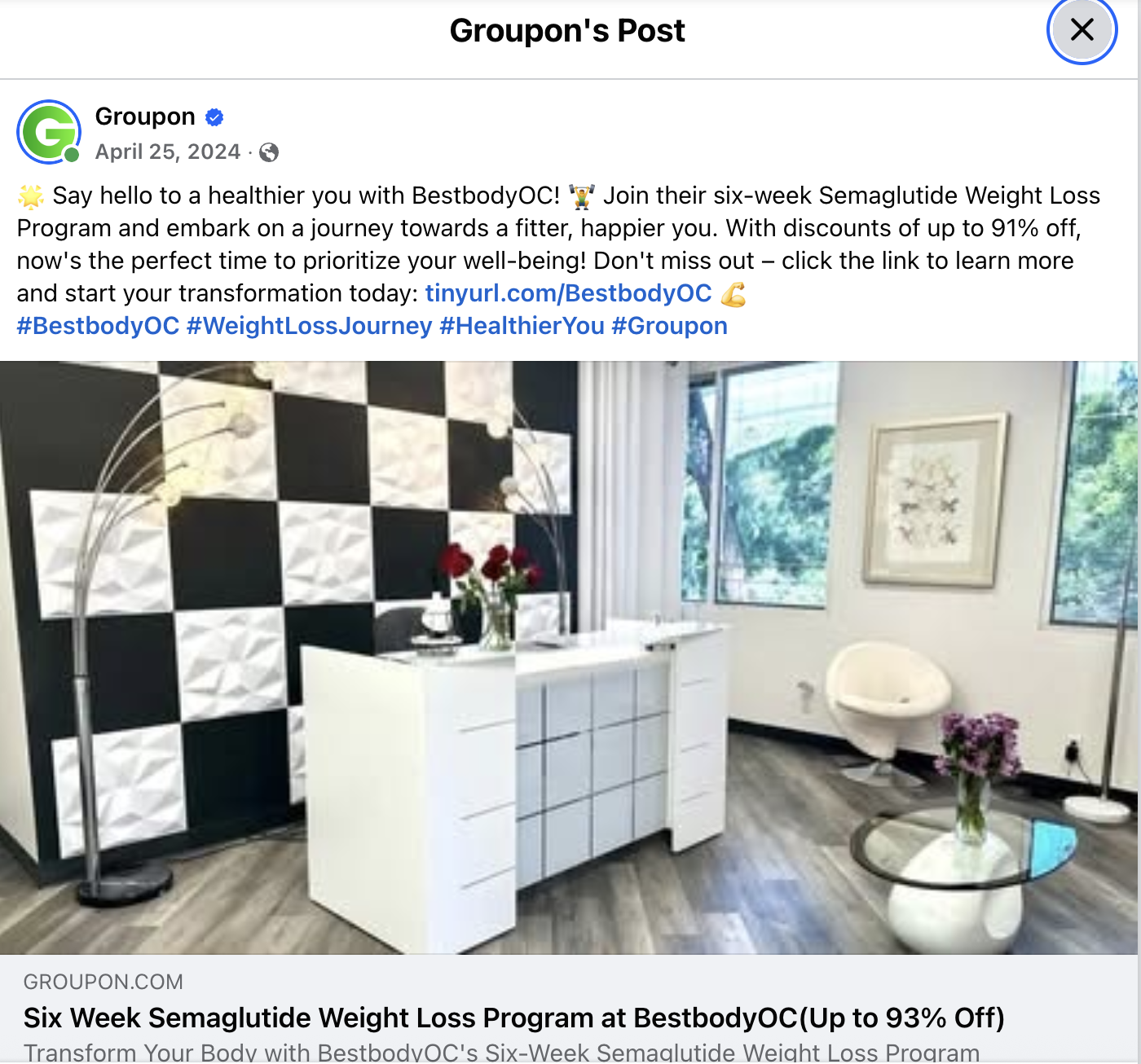

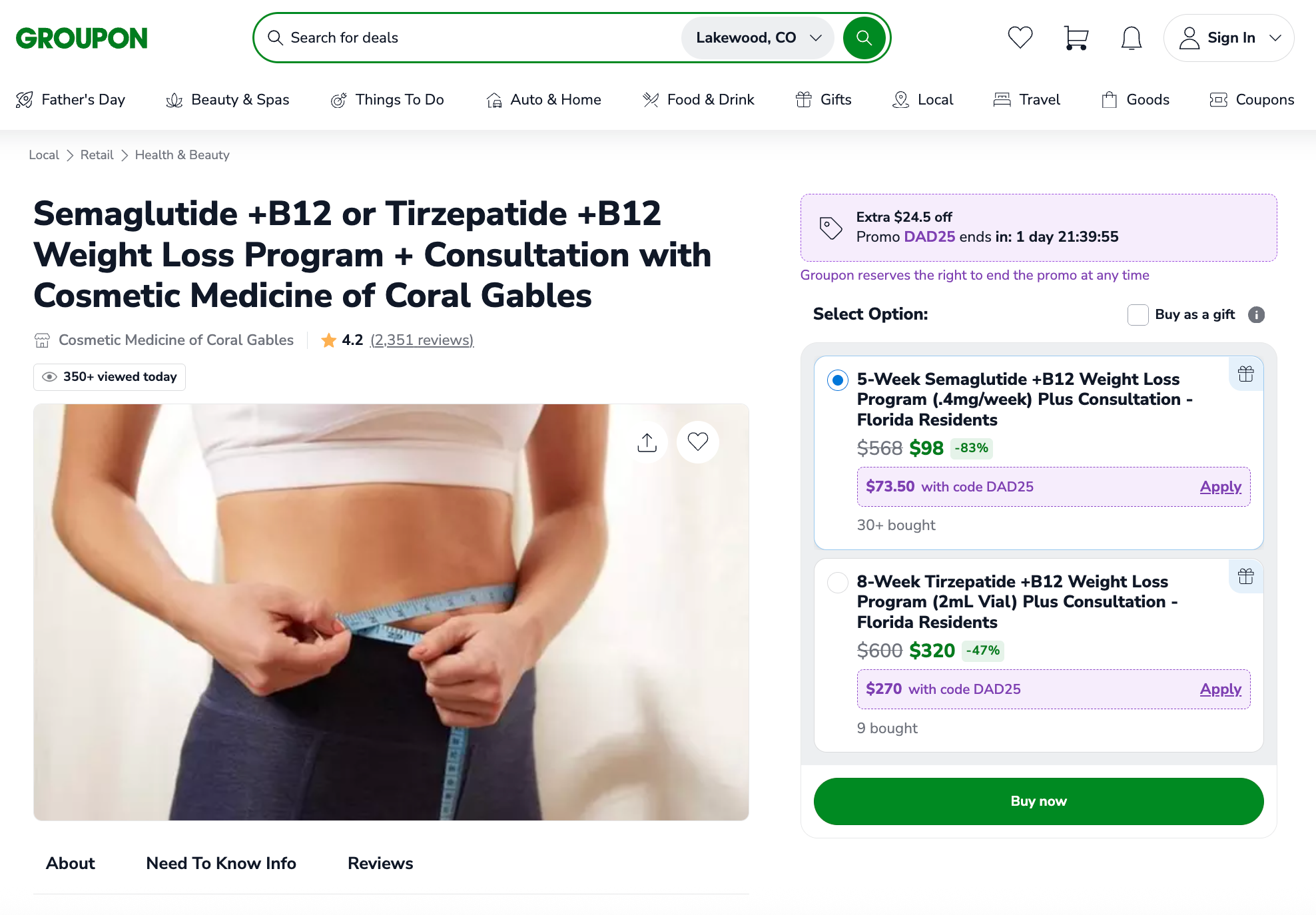

While I could type out extensive notes detailing the proliferation of compounded semaglutide and tirzepatide products on Groupon, it's likely best to let the content mostly speak for itself. These GLP-1 offers have taken over Groupon in the last 18 months, with everything from paid #GrouponPartner influencers promoting GLP-1s on social media to continuous email marketing pushing these products. There are hundreds of different entities ranging from telehealth services to med spas that have advertised compounded GLP-1 medications on Groupon.

@iamblackheaven My GROUPON Glp-1 is here! 🥳 🎉 🪅 🎊 #tirz #tirzepatide #compoundingpharmacy #tirz #blackgirlweightloss #WEIGHTCARE #GROUPON #HALLANDALEPHARMACY #fyp

♬ original sound - HeyZeusGetLoose

@savannahkthrower #Ad @Groupon has so many discounts, but did you know they have amazing products too? So excited to be back on my weight loss journey thanks to Groupon! If you’re interested in starting or starting back, check out the link in my bio to so many amazing Groupons! #GrouponPartner #GiftingWithGroupon #GrabLifeByTheGroupon

♬ original sound - Savannah | Lifestyle

GLP-1 'Inventory Stuffing' Ahead of the Shortage: How Groupon's Business Model Encouraged Sales to Roll Forward & Why This is Unsustainable

Core to this short case is the unsustainable unit economics of these long tail telehealth and med spa providers offering GLP-1 services.

Each of these providers competes with one another, driving prices down as they take a bath on offering the initial month, 6-week, 8-week introductory offer through Groupon. The only reason these providers are willing to offer such low margin, cheap deals is because they hope to convert enough of these introductory customers to recurring revenue streams over the coming months and years. While customers may get the first month for as low as $60-$80, most of these providers then enroll customers in $299, $399, $499, etc. monthly subscriptions.

However, these Groupon customers are more customers of Groupon and less customers of a specific provider. This is a classic case of adverse selection which eventually leads to merchant churn.

Given that so many providers are present on Groupon and given that it has been very publicly announced that the shortage is over and both 503A and 503B pharmacies offering compounded solutions would have to come to an end, consumers caught on in late 2024 into early 2025 that they can effectively just sign up for 1 trial with each provider on Groupon and stockpile doses from multiple providers rather than stick with a single provider.

Obvious this is very reckless behavior and sampling 4-week, 6-week, 8-week trial offers from multiple brands is not ideal given that these medications come from different pharmacies with different add-ins, prescribed by different doctors.

In the below TikTok video from November 2024, one user of Groupon GLP-1 medications lays out her behavior:

"...I kept getting emails from Groupon that they have [GLP-1 treatments] for a lower price, and it's for one month only, so I'm just going to try it out and see, and there are different little companies that sell [GLP-1 treatments] on Groupon, like med spas pretty much, and if that works well for me I will be trying every single one of them."

@kenzieschanging groupon GLP-1 is crazy 👀 #marriedsinglemom #changingmylife #glp1 #glp1forweightloss #tirzepatide #groupon

♬ original sound - kenzieschanging

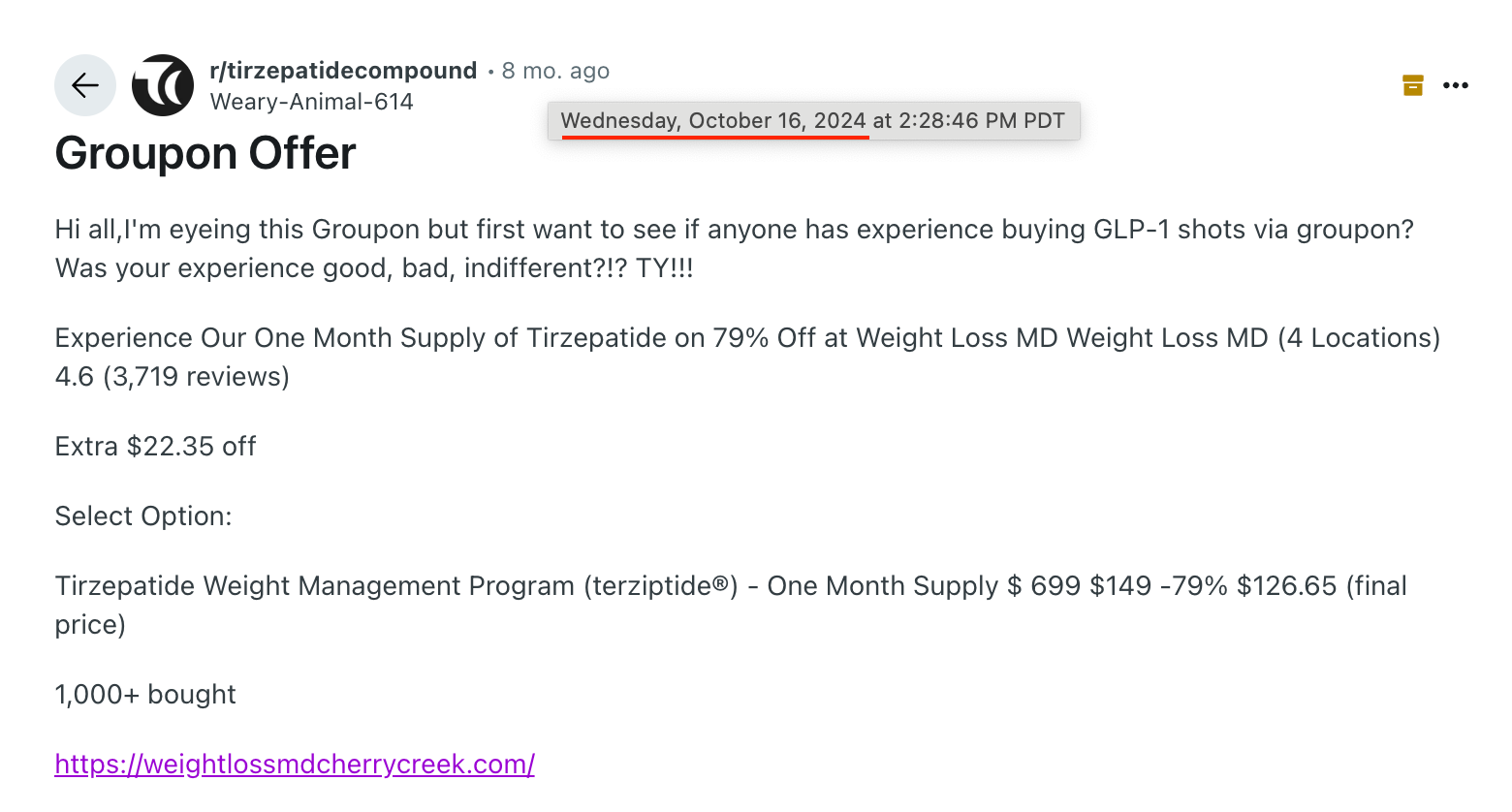

Here's a price sensitive user posting on Reddit about shopping around on Groupon and trying out their third Groupon trial offer.

This below Reddit user is also shopping around doing 1 of every trial offer on Groupon instead of sticking with 1 consistent provider.

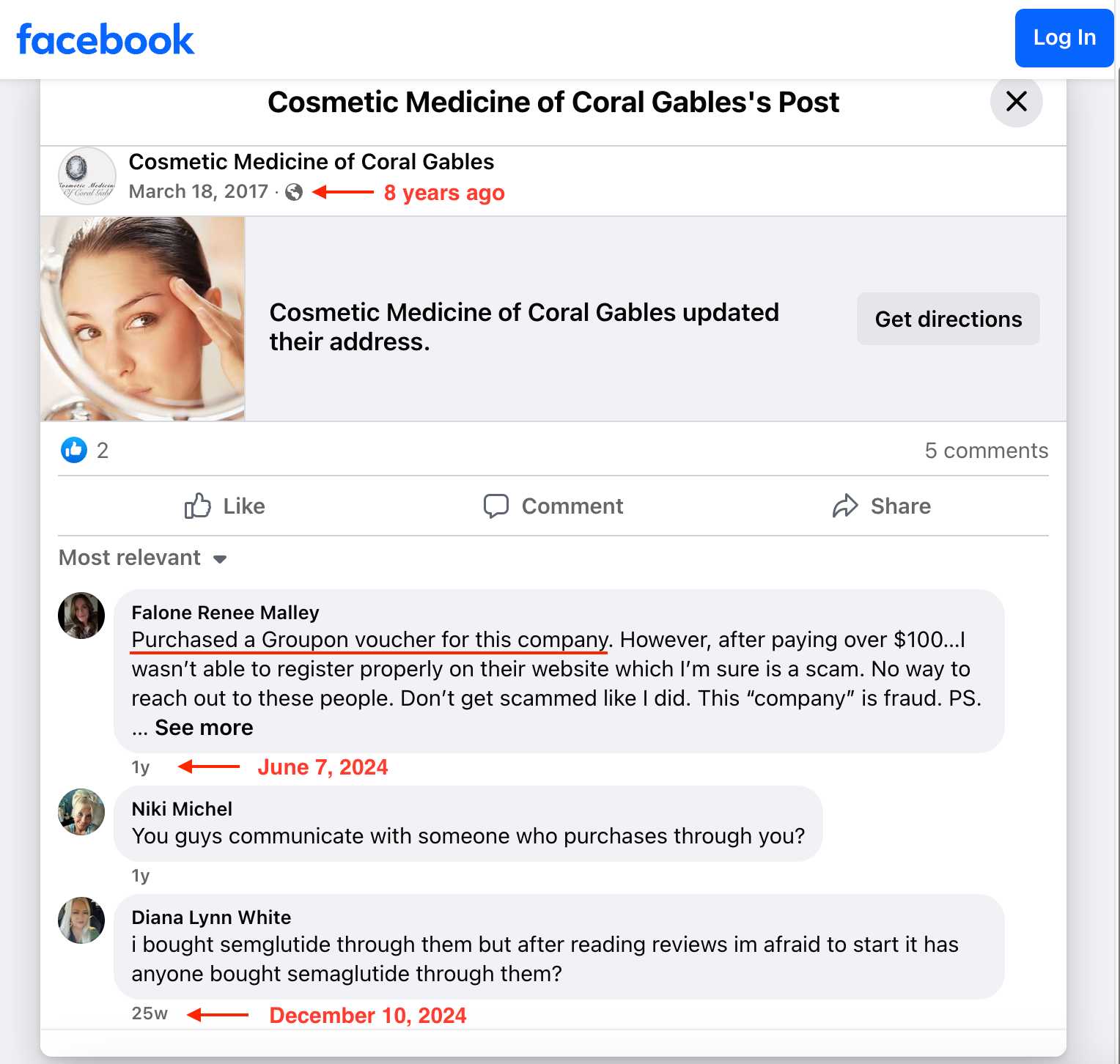

This below poster on Facebook spells the name of the medication incorrectly and promotes shopping around and doing this "1 of every trial offer on Groupon" behavior instead of sticking with a single stable provider.

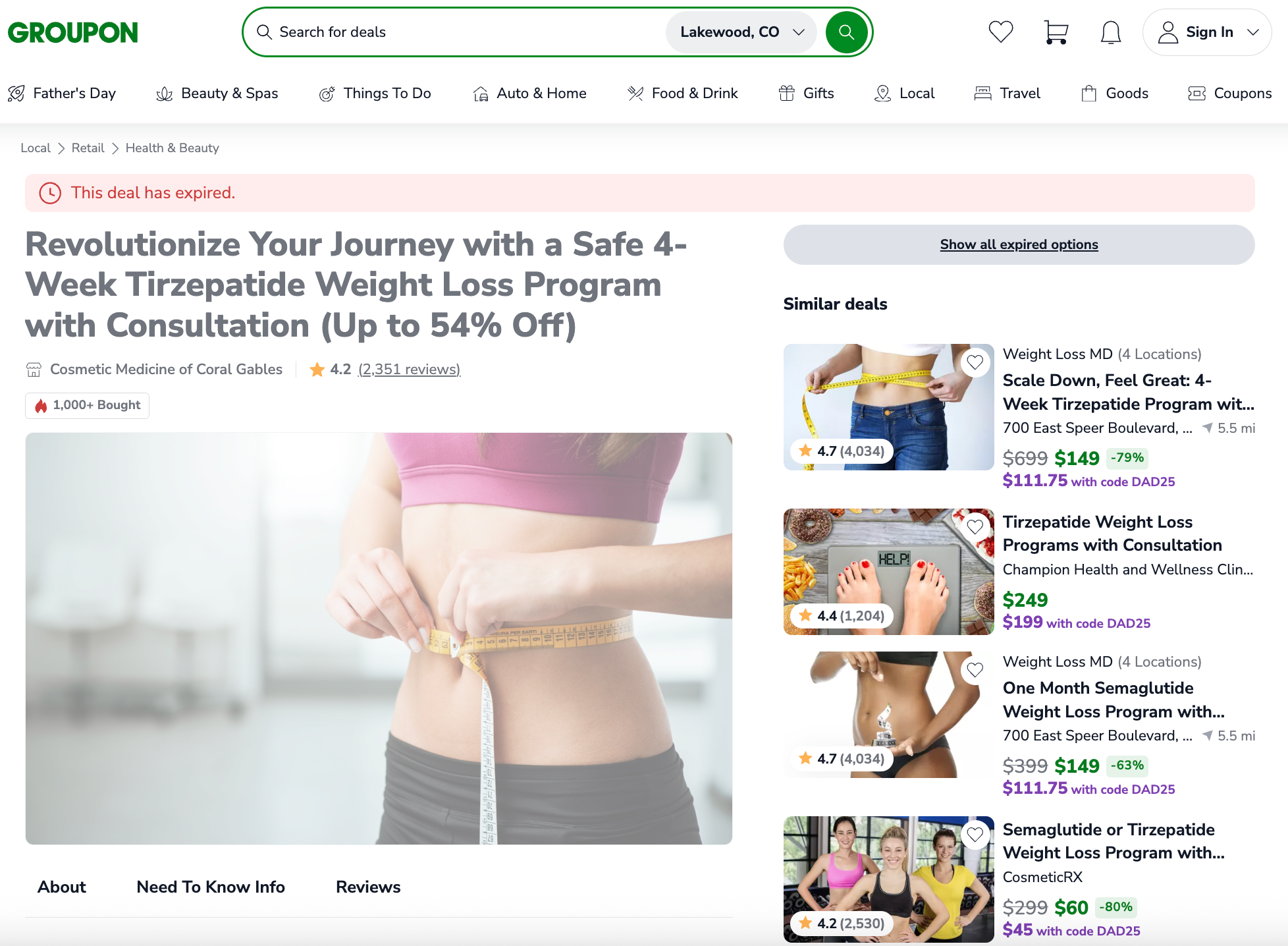

So the question then is: are Groupon vendors churning or about to churn? If these vendors are taking on too much risk or taking a bath on intro offers that do not turn into recurring revenue, is there evidence that they are no longer on the platform?

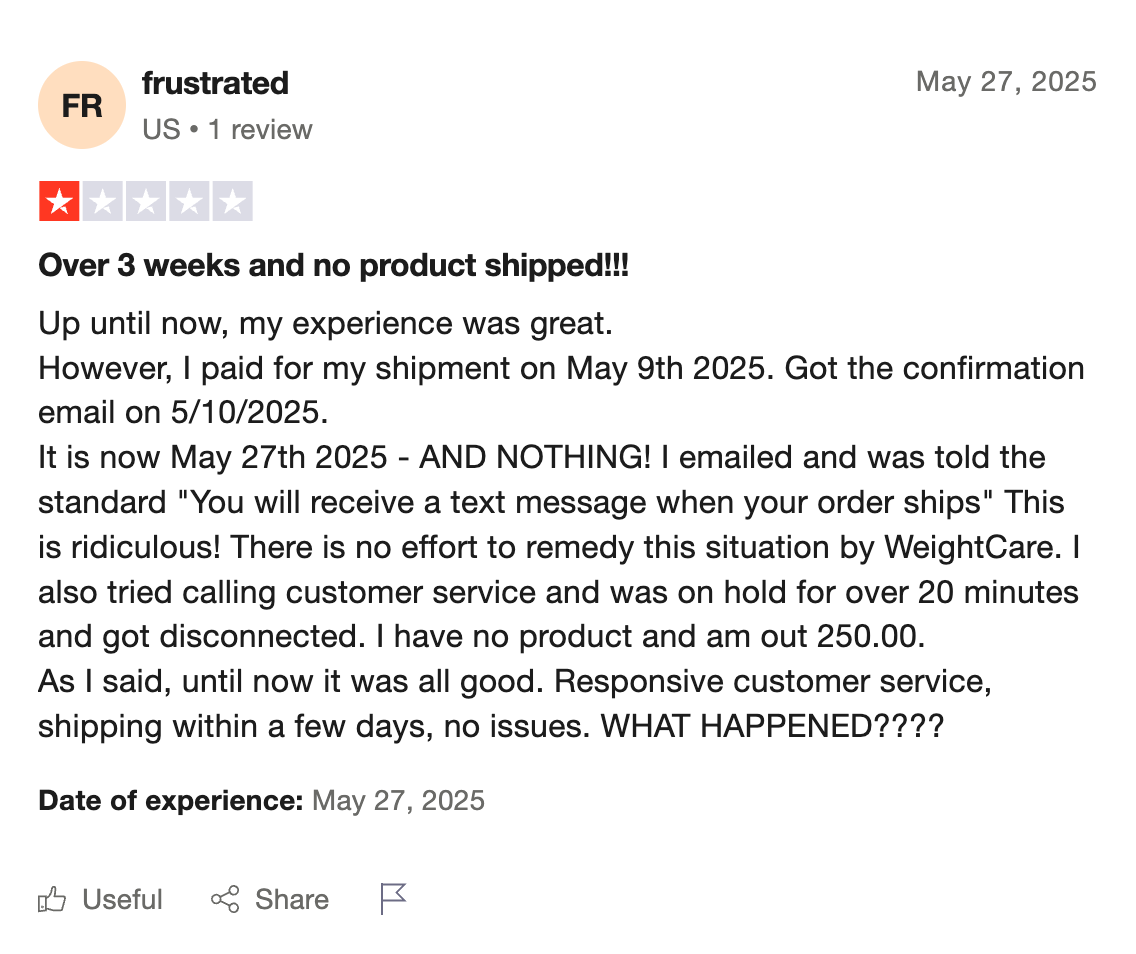

It seems that after the April and May 2025 changes to compounded GLP-1 medications, there are serious cracks in Groupon's armor that have just developed.

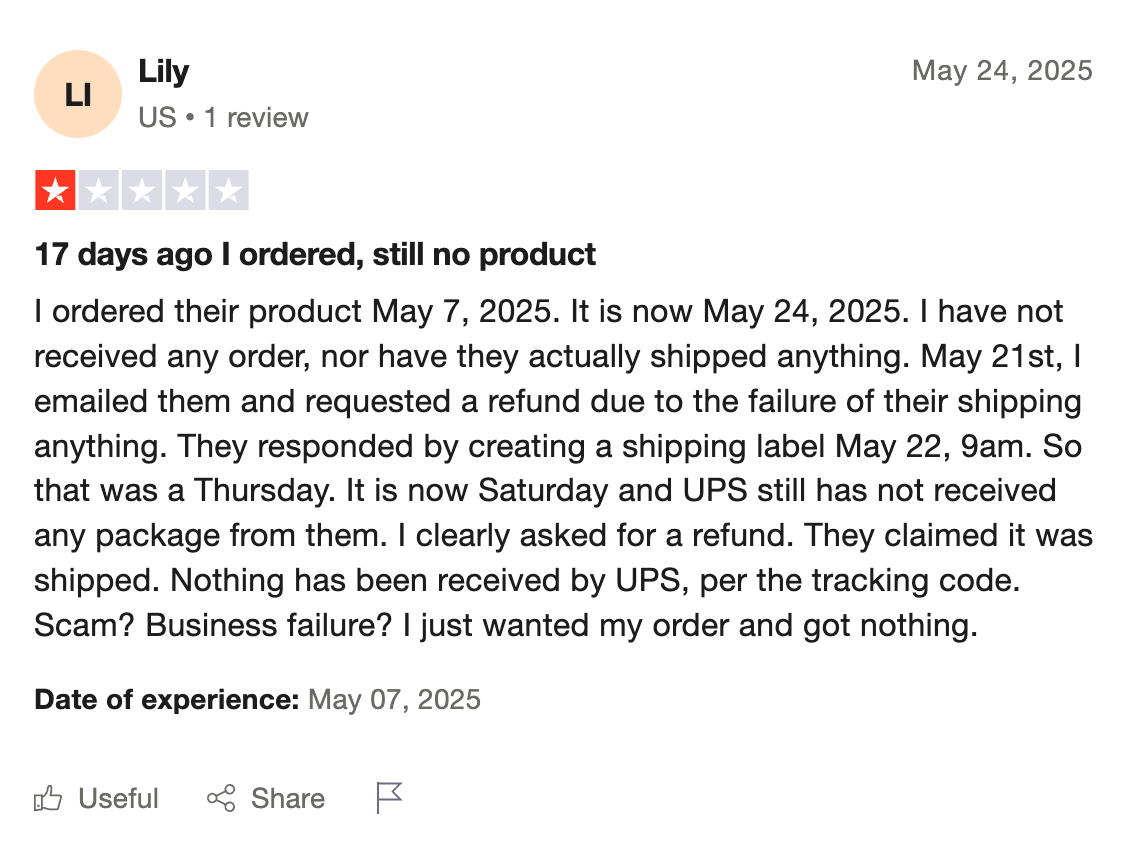

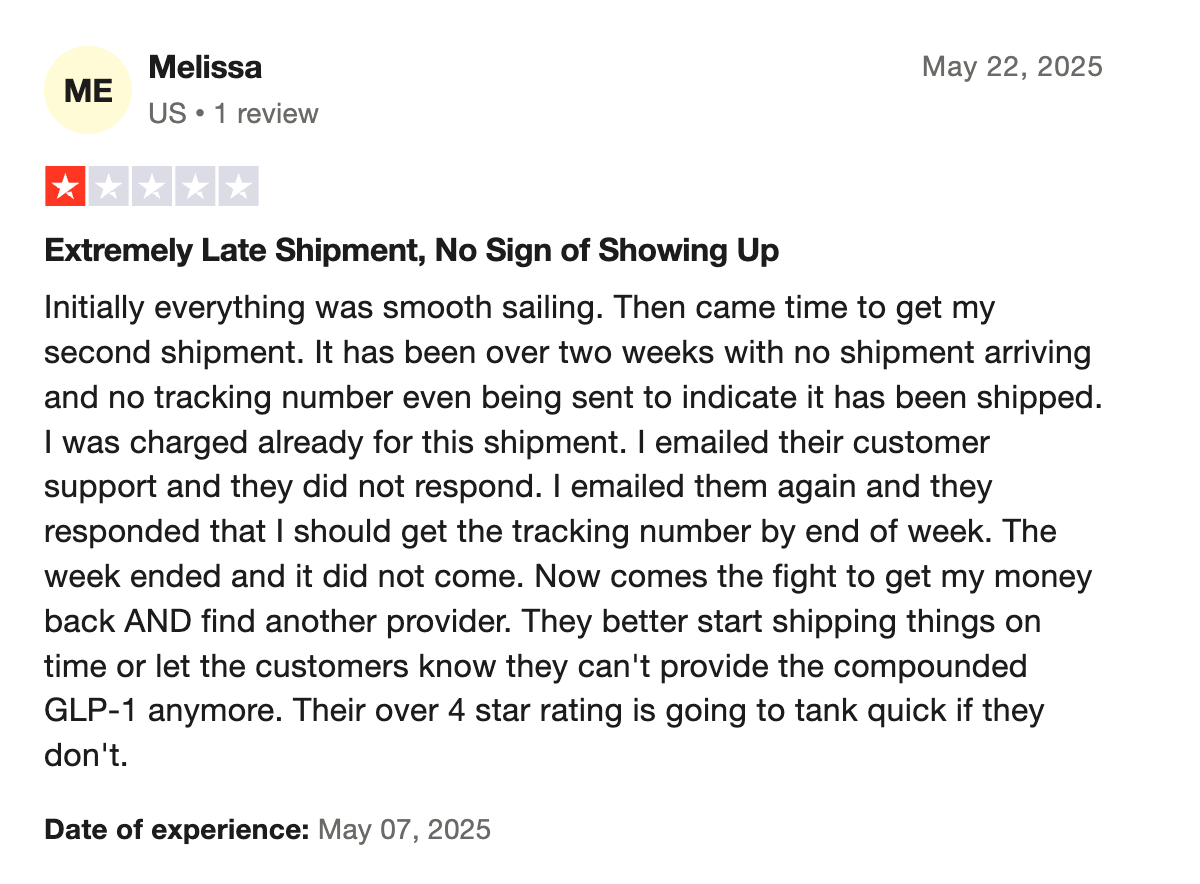

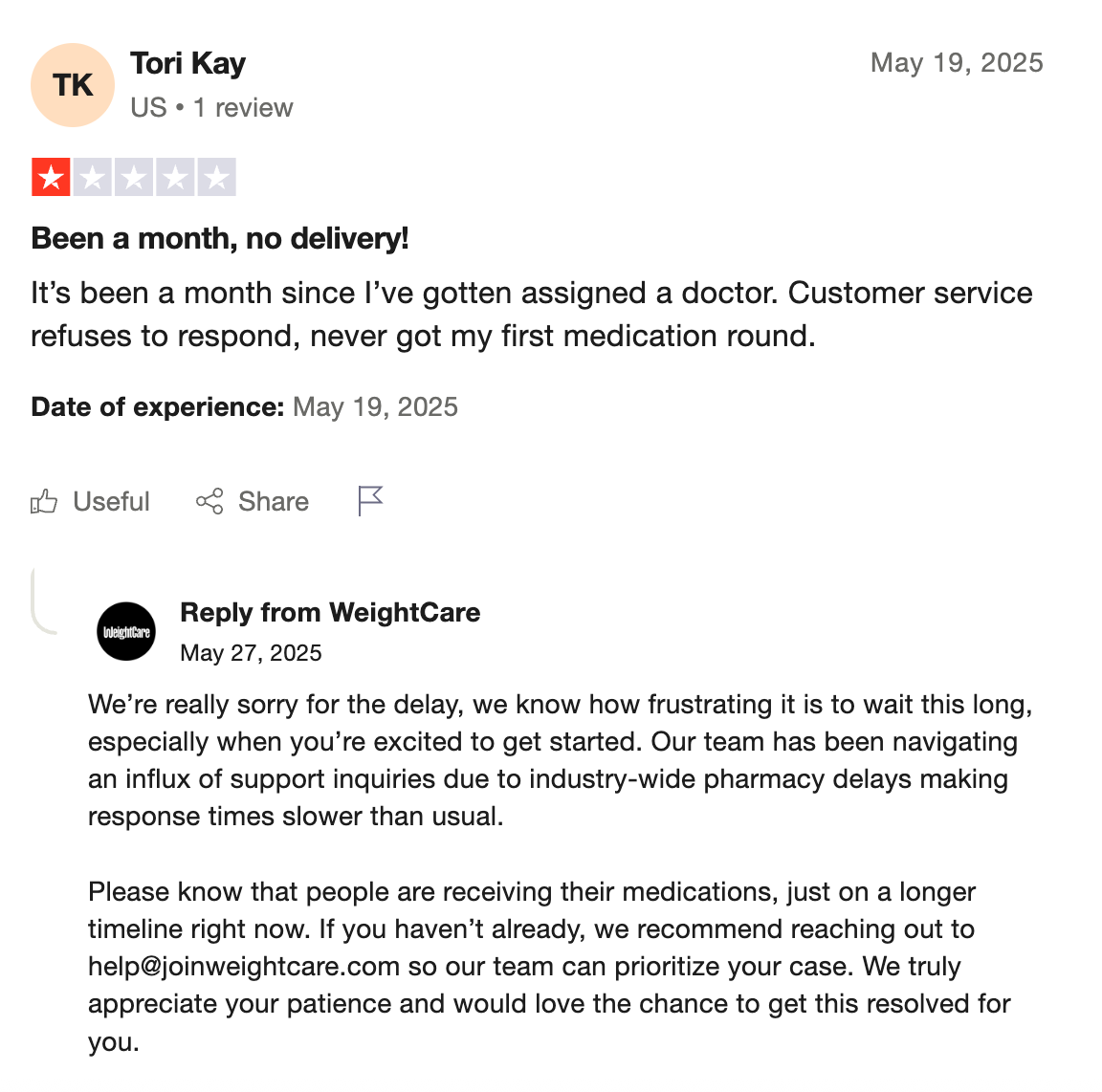

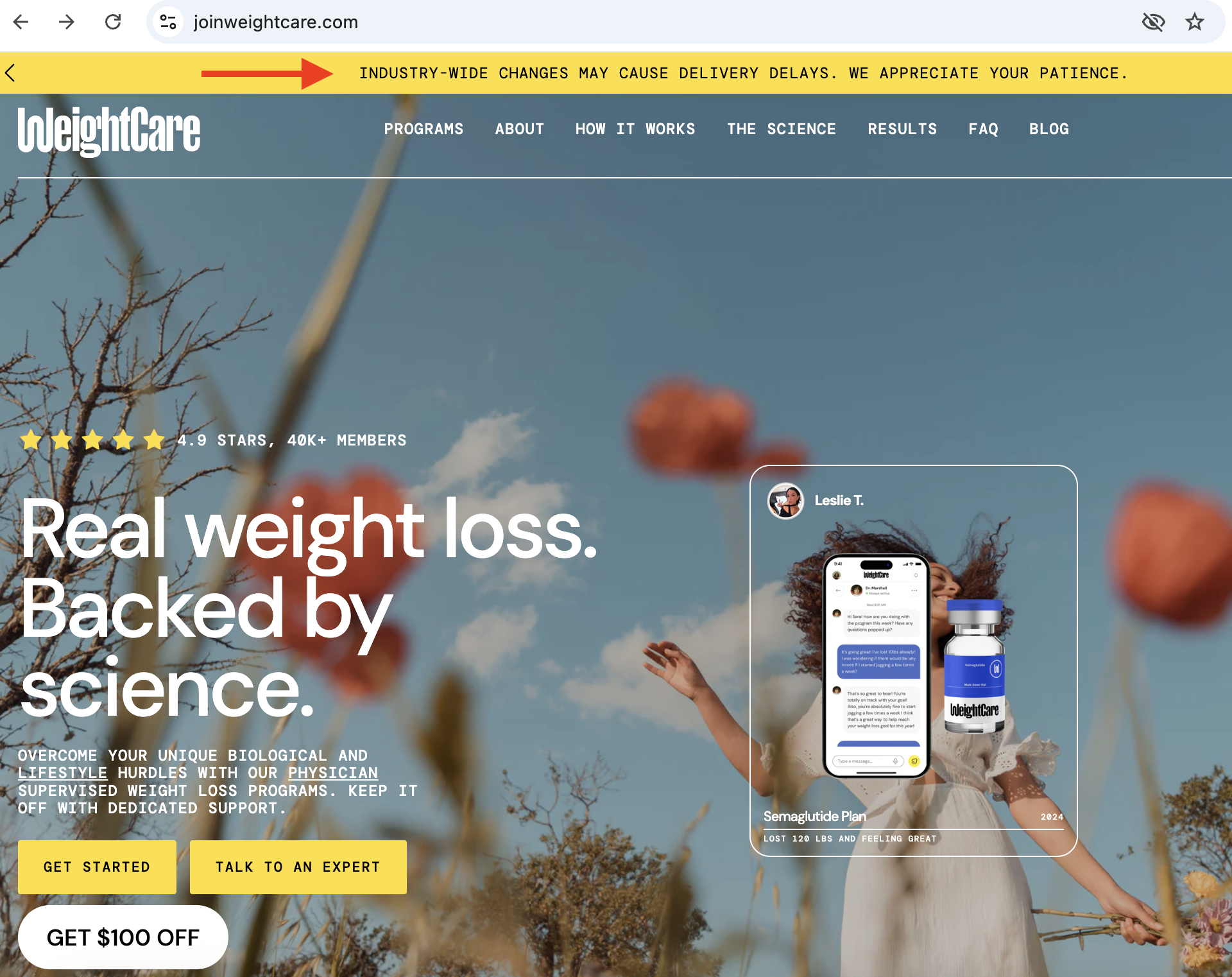

Crack in Armor #1: Major Groupon Player WeightCare Experiencing Issues This Past Month

WeightCare has seen relatively stellar reviews...up until the past several weeks post April and May changes to FDA regulations. https://www.trustpilot.com/review/joinweightcare.com

Crack in Armor #2: Entities with Groupon Specifically Named on Their Websites Are Churning and No Longer Have Active Offers on Groupon

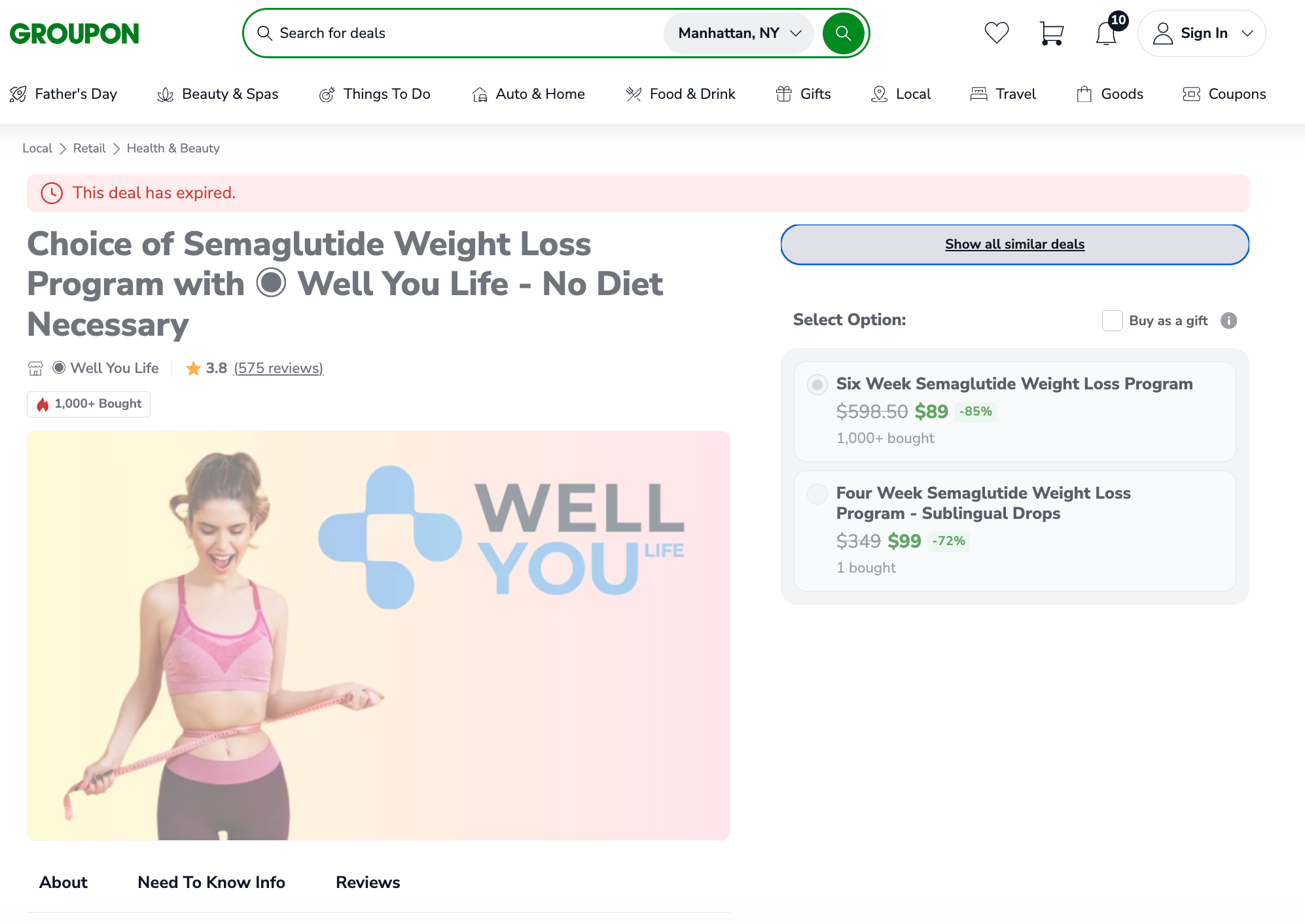

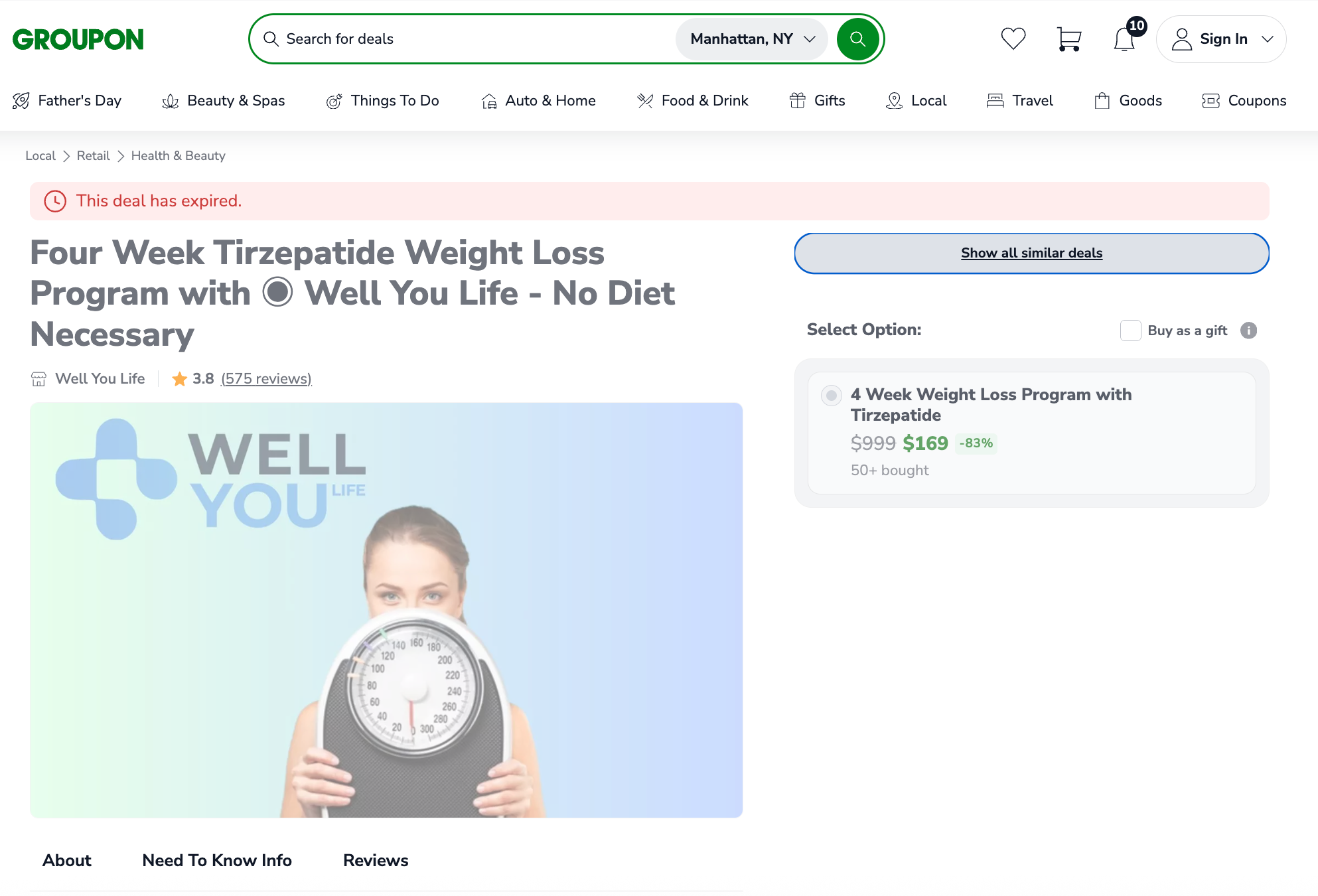

Wellyou.life is a related entity to Health Solution MD and they have pulled down their semaglutide and tirzepatide offers from Groupon.

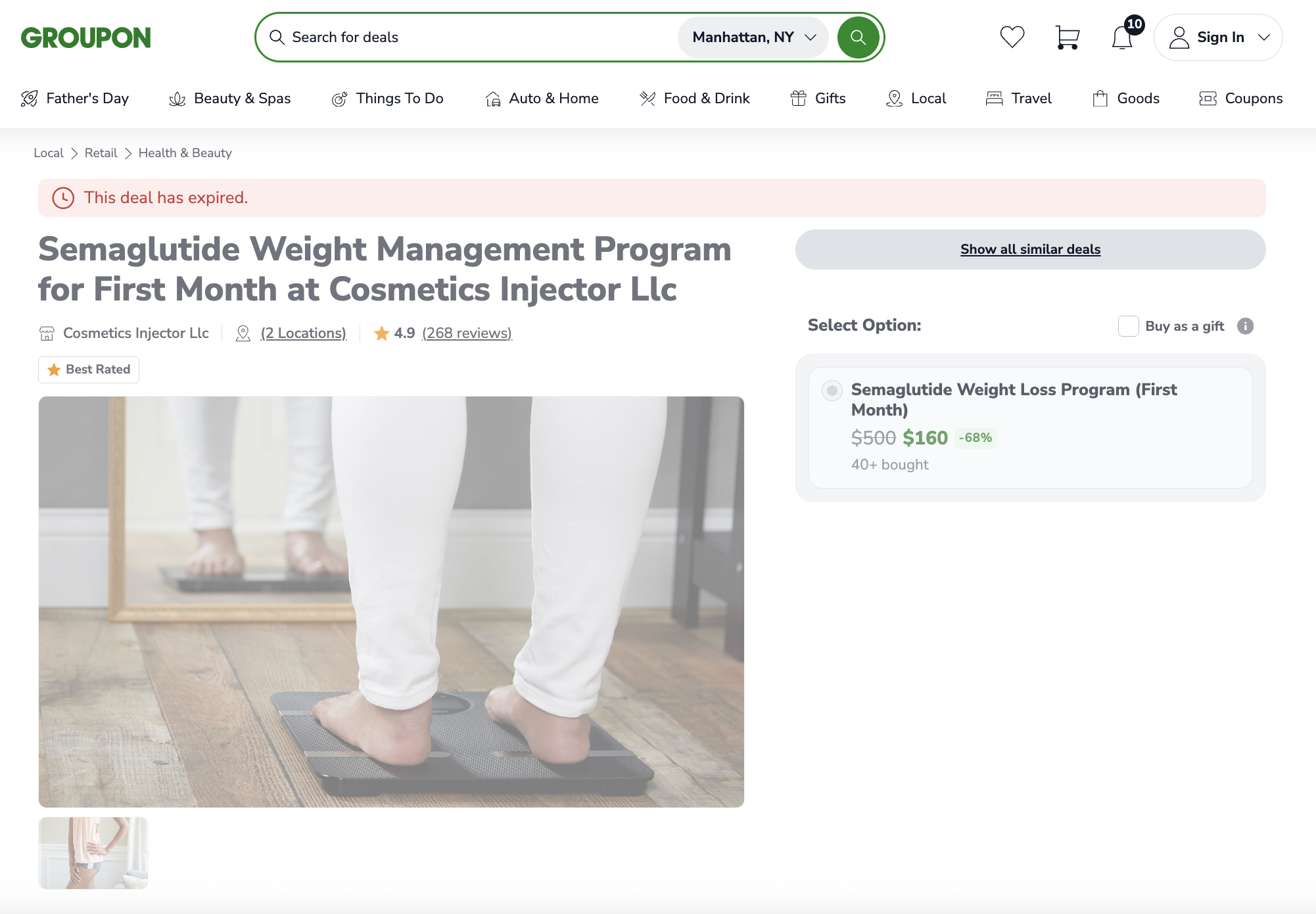

Below is telehealth entity called Weight Loss Injector which was made by a business called Cosmetics Injector that is located inside of a beauty salon in a shopping mall in King of Prussia, Pennsylvania. They have recently pulled down their Groupon offer and seem unable to compete with larger operations on Groupon that are offering deals around $50-$60.

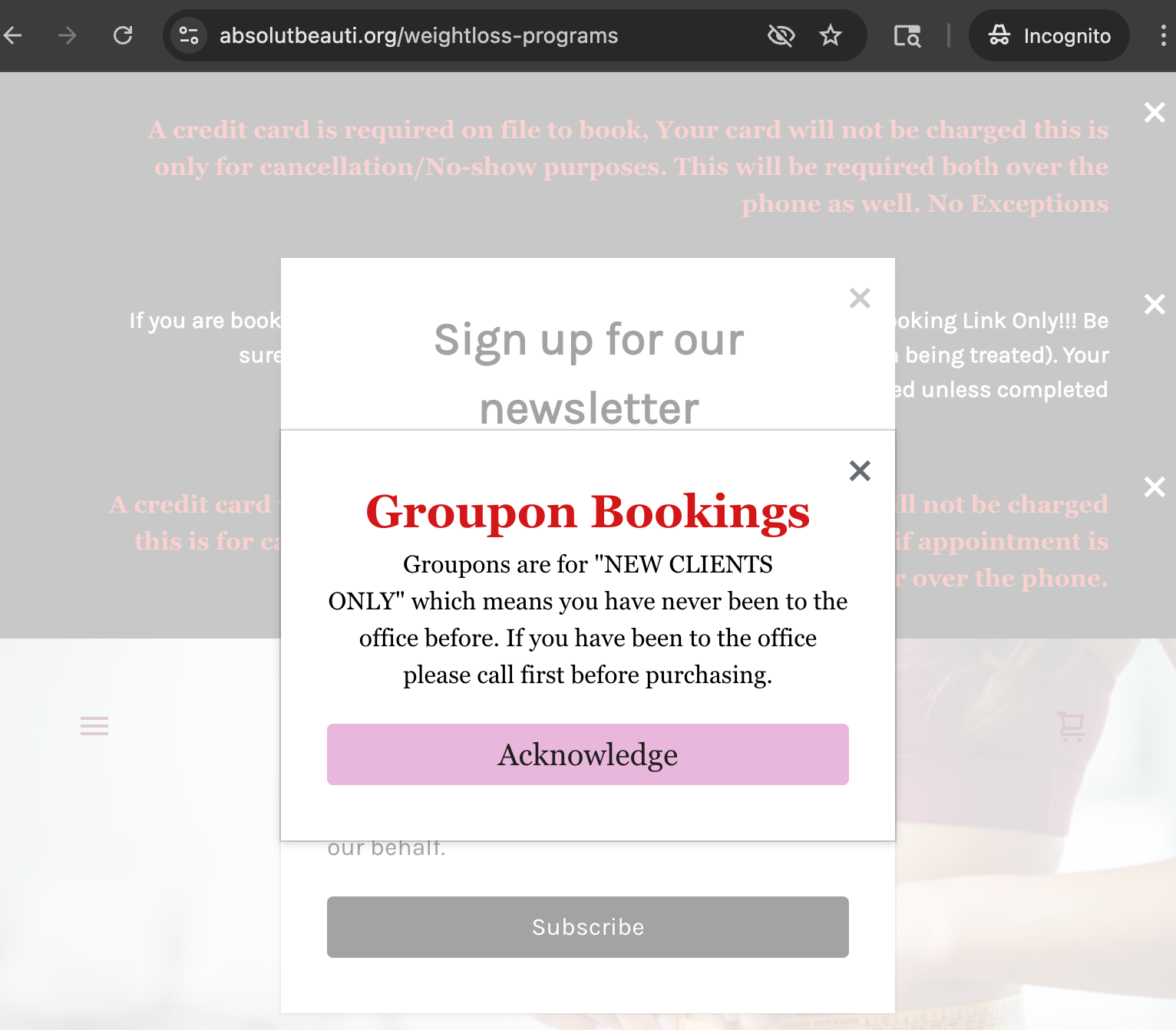

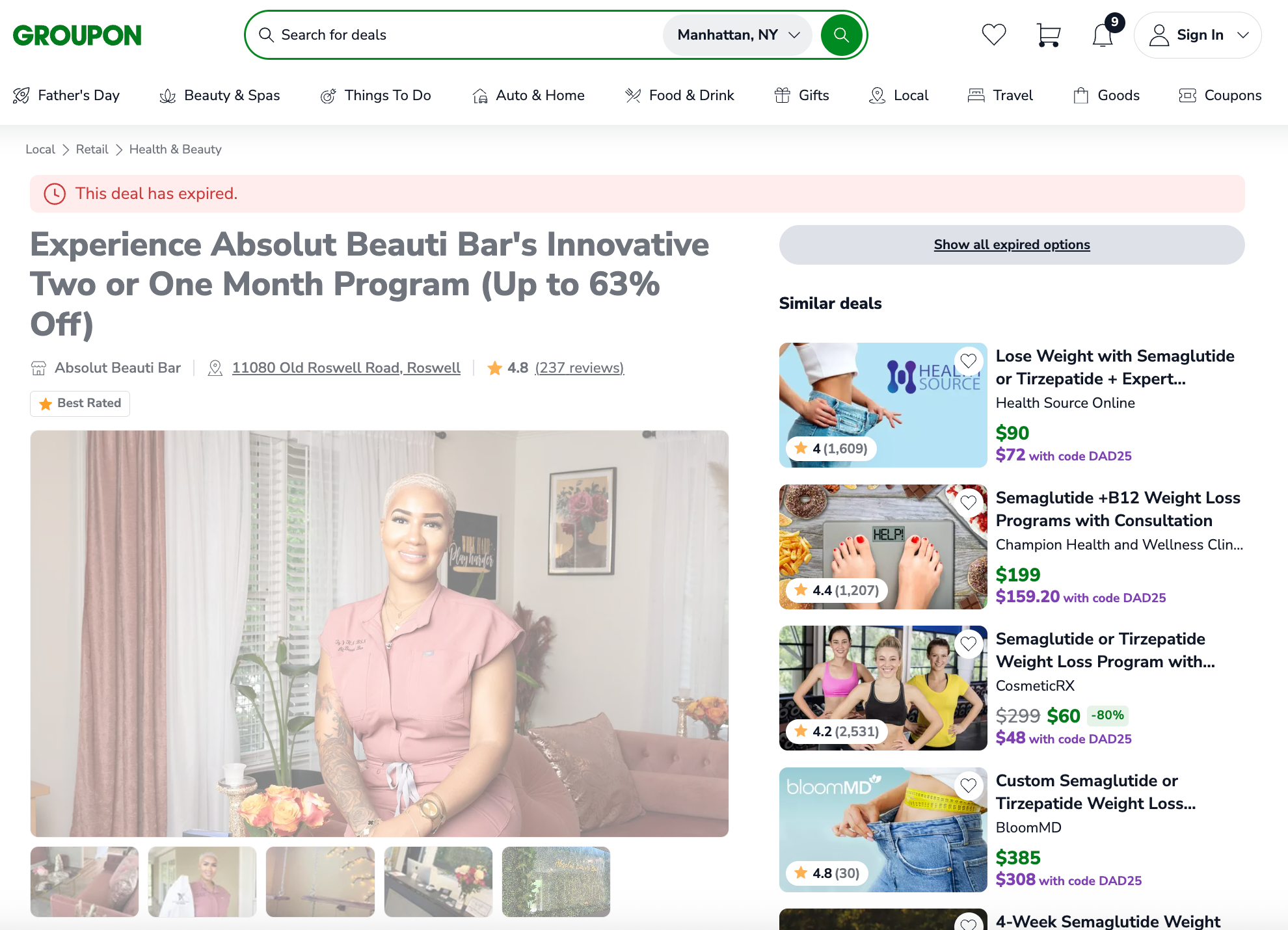

Below is a completely insane landing page experience from a med spa called Absolut Beauti (dot org?) in the Atlanta area, showing that this business clearly relies heavily on Groupon for weight loss customers.

Absolut Beauti Bar actively advertises on Groupon for Botox and other filler products, yet appears to have now abandoned their Groupon efforts around GLP-1, which they have advertised since June 2024 a year ago.

https://www.instagram.com/absolut_beauti/reel/C8hTzwbO0g2/ and https://www.groupon.com/deals/absolut-beauti-bar-9

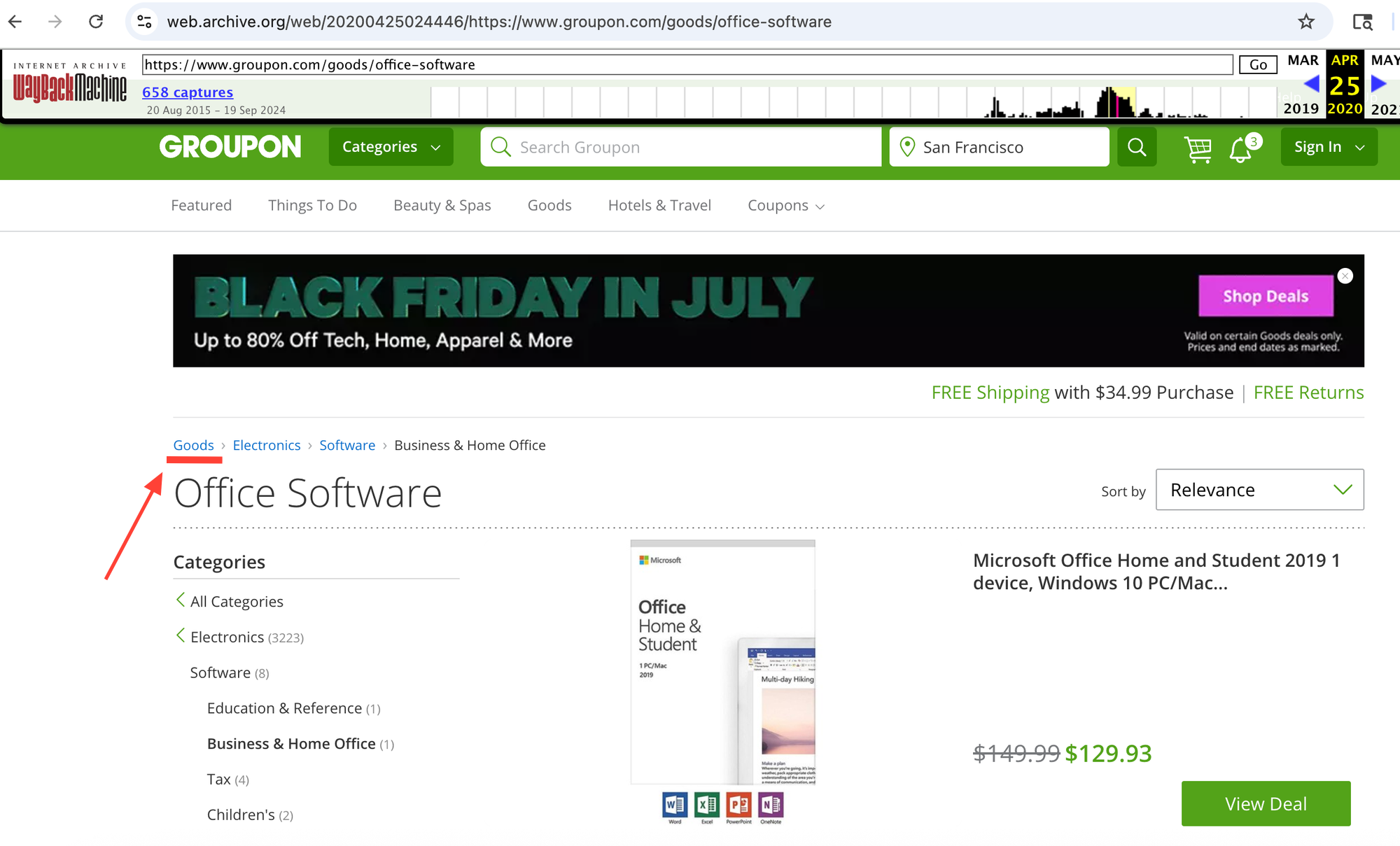

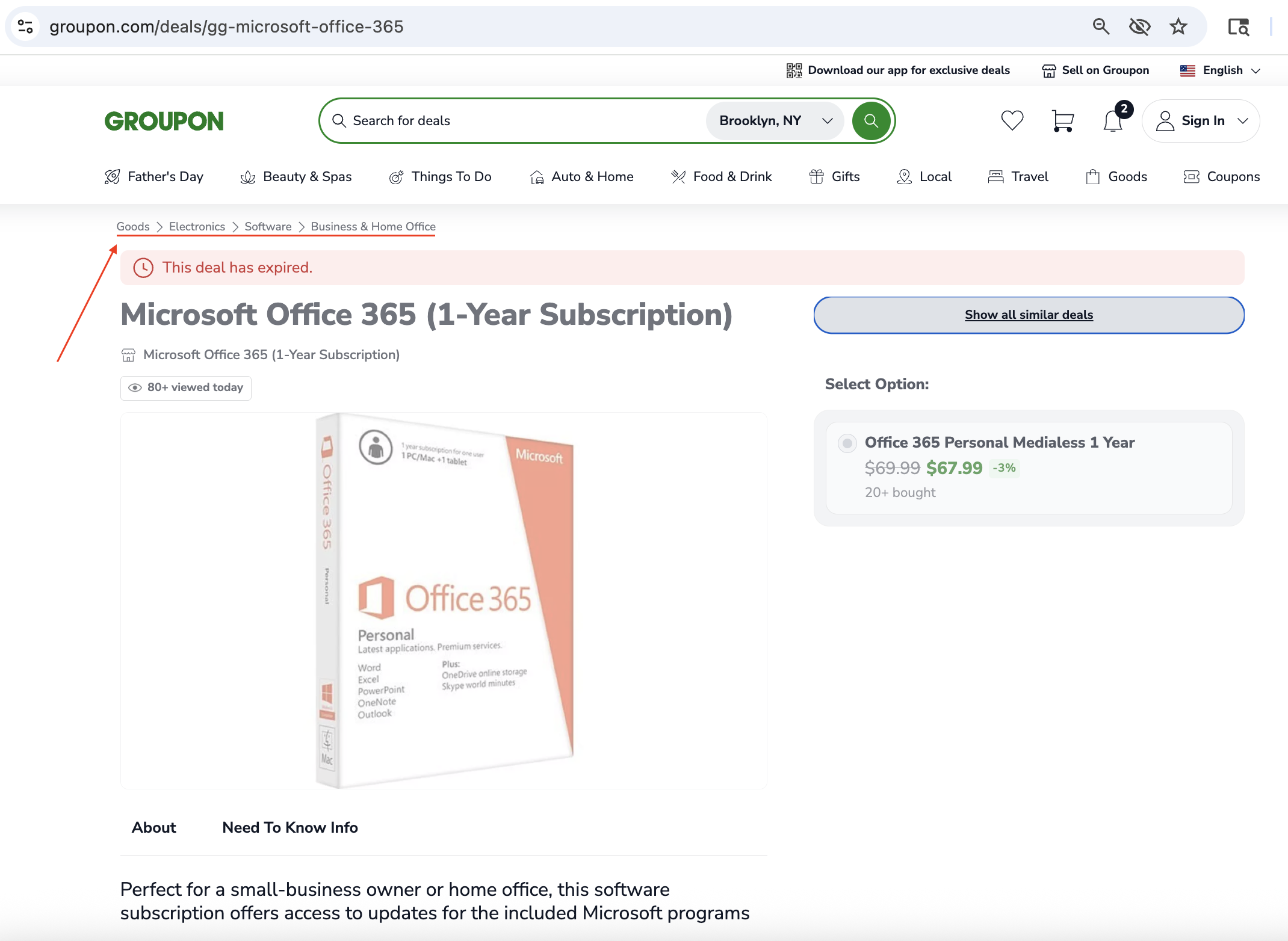

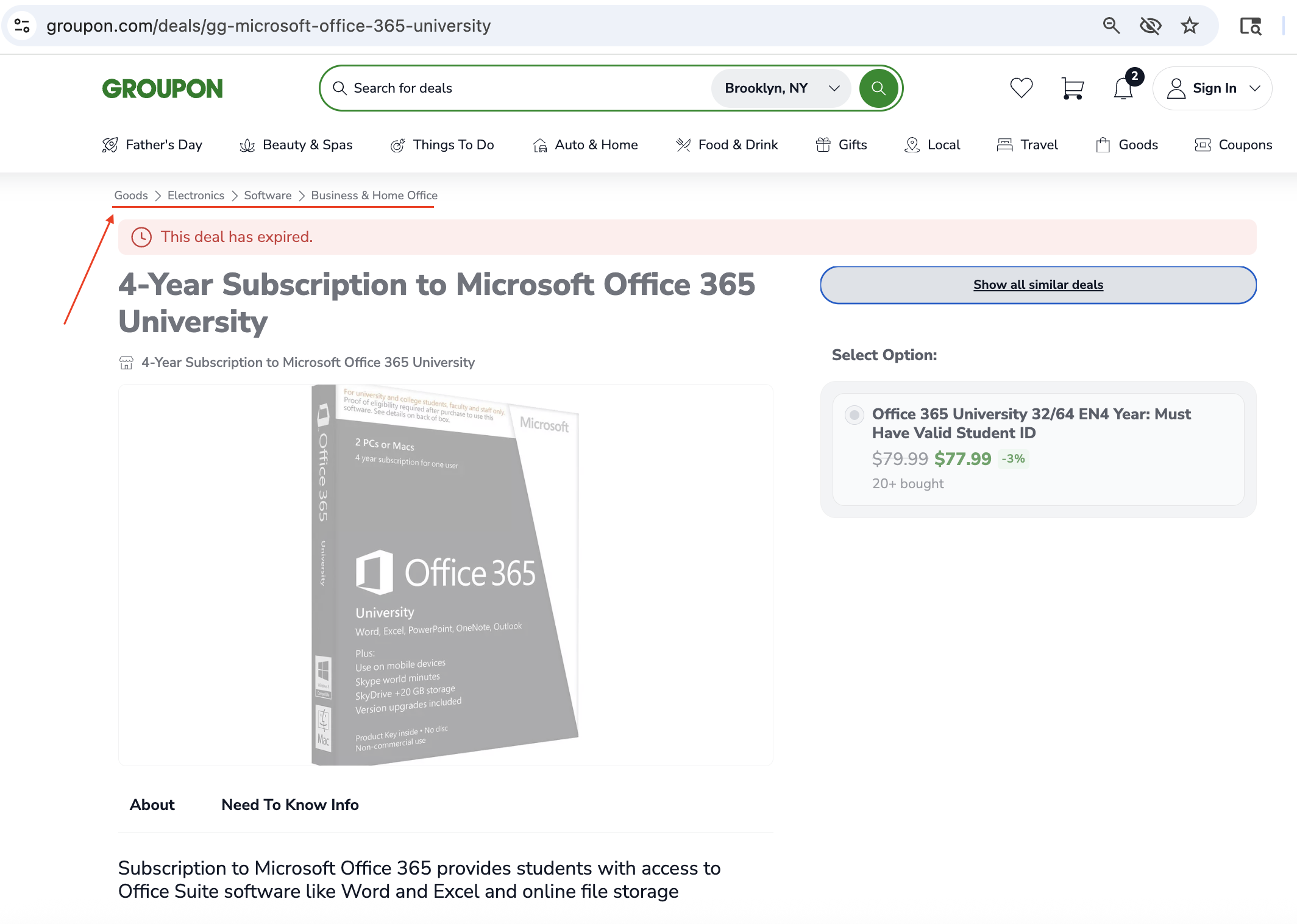

Groupon Leans Into Microsoft Office 2024, Released to Consumers October 1, 2024...and These Software Keys are Segmented as 'Local'

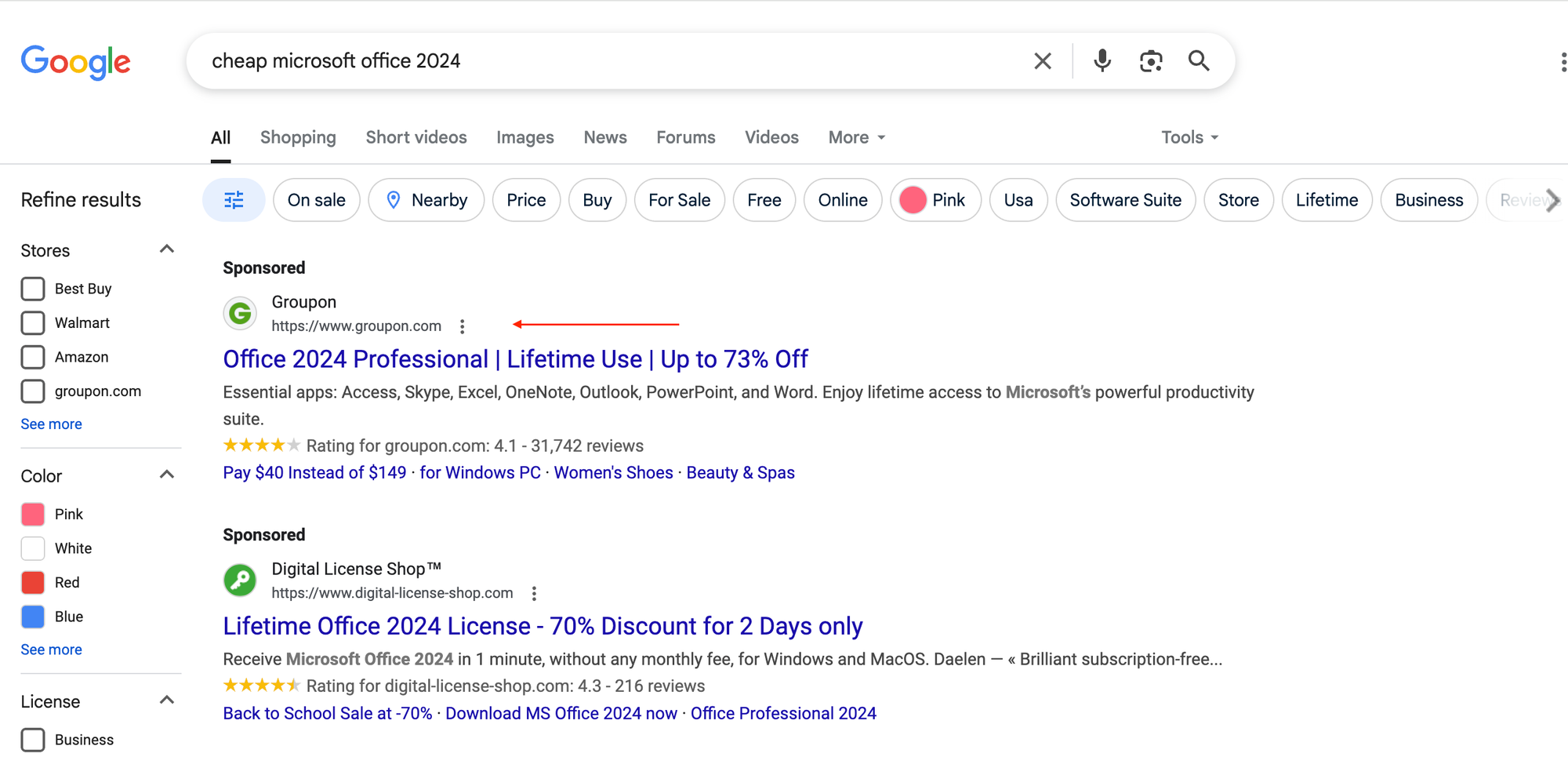

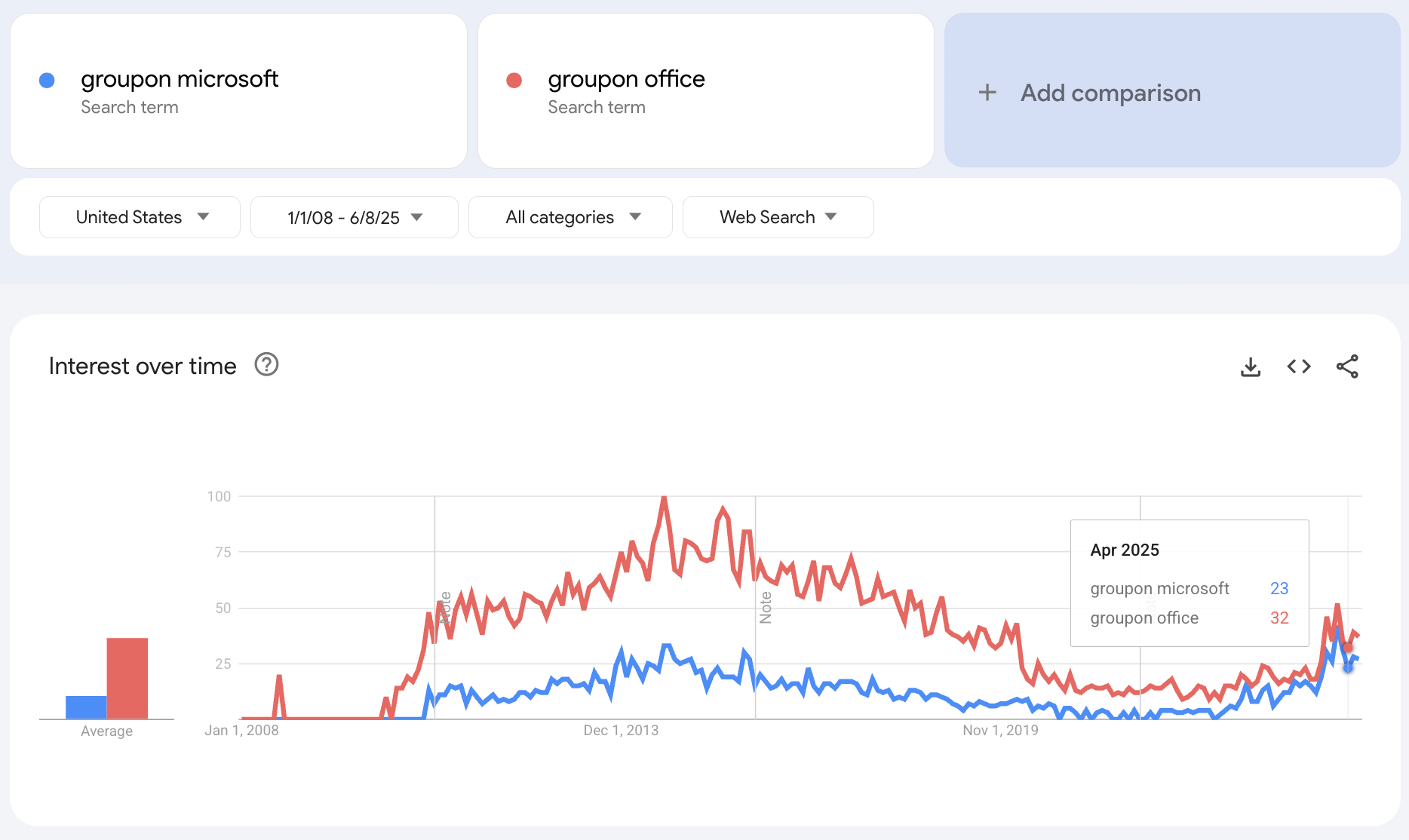

While Groupon has historically had various software license and product key offerings of varying quality over the years, it is clear that current management has actively pushed Microsoft Office to align with Microsoft's October 1, 2024 release of Office 2024. Included in these efforts is a push in USA Today in March 2025 and paid sponsorship and priority placement on Google Search.

Groupon's prior management team did not prioritize Microsoft Office-related efforts. The current management team's efforts show a clear spike in Q4 2024 through Q1 2025 centered around Microsoft's Office 2024 new version release, though this trend appears to have begun to tail off in Q2 2025.

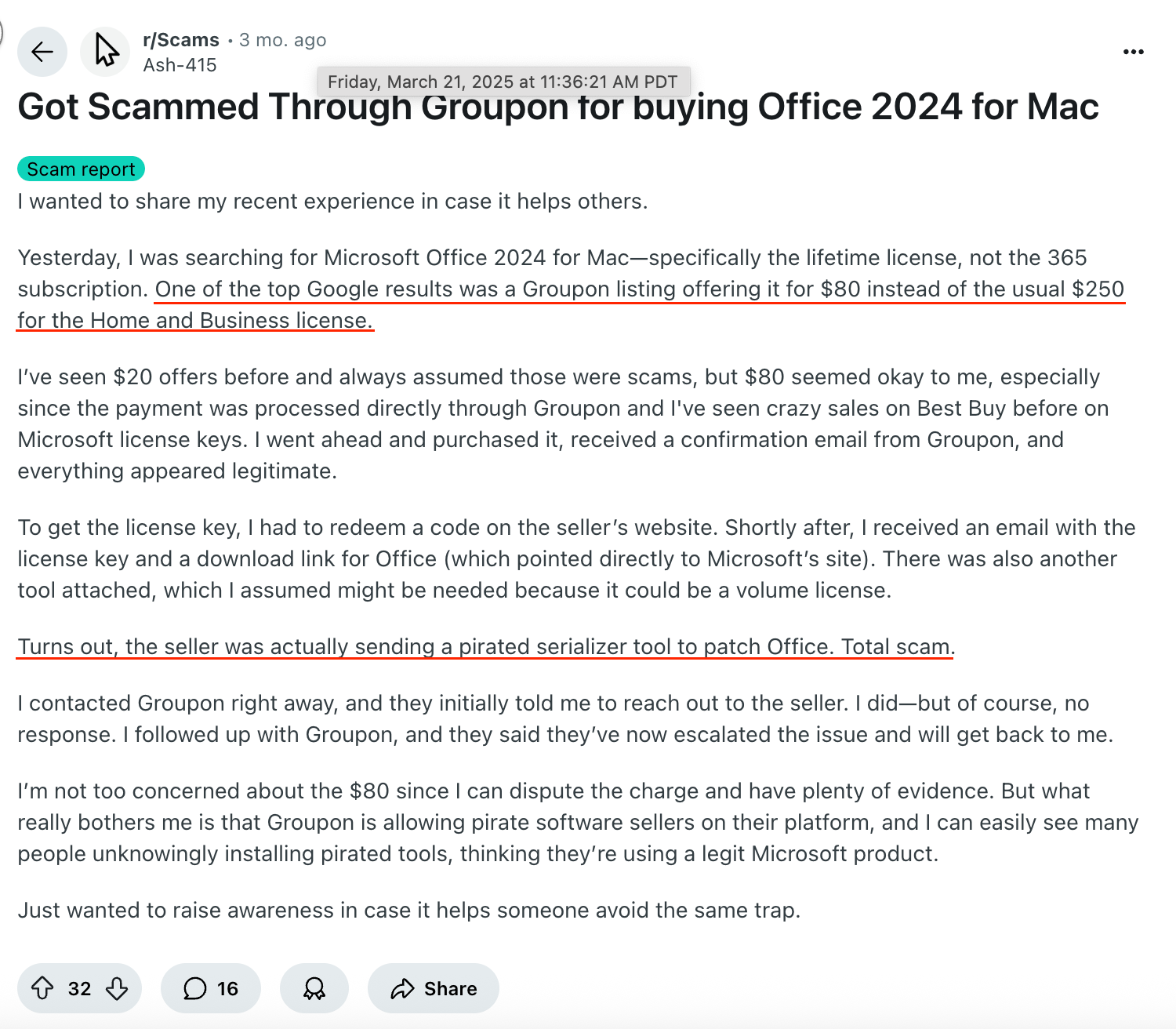

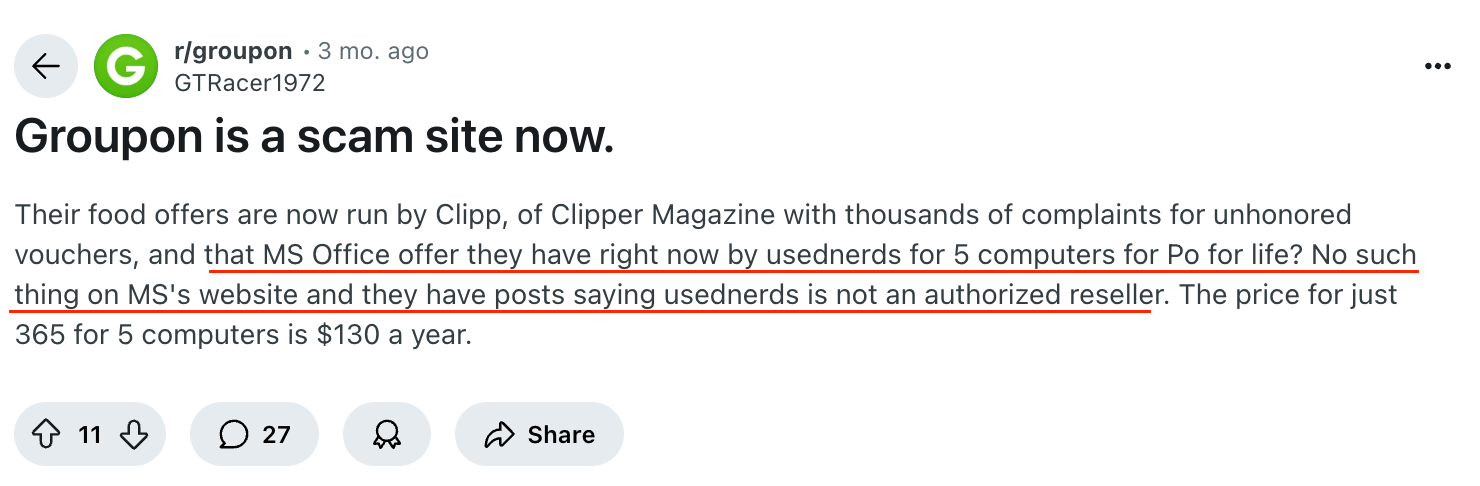

Additionally, there has been an uptick in reported scams and questionable product keys across social media and Microsoft forums related to Groupon's investment in pushing Microsoft Office 2024 sales such as this post about Groupon partner License Tom from February 2025 or this other post about License Tom from December 2024 or the many other posts across internet forums where Groupon customers report having issues with Office bought through Groupon.

Given that Microsoft Office 2024 was only first available to consumers from October 1, 2024 onward and given that Groupon posts their unit sales increments, we can proxy a floor for billings contribution from Microsoft Office 2024 and especially contribution to the North America Local billings.

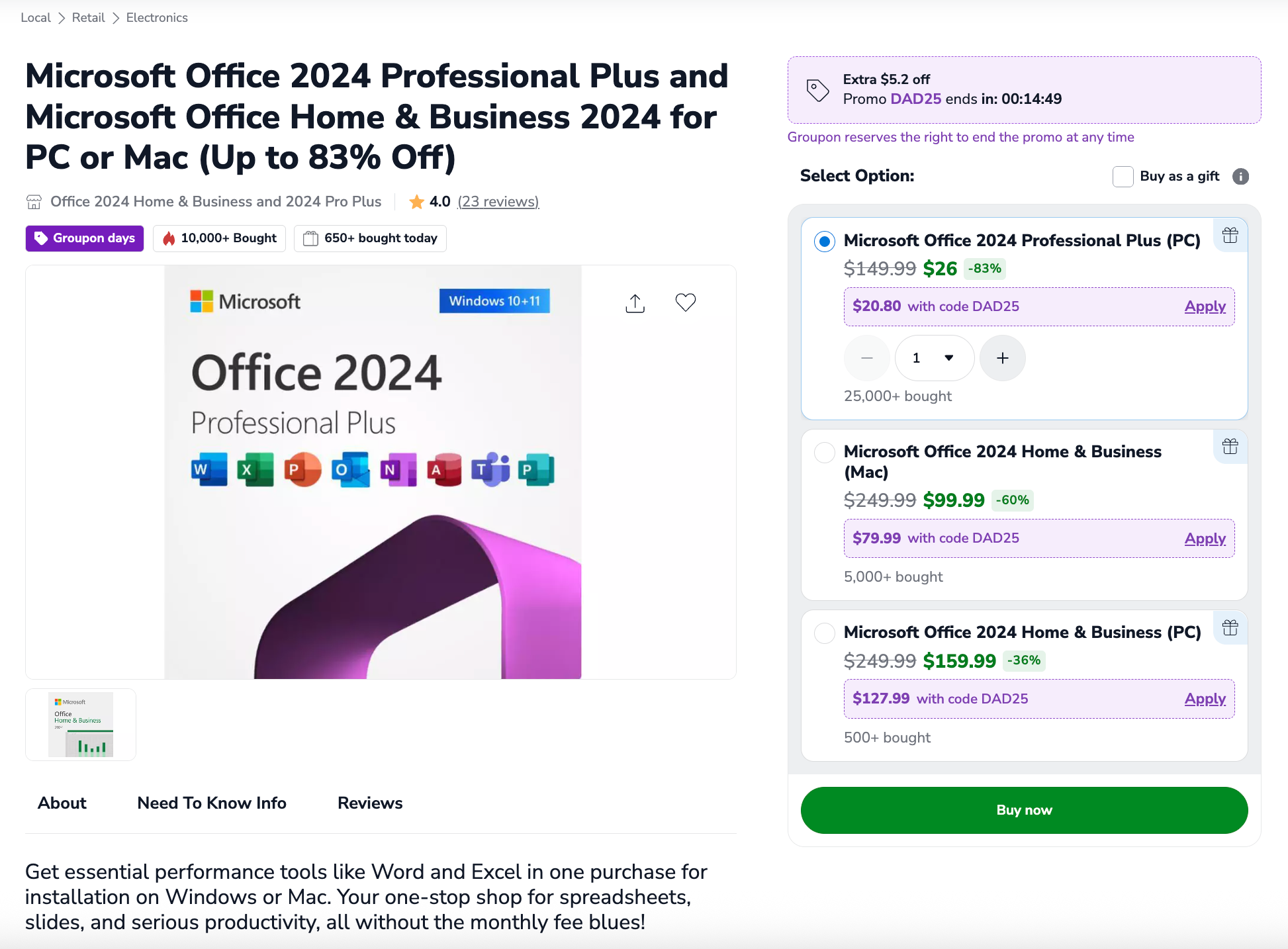

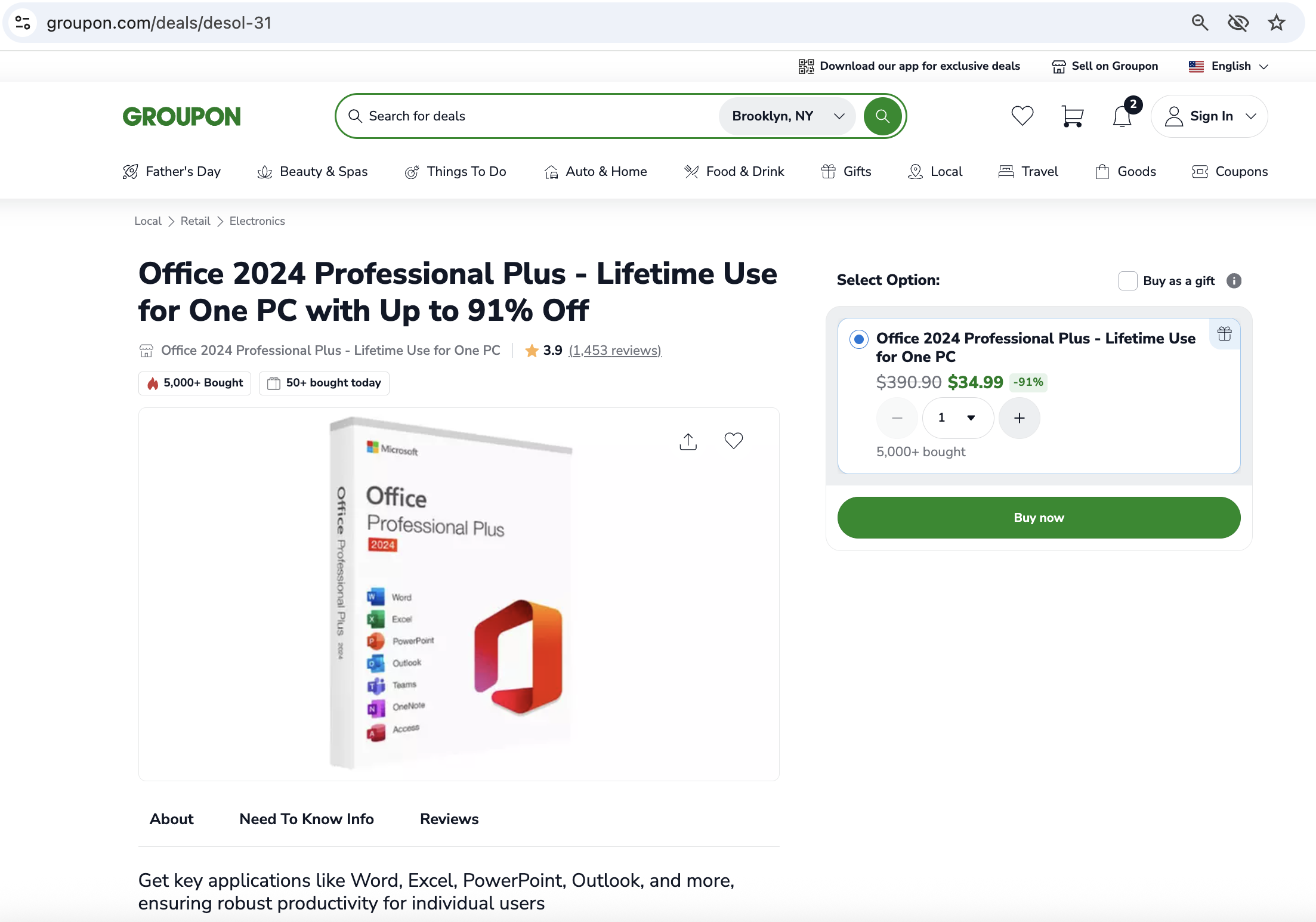

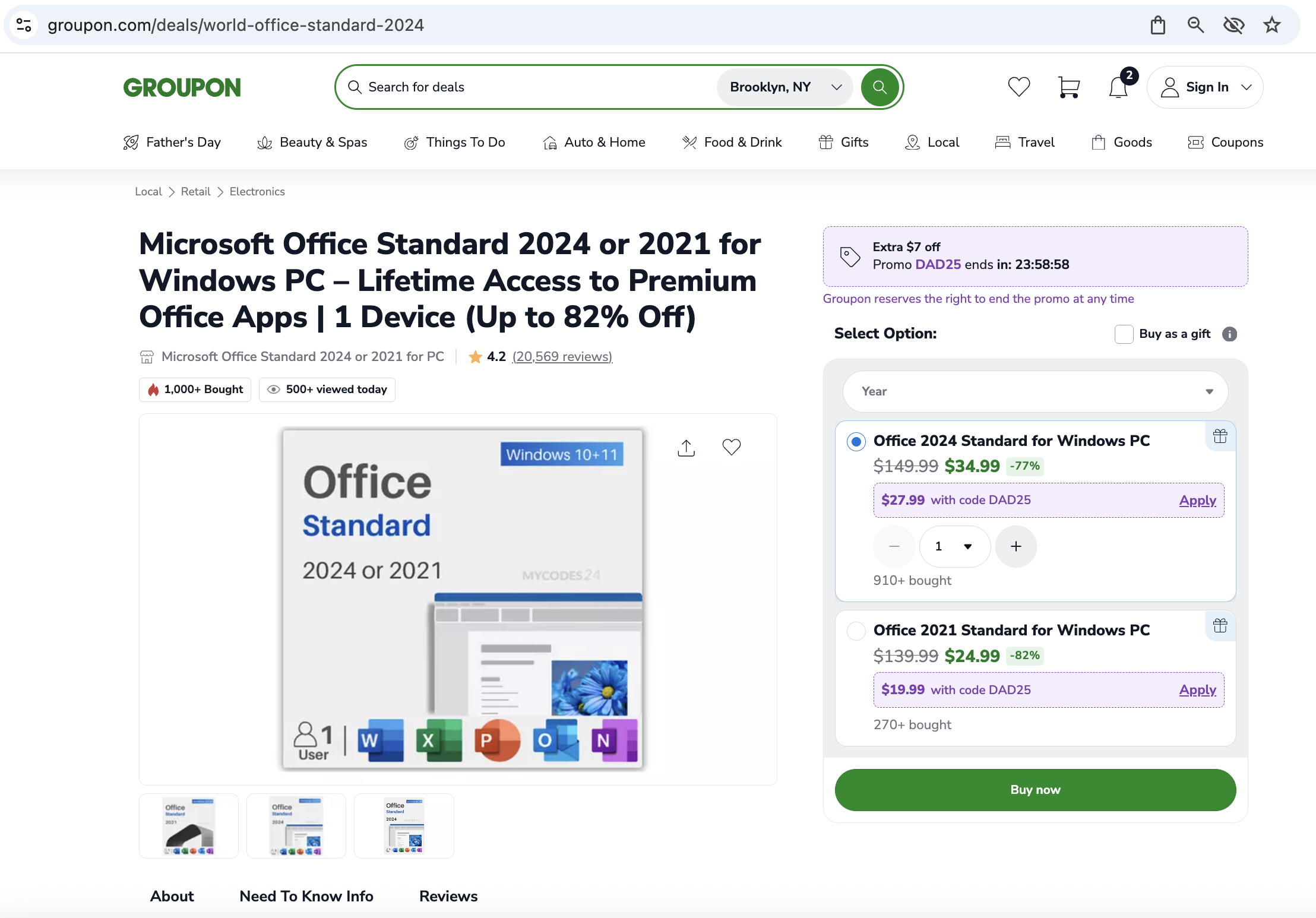

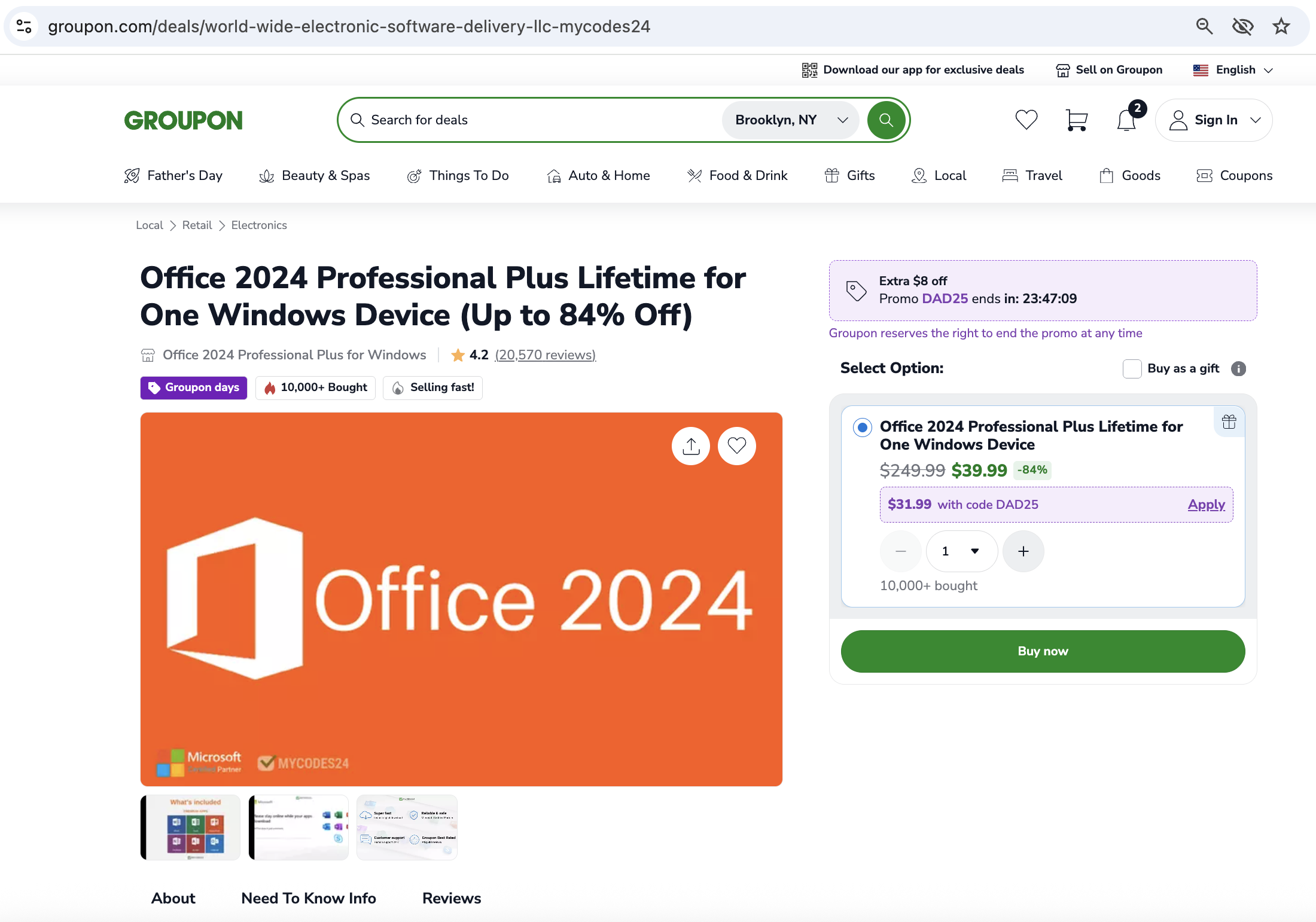

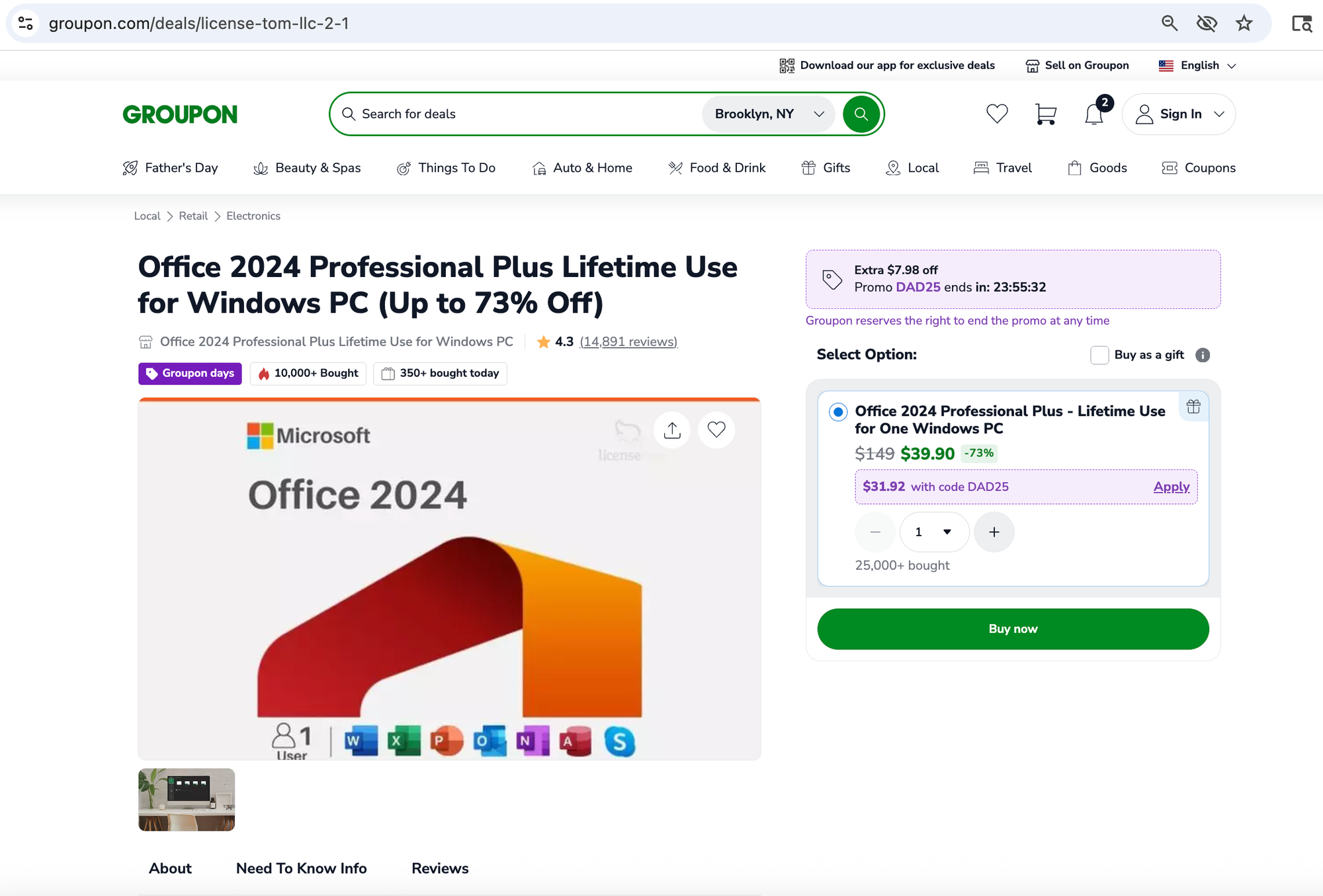

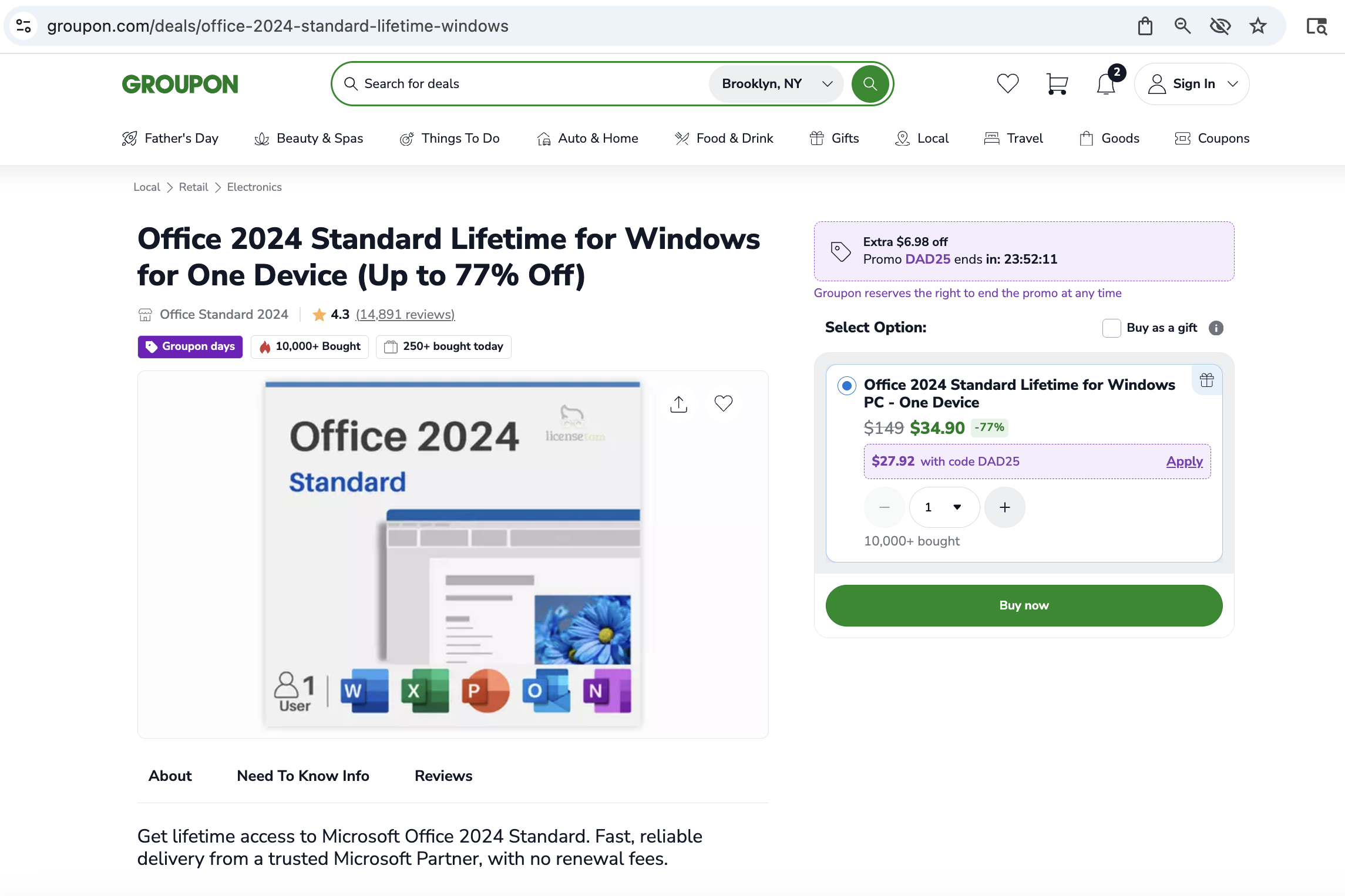

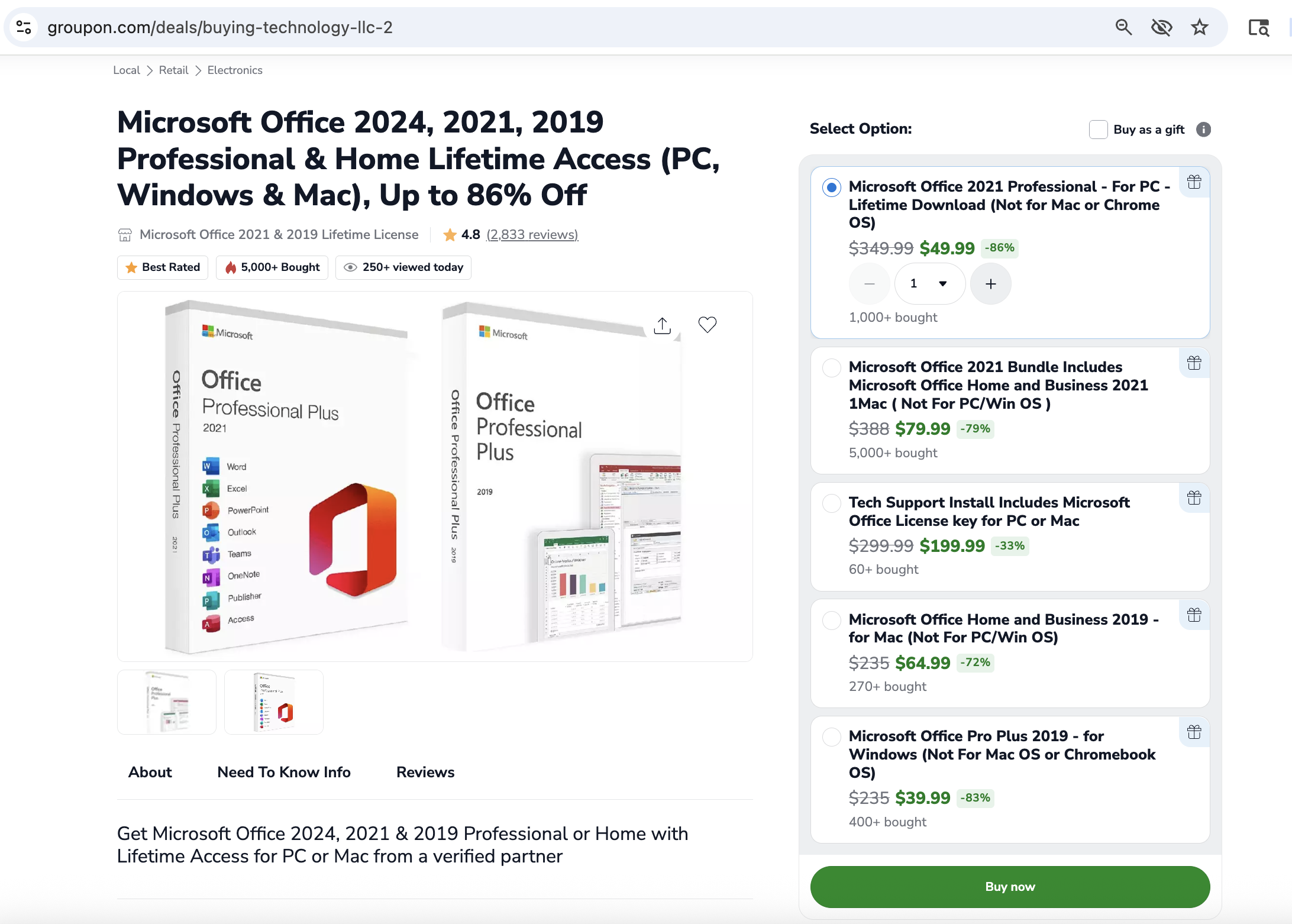

Below are the current Microsoft Office 2024 offers listed on Groupon's website as of June 8, 2025.

I note that these estimates are:

a) simply a floor, and the real billings numbers are likely much higher given that the unit sales are presented as round numbers (eg. 10,000+, 25,000+, etc.)

b) only reflective of the deals currently on the site as of June 6-8, 2025, and that many vendors come and go and are not currently displayed on Groupon

c) only reflective of the recent Microsoft Office 2024 offerings, although the increased traffic driven from this Microsoft release certainly translated to sales on Office 2021 and other versions, which became even more discounted

1) 2GoSoftware: Estimated Floor of $1.23M

25,000 units * $26 = $650,000

5,000 units * $99.99 = $500,000

500 units * $159.99 = $80,000

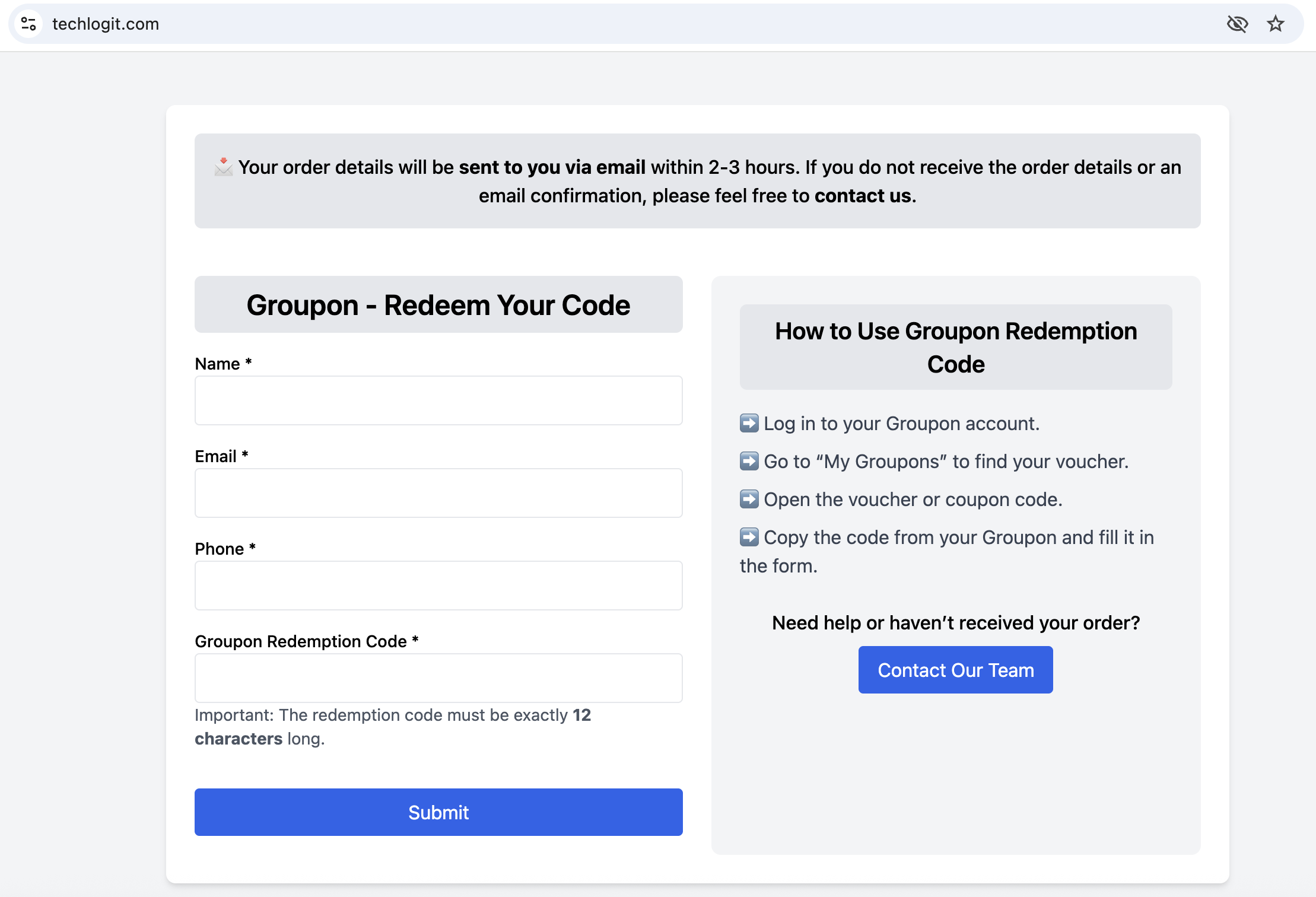

Note: this offer contains links that redirect to a site - techlogit.com - that seems to exclusively use Groupon.

2) Desol LLC: $0.175M

5,000 units * $34.99 = $175,000

3) MyCodes24: $0.44M

910 units * $34.99 = $31,850

10,000 units * $39.99 = $400,000

4) License Tom: $1.35M

25,000 units * $39.99 = $1,000,000

10,000 units * $34.90 = $349,000

There are also a number of other offers advertising Microsoft Office 2024 post-October 1, 2024 that do not actually offer Microsoft Office 2024, only earlier versions of Office. One example is below:

SQL Software Solutions: $0.46M

1,000 units * $49.99 = $50,000

5,000 units * $79.99 = $400,000

60 units * $199.99 = $12,000

270 units * $64.99 = $17,550

400 units * $39.99 = $16,000

It's obvious that home and business software is a priority for Groupon's management team and that this is contributing at least several million per quarter to North America Local billings and revenue.

Notably, all of this home and software seems to have become listed under the "Local" business segment in recent years, even though there is nothing inherently "Local" about digital licenses.

Looking into historical offers from the prior management team, home and business software appears to have been segmented as "Goods" in the past.

Why the Obfuscation from Groupon Management Around Segments and Categories?

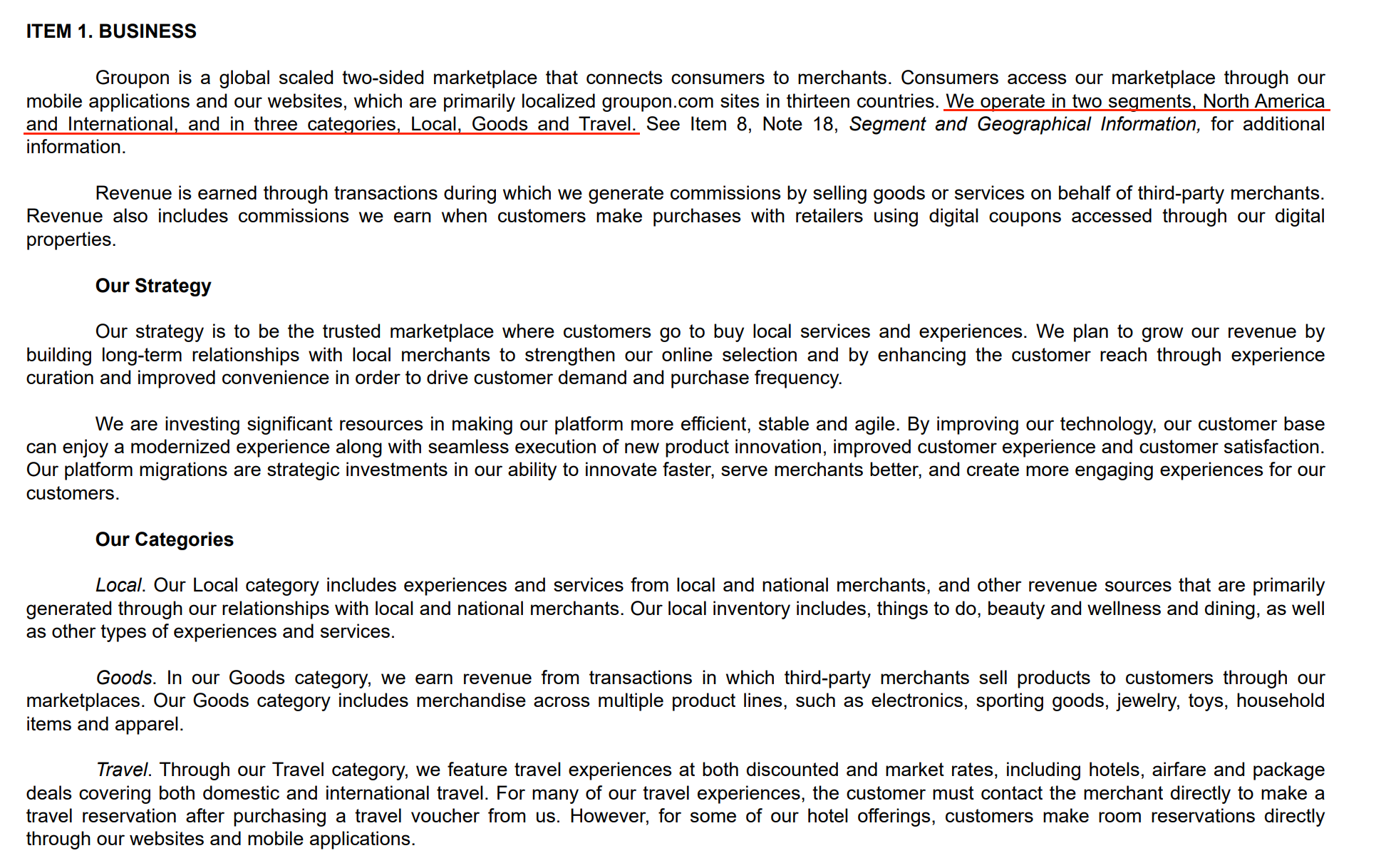

Groupon makes it crystal clear that they operate three distinct categories - Local, Goods, and Travel - across both North America and International, and that the key driver to the current management's turnaround plan is investing in and getting returns from the North America Local slice of the business, which is pitched to investors as what most people think of when the think of Groupon - the restaurant and massage and night out experiences at discounted rates.

As shown earlier, virtually all of the semaglutide/GLP-1 offers including the telehealth offers plus all of the home and business software are categorized as "Local" even though there is nothing inherently "local" about these deals.

Even after posting strong North America Local results for Q4 2024 and for the FYE December 31, 2024 Groupon CEODusan Senkypl still remained opaque about the nature of what is driving the key North America Local results.

On the associated earnings call from March 12, 2025 (which can be listened to here) there were no serious answers given to questions about what is driving the North America Local segment.

From the call:

Sean McGowan: Roth Capital

Thank you. Appreciate that. Yes, can you talk a little bit about the - what you think was driving that Local growth in the US? It seemed like it really turned around. I mean, I think when you gave us an update on the third quarter conference call it was running down, through October. So what do you think drove that turnaround in the late part of the quarter?

Dusan Senkypl

Yes. So thanks for the question. We had a lot of headwinds during last year, with technical migrations and platform projects, which were impacting our ability to deliver. So it was definitely one of the drivers. And as we were either finalizing them, or mitigating impact, our platform returned to, let's say, the performance, which we are expecting from it.

But at the same time, during the last several earnings calls, I was talking about our strategy shift, shifting to curated marketplace with sales organization focusing on quality when we don't go - for quantity. But we really look what we need on our platform. We are also spending much more time with our merchants, to make sure that they have deals, which perform.

So I would say that this is a combination of all these elements, which finally all fit together, and they work and they are reflected in the results, especially in the later part of Q4.

Operator

All right, we'll now pose written questions to management that, came in through our Investor Relations press line. Our first written question is for Dusan. Can you share what the December Christmas period looked like, from a growth perspective? North America Local was running in the low single-digits positive, during Black Friday, Cyber Monday and was likely down negative high single-digits, to negative low double-digits in October. Based on your commentary at that time around guidance framing though, would this imply the business was running up positive double-digits in December Christmas based on reported North American Local growth of plus 8% year-over-year?

Dusan Senkypl

So December, was very good. However, what we have to take into account, is that year-over-year compare was impacted by timing of Black Friday and some Cyber Monday. So it's not really apples-to-apples, but even said that on a like-for-like basis, comparing holiday 2024, to holiday 2023, we believe we had a very successful year in Local including some great numbers in the lead up to Christmas, and period between Christmas and New Year.

And what's important in the past, we have mentioned that we have observed that our platform tends to perform better during the key buying seasons, and Q4 was really no exception to that. For our Q1 outlook, as mentioned in earnings commentary, we lost some of the excitement from the Q4 season as we started Q1.

But we have been pleased with the momentum in North America Local, and see continued growth in billings. And while we commented that our first quarter outlook assumes better performance in local versus Q4, at this time we don't believe it will be double-digit growth in billings.

At no point are the elephants in the room of GLP-1 and Microsoft Office 2024 mentioned, nor has anyone brought up the fact that Groupon has quietly shifted its consumer software from "Goods" to "Local" or that all of these telehealth offers that blew up in growth through late 2024 are also "Local" designated on Groupon's US website.

Bringing It Together

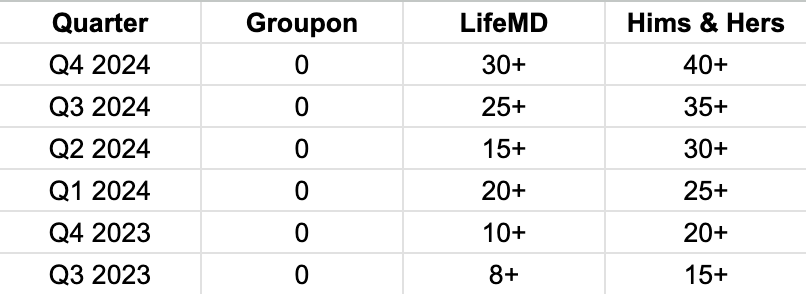

So what about Hims & Hers Health (NYSE: HIMS)? What about Ro and similar GLP-1 players? LifeMD (NASDAQ: LFMD)?

Well, first of all, year-to-date through June 6, 2025 GRPN is outperforming HIMS.

GRPN is up 174.5% YTD and HIMS is up 123.5% in the same period.

Hims and Ro and other larger distribution players will eat first before all of the hundreds of smaller players that must rely on Groupon for marketing. These larger players are able to compete on Meta and Google while the smaller players give one-third or more of their intro offers to Groupon for customers who are largely not loyal to any specific brand.

Additionally, Novo Nordisk has decided to partner with Hims & Hers as announced in April and Eli Lilly is partnering with Ro on Zepbound as announced in December. Novo Nordisk's Wegovy is also available on Ro and LifeMD.

These companies like Hims and Ro are real enough businesses with responsibility to shareholders and tons of regulatory scrutiny on them. They are somewhat household names compared to the garbage that exists on Groupon, where many of the ads and offerings do not even have proper spelling or risk disclosures in the offers. With prices coming down for name brands, it is clear that the business models of these fly-by-night telehealth services no longer work.

A quick run through of recent earnings transcripts of recent quarters for GRPN, HIMS, and LFMD is below showing the number of times semaglutide, GLP-1, weight loss, tirzepatide, and related terms are mentioned in each call, from mid-2023 through the final quarter corresponding with the end of calendar 2024.

Number of Times I Counted Semaglutide/Tirzepatide/GLP-1 Related Topics Brought Up on Quarterly Earnings Calls

Groupon's management team is willfully omitting the two biggest trends driving growth in the key North America Local segment. These two trends are full of liabilities, risks, and sketchy vendors operating in legal grey markets. Regardless of any enforcement from the FTC, state AGs, FDA, etc. these two trends of compounded GLP-1 treatments and MS Office 2024's release cycle are over and wrapping up.

While other bears may look extensively at merchant redemption rates or weakening consumer discretionary spend among low income Americans or Groupon's continued decline in revenue or even the increasing number of merchant complaints about Groupon on social media, I believe the true bear story here is that most investors long and short do not even fully appreciate that Groupon has become a GLP-1 and bootleg MS Office racket.

The upside is limited and the stock is over $30 per share in line with Groupon's ideal case for their late 2024 debt refinancing.

Groupon's management team cannot even discuss GLP-1 treatments or MS Office 2024 downloads when these are two of the larger trends of the past several quarters, so how can you be long this pile of rocks? If you really like GLP-1s, why aren't you investing your money into HIMS or LFMD or into the manufacturers directly instead of parking it in this much riskier affiliate marketing play on the crappiest GLP-1 pop-up shops?

________

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. Lauren Balik does not represent the interests of any fund or of any investor other than herself. Past performance is not indicative of future results. This content speaks only as of the date published. Any projections, estimates, forecasts, targets, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.