How Zeta Global (NYSE: ZETA) Cooks Revenue Guidance

Opinion: ZETA remains a Strong Sell.

Background

- On October 11, I discussed how Zeta Global uses low-quality political blogs and election prediction market PredictIt for comments section data collection through the Disqus product and why Zeta Global’s ‘Zeta 2025 Plan’ aligns Zeta equity value to coincide with the 2024 US election cycle.

- On October 15, I discussed how Zeta Global leaked the data of ~15,000 Zeta customers and prospects by failing to secure customer data and leaving it exposed on the open, public internet. We went over how we can use Zeta’s leaked data to proxy which customers are among Zeta’s largest.

- On October 18, Barclays downgraded ZETA, moving the stock rating from Overweight to Equal weight with a price target of $28.00.

- On October 21, I discussed how Zeta Global runs a comically ridiculous business called “Aptroid” and has filled Aptroid’s website with fraudulent marketing claims. We also went over how there is almost nothing at all to Zeta Global’s “AI” story and how Zeta is using Snowflake (NYSE: SNOW) for a white label in addition to reselling Snowflake, thus “double dipping” on customers.

- Today, we will cover how Zeta Global has been manipulating revenue guidance through creative wordsmithing in order to dupe investors into believing certain election revenue is not cyclical, thus giving a rosier picture of sustainable revenue growth.

‘Political and Advocacy Customer’ Revenue

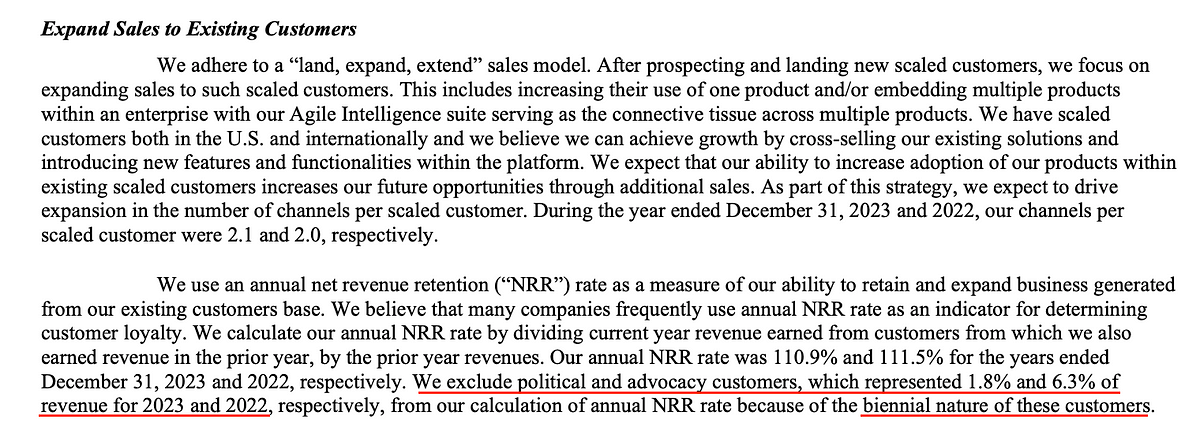

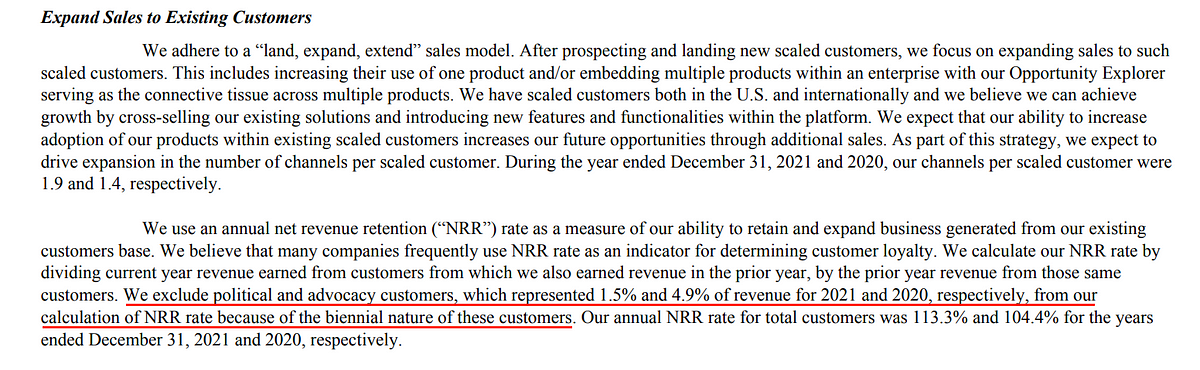

In Zeta Global’s 10-Ks, it’s noted that due to the biennial nature of “political and advocacy” revenue, political and advocacy revenue is excluded from NRR calculations.

From this 10-K, we can gather Zeta Global’s political and advocacy customer revenue.

In fiscal year (which aligns to calendar year) 2022, Zeta Global claims $590,961,000 in revenue and 6.3% of that equals $37.2M of political and advocacy customer revenue in 2022.

Likewise, we can gather 2020–2021 data from the FY2021 10-K as well as other 10-Ks, as seen below.

In fiscal year (which aligns to calendar year) 2020, Zeta Global claims $368,120,000 in revenue and 4.9% of that equals $18M of political and advocacy customer revenue in 2020.

So to recap, per Zeta Global’s audited 10-K’s:

- 2020 Election Cycle: Zeta Global did roughly $18M in FY2020 “political and advocacy customer” revenue

- 2022 Election Cycle: Zeta Global did roughly $37.2M in FY2022 “political and advocacy customer” revenue

Zeta’s Creative Wordsmithing

***I note that unless one is actively performing the algebra on this one specific sentence buried in the NRR definition in the 10-Ks, as I performed above, it’s unlikely that the nuances of this biennial spike are actively accurately tracked by investors.***

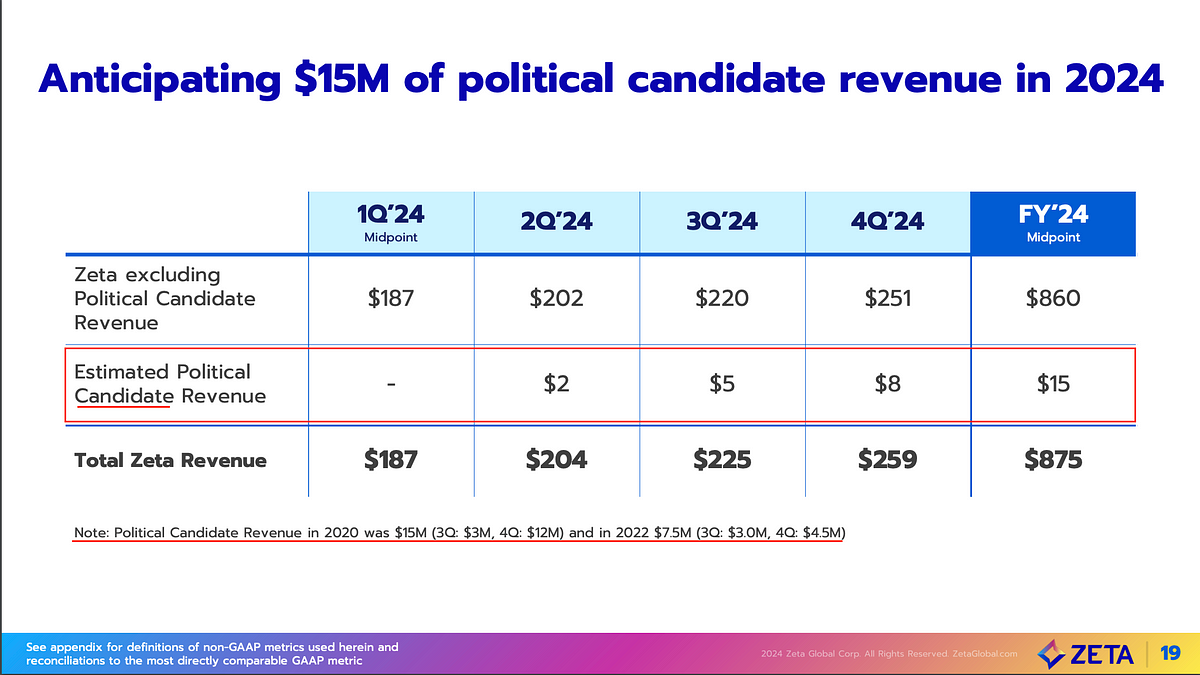

In 2024 Zeta Global has been providing materials to investors that appear to be a change in definition around this biennial revenue.

In Zeta Global’s earnings presentation and deck dated February 27, 2024, under the section titled “1Q’24 & FY/24 Guidance” Zeta Global claims:

- They anticipate $15M in political candidate revenue in 2024

- Political candidate revenue in 2020 was $15M and in 2022 was $7.5M

Huh? How is that possible? Above we used the 10-Ks to line up what Zeta Global claimed as political and advocacy customer revenue that equals $18M in FY2020 and $37.2M in FY2022.

And now Zeta Global is claiming that political candidate revenue was $15M in FY2020 and $7.5M in FY2022?

This is a clear difference in definition.

Zeta Global seems to be rolling up advocacy revenue (PACs, special interests groups, anything not directly a politician’s campaign itself, etc.) into the “non-political” line in their guidance. However, as we all know, most of this election season spend is still biennial in nature, whether it’s coming from a PAC or special interest group or other political group that is not directly a politician’s campaign.

In fact, just off the numbers here, in 2022 Zeta Global has $37.2M in political and advocacy customer revenue minus the $7.5M claimed as political candidate revenue, meaning a difference of $29.7M in 2022 revenue attributed to political and advocacy groups that are not political candidate campaigns themselves. Zeta Global did roughly 4x more revenue from non-candidate political and advocacy groups in 2022 than they did direct from the political campaigns themselves.

Zeta Global has stuck with this narrative about “political candidate” vs. “non-political candidate” as the disaggregation all year.

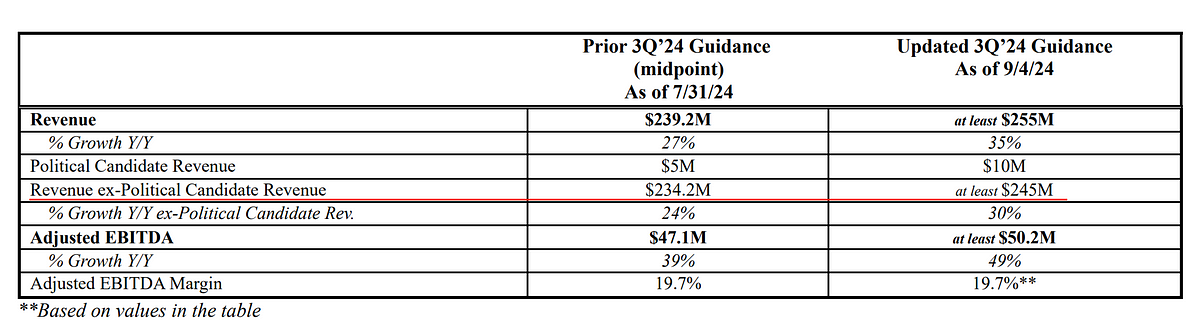

In fact, on September 4, 2024 Zeta Global put out an 8-K and press release between earnings calls raising guidance for Q3 2024 and again reiterating this revenue disaggregation in a manner not in line with their 10-K reporting.

Don’t get stuck holding the bag when this revenue disaggregation definition obfuscation collapses — this is clearly a major part of this growth story that’s been boosting the stock price this year.

________

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. Lauren Balik does not represent the interests of any fund or of any investor other than herself. Past performance is not indicative of future results. This content speaks only as of the date published. Any projections, estimates, forecasts, targets, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.