Klaviyo (NYSE: KVYO): A Tunnel Painting on a Rock

Opinion: Klaviyo is a Strong Sell, with extreme and under-appreciated risks through 2025. Its customers are poorly capitalized, tenuous businesses with massively disproportionate exposure to consumer discretionary. I am short KVYO.

Klaviyo is MailChimp for e-commerce SMB. However, plenty of e-commerce companies also just use MailChimp or other email service provider solutions.

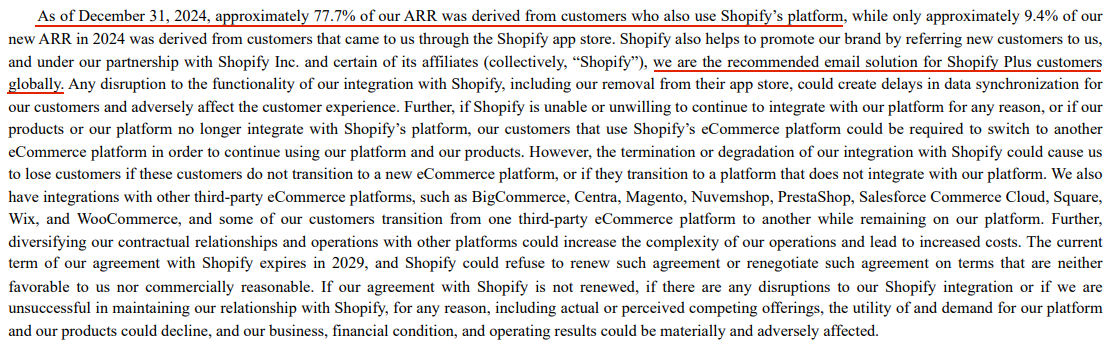

Klaviyo lives and dies by the health of the Shopify ecosystem, with Shopify as an investor of Klaviyo and an agreement set up where Shopify will promote Klaviyo as Shopify's recommended email solution for all Shopify Plus customers. In fact, as of the most recent 10-K reflecting year ending December 31, 2024 nearly 78% of Klaviyo's annualized recurring revenue (ARR) in 2024 came from Shopify customers.

This revenue exposure to Shopify and e-commerce has not meaningfully changed in the approximately two years since Klaviyo's IPO, with Klaviyo's S-1 showing that as of December 31, 2022 Klaviyo had near 78% ARR exposure to Shopify.

Klaviyo is uniquely exposed among US publicly traded software companies to not only ongoing tariff issues among its customer base, but also the close of the de minimis loophole which has allowed Klaviyo's customer base of dropshipping outlets and long tail Shopify stores to flourish.

I believe over 50% of Klaviyo's 167,000 SMB e-commerce customers are at extreme risk of going out of business by the end of calendar 2025, and I believe customers representing roughly one-third of Klaviyo's 2024 revenue is at a risk of disappearing altogether through 2025.

Even if the ongoing tariff rates for China and elsewhere settle out at a much less extreme rate than what is currently in place, Klaviyo's customer base of dropshipping e-commerce outlets and long tail single and two digit millions gross revenue e-commerce shops will largely be unable to sustain a business model without the de minimis exemption. This is an extinction level event for Klaviyo's customer base and the Trump Administration, and even some Democrats through 2024, have signaled the desire to close this trade loophole regardless of specific tariff rates.

Large Customer Concentration - or Lack Thereof

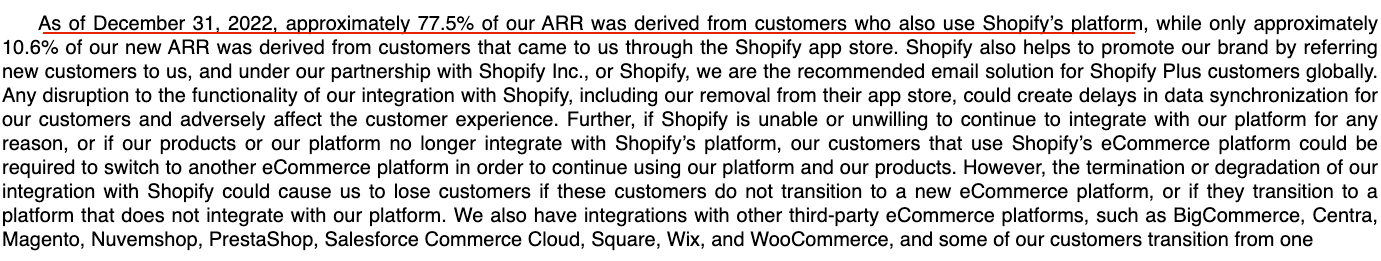

Klaviyo distinguishes its higher contract value customers by establishing a business metrics of Customers Generating Over $50,000 of ARR.

In filings, Klaviyo states:

We calculate our number of customers generating over $50,000 of ARR (as defined below) as those customers that have an average ARR of greater than $50,000 over the prior twelve months (or the entire duration of the customer’s paying relationship, if it is less than twelve months) as of the date of determination. We believe the number of customers generating over $50,000 of ARR is a key performance metric to help investors and others understand and evaluate our results of operations in the same manner as our management team, as it is an indicator of our ability to grow the number of customers that are exceeding this ARR threshold, both from our existing customers expanding their usage of our platform and from our sales to larger customers. We believe this is an important indicator of our ability to continue to successfully move up market.

However, this "ability to continue to successfully move upmarket" shows anything but the ability to move upmarket.

First, $50,000 per year in revenue contribution is an especially low threshold for mid-market and enterprise businesses.

Second, as of the most recent 10-K, over 98% of Klaviyo's customers still contribute to ARR at rates under this $50,000 per year.

Klaviyo is a long tail play and even their "larger" customers are not necessarily truly large customers.

Credit Card Risks

The largest risk of holding so many long tail customers in the e-commerce space is that many pay Klaviyo on a month-to-month basis rather than Klaviyo's "manual invoice" program. Klaviyo's Average Revenue Per Account or revenue divided by number of customers comes in under $6,000 per year and as this is an average it is skewed by some of the larger $50k+ ARR customers.

Klaviyo does not permit the majority of customers to pay via invoicing, instead charging credit cards month-over-month, as outlined in Klaviyo's terms. In fact, customers only become eligible to move away from credit swipes if they contribute over $10k per month to Klaviyo. This is beyond even the $50k ARR customer metric.

As these e-commerce businesses begin to turn the lights off, credit cards will simply stop working and Klaviyo won't even be meaningfully able to claim AR – the cards will simply shut off as these businesses close.

Let's dive into specific examples highlighting the absolutely dire situation many of these Klaviyo customers are facing...

Klaviyo's Customer Base is Not Alright: Cases of Klaviyo Customers About to Fold or Cut Down on Spend

In recent weeks, media ranging from The Wall Street Journal to CBS News and seen throughout social media points to a panicking Klaviyo customer base.

In fact – and I do not believe anyone else has publicly put this together and publicly stated it – many of the most widely shared articles and pieces feature Klaviyo customers.

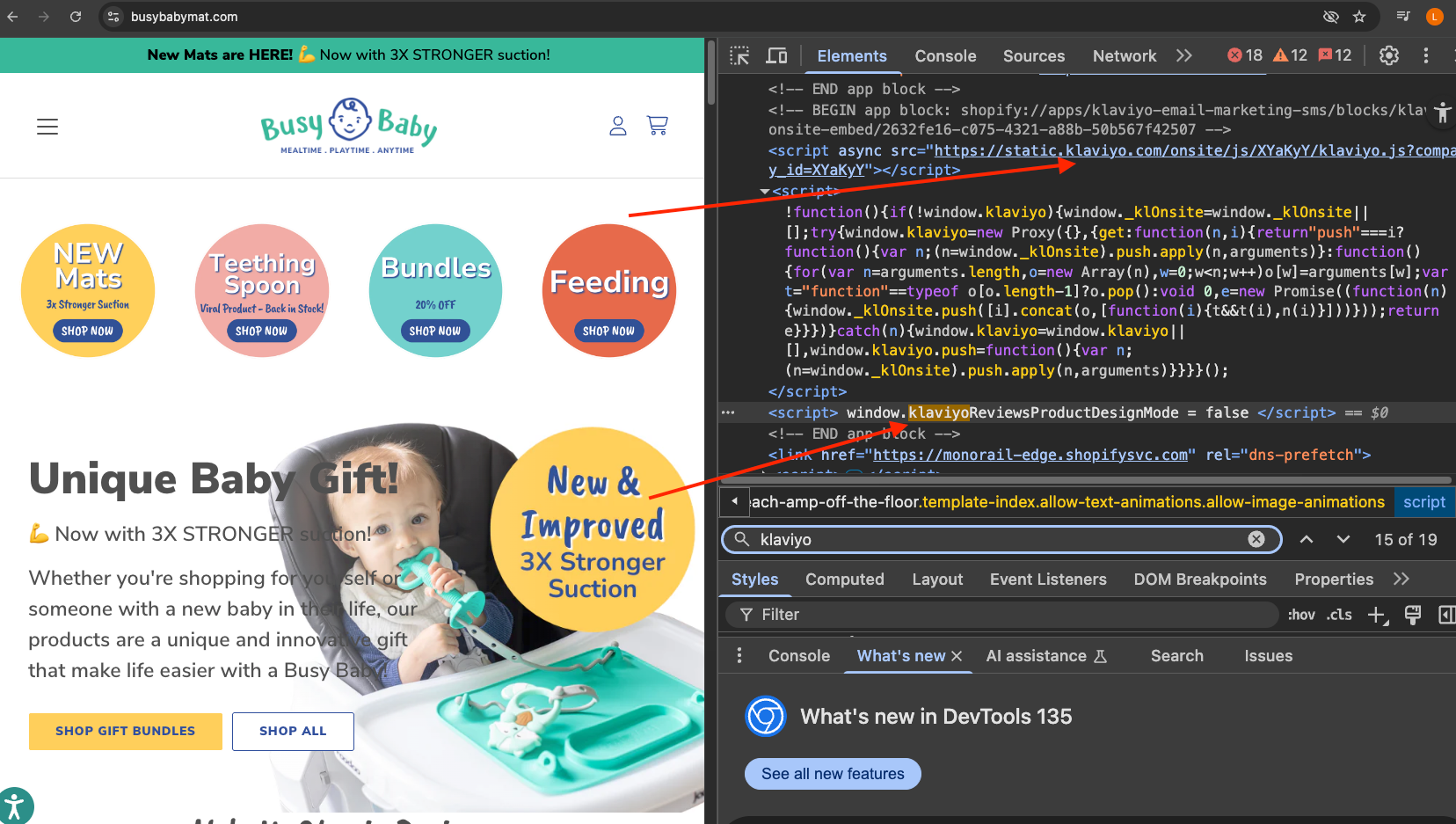

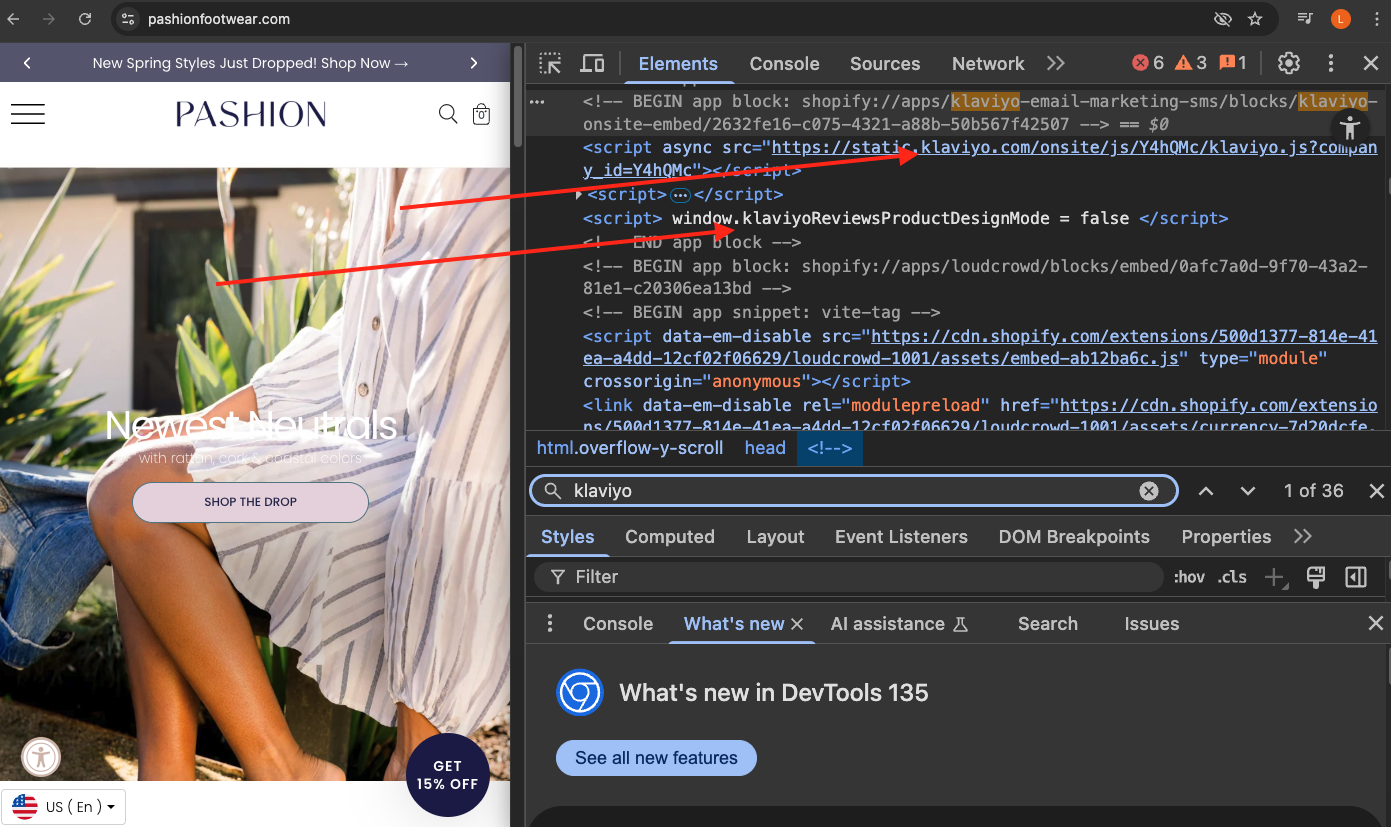

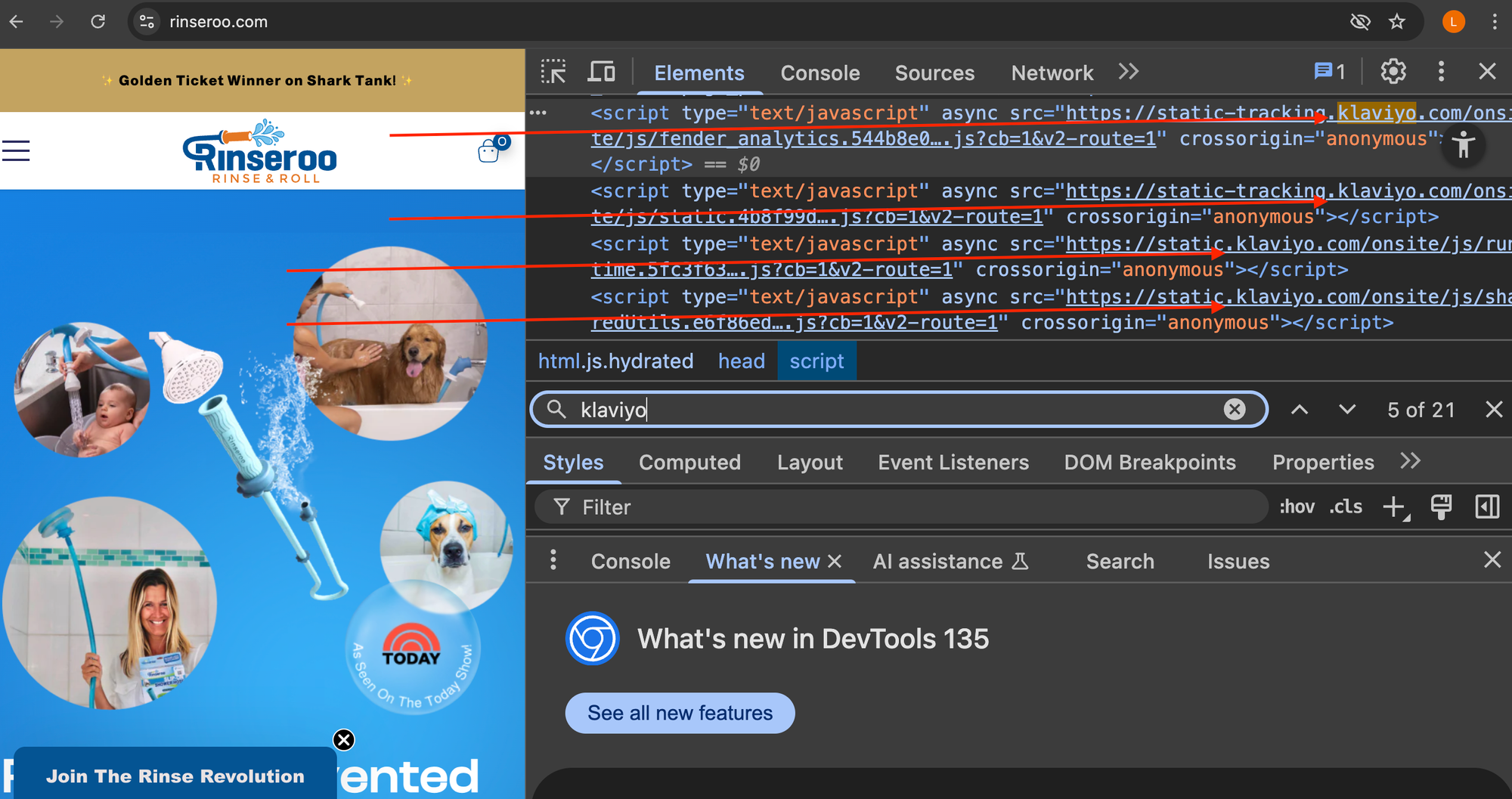

It's very simple to evaluate whether an e-commerce merchant is using Klaviyo through one of two simple methods.

1) Right-click on the website's page, then hit "Inspect" in most browsers and see whether Klaviyo is present on the page.

2) Sign up for a marketing email list on an e-commerce website and see whether the emails you receive are coming from a Klaviyo domain, as most Klaviyo customers share email pools.

Let's look at some cases of Klaviyo customers among the more shared articles and pieces from the past few weeks.

Klaviyo Customer Busy Baby: Starting a GoFundMe to Finance Continued Operations

Over 1M views of this Klaviyo customer's struggles to stay afloat have been seen across social media and television, from local news to CNN.

Klaviyo Customer Pashion: An Open Letter Begging the Trump Administration to End Tariffs

In a widely circulated LinkedIn post, Pashion Footwear CEO Haley Pavone begs the Trump Administration to reconsider closing the de minimis loophole, as this will destroy her ~$9M gross revenue, ~19% EBITDA footwear business that sources from China.

According to Ms. Pavone, approximately 30% of Shopify businesses rely on the de minimis loophole staying open. The full open letter, unedited, is below:

April 28, 2025

Dear President Trump, Vice President Vance, and Honorable Members of the Administration,

My name is Haley Pavone & I am the Founder/CEO of Pashion Footwear - a registered Delaware C Corporation with 12 employees (all US citizens, 11 of whom are women). I am writing to you on behalf of small businesses, like myself, who utilize Section 321 de minimus value imports as a way to further reinvest in the growth of our American Dreams.

I invented my Company’s core technology - fully convertible high heels that turn into flats - when I was a 20 year old Junior in college at California Polytechnic State University-San Luis Obispo (I am a proud recipient of an entirely public California school education). It took 2.5 years of R&D and supply chain sourcing to make our technology possible - an innovative tech that requires precise injection molding in conjunction with craftsman footwear assembly. These two manufacturing methods only co-exist at scale, currently, in China.

We launched the brand into the market in June of 2019 and, since then, have weathered a series of challenging events that have tested my & my team’s resourcefulness, creativity & resilience. In spite of the first trade war, the pandemic, the supply chain crisis, and the recession occurring in succession during our first 5 years on market - I’ve been able to build out my American Dream. Today, Pashion is a profitable growth business. We grew top line 85% in 2024 to $9M in gross revenues, and achieved a 19% EBITDA - nearly double the industry average for footwear.

Our success has been hard fought. Our growth and profits are a direct result of the textbook American Entrepreneurial spirit.

I cannot emphasize enough that the current breadth and speed of policy changes stands to absolutely gut, seemingly overnight, everything that I have worked so hard to build. The same is true for thousands of other businesses like mine.

I can appreciate the Administration’s desire to onshore more of our manufacturing. However, the simple fact is that supply chains do not grow overnight. Speaking to my own industry, building out a high-end technical footwear manufacturing facility in the USA would take 3-5 years and tens of millions of dollars that a company my size simply does not have.

That leaves us with the option of trying to move from China to another country - however, not all countries are created equal when it comes to the facilities, materials, and labor at their disposal.

For instance, in Vietnam - we would be forced to adhere to minimum order quantities per style of 3000 pairs - due to increased overhead in the country caused by less technical labor and no domestically available material sourcing. Comparatively, our suppliers in China only enforce a 200 pair minimum. This jump would represent hundreds of thousands of dollars per purchase order that we, again, simply do not have.

Similarly, in Brazil - while they are more flexible on minimum order quantities, their facilities use equipment that is different than the equipment readily available in China. Attempting to move to Brazil would entail us abandoning the ~$400K worth of molds & tooling we have created custom for our unique product, and then paying ~$400K to reopen a new set to meet the spec of the Brazilian equipment. Again, this is money that we simply do not have.

I could regale you with similar stories pertaining to attempting moves to India, Malaysia, Thailand, and more - but at the end of the day, all are a moot point. Industries like footwear have a 4-6 month lead time on shipments. Even if I was able to source a new non-Chinese supply chain within the next few months - my Summer shipment is already on a ship. My fall shipment is 60% through production in China. My holiday order must be placed next month in order to stay on track - and given that it took 2.5 years to source & train our current supply chain, it is not reasonable to assume a transition can occur before that order must be placed. In the extremely optimistic scenario that a change could be made by Spring of 2026, I would still be paying tariffs for the next 9 months at minimum - suffering even while actively working to adapt to these new policies.

Now, to the tariffs. Product based businesses are fundamentally built on product cost. Our cost determines our MSRP. The difference between the two determines our operating margin - how many people can we hire, how much can we spend on marketing, etc.

The current compounding tariffs would, overnight, raise my tariff rate to over 200% per shoe. For my knee high boots, for instance - they cost $50 to make. I am able to sell them for $200. When these tariffs hit, suddenly - that shoe will cost me $150 to make. This puts small business between a rock and a hard place - do we not raise prices, and gut our own margins - limiting our ability to keep our team members employed? Or, do we raise prices, and hope our customers keep buying at double the price? Neither scenario is a good one.

Small business owners are faced with a question: what comes first, the execution of a complex supply chain move, or the bank account hitting $0?

This brings me to Section 321 de minimis value. Ever since the first trade war tariff hike in 2019, we have been proud to use this exemption. It is, without question, the smart business move for any D2C operation - and, it is an exemption with tremendously beneficial trickle down effects to American businesses, American people, and to the US government.

The use of Section 321 allows us to ship to our US customers duty-free, essentially experiencing a true “free trade” effect. This creates three main benefits that should not be ignored:

1. We are able to provide better pricing to our US consumers than to consumers from any other country

2. We are able to have stronger operating cash flows - which in turn allows us to create more US jobs & fuel more growth

3. That additional growth and cash flow = additional profits, increasing our Corporate federal income tax base. Because of 321, Pashion paid our first ever federal corporate income tax in 2024 - something that we were proud to do and achieve as a corporate milestone

Of course, I appreciate that as with any system, there can be abuse. It is not a secret that Chinese-origin dropshippers - such as Temu and Shein - have exploited Section 321 to take advantage of points 1 & 2, but then being of Chinese origin, they do not participate in point 3. It is completely fair to take issue with that as the US government - these companies make large profits off the US consumer, and the US government is entitled to their share.

However, I must humbly ask that you not ignore the fact that entities like Temu & Shein are far from the only corporations utilizing Section 321. Approximately 30% of top Shopify brands and 4 million daily packages rely on this exemption. Its removal would disrupt operations, strain U.S. Customs, and erode the competitive edge of American companies.

I respectfully propose a balanced approach to preserve Section 321 with modifications that align with your goals while supporting small businesses - immediate concepts that come to mind:

● Restrict eligibility to importers with a valid U.S. EIN.

● Limit exemptions to industries without short-term domestic manufacturing options (e.g., footwear, apparel).

● Cap eligibility at businesses with fewer than 100 employees as of year-end 2024

● Introduce a “Section 321 permit” combining these criteria to ensure compliance

Of course, these are just ideas from the desk of one small business owner - but my goal in this effort is to illustrate potential options that could both meet your goal of regulating Chinese drop shippers, while continuing to empower US small businesses to grow and profit.

I support the long-term vision of right-sizing trade deficits, but urge a phased approach. Establishing U.S. manufacturing infrastructure and training a skilled workforce will require years and significant investment. Small businesses must remain viable during this transition to maintain competitive pricing, employ American workers, and contribute to the tax base.

The uncertainty of the current trade climate threatens the survival of countless small businesses—the backbone of our economy. Every day that this trade climate continues, successful small businesses are faced with unjust insolvency.

I respectfully request your consideration of these proposals to protect American Dreams like mine while advancing your policy objectives. Thank you for your time and leadership.

Respectfully,

Haley Pavone

Founder & CEO, Pashion Footwear Inc.

As we can see from inspecting Pashion's website, they too are an active Klaviyo customer that will likely fold as the business model simply does not work without huge gross margins and the de minimis exemption in place.

Klaviyo Customer Helen of Troy (NASDAQ: HELE): Suspended Fiscal Guidance, CEO Suddenly Parted Ways on Friday

One of Klaviyo's marquee customers featured in case studies and press releases is publicly traded Helen of Troy, a rollup of brands ranging from Osprey backpacks to Hydro Flask drinkware to OXO kitchen gadgets.

On Friday, May 2, 2025 Helen of Troy announced the immediate departure of CEO Noel Geoffroy.

Helen of Troy has suspended fiscal 2026 guidance given their inability to predict revenue and possessing a supply chain tied to China and Asia.

Per Klaviyo marketing materials, Helen of Troy has been in the process of moving some of their brands email marketing over to Klaviyo in recent quarters.

Klaviyo Customer Rinseroo: "From Thriving to Barely Surviving"

Rinseroo makes simple hose and shower attachments for grooming pets and was recently featured on Shark Tank.

Per a Business Insider article from just over a week ago, Rinseroo's CEO is struggling and she has even described her ~$5M/yr. gross revenue business as going from "thriving to barely surviving" as she manufactures in China and her business model won't work without this cheap manufacturing.

@rinseroo From thriving to barely surviving. Tariffs are killing small businesses like mine. #savesmallbusiness #tarifftrouble #smallbizowner #unfairtrade #rinseroo

♬ original sound - Rinseroo™

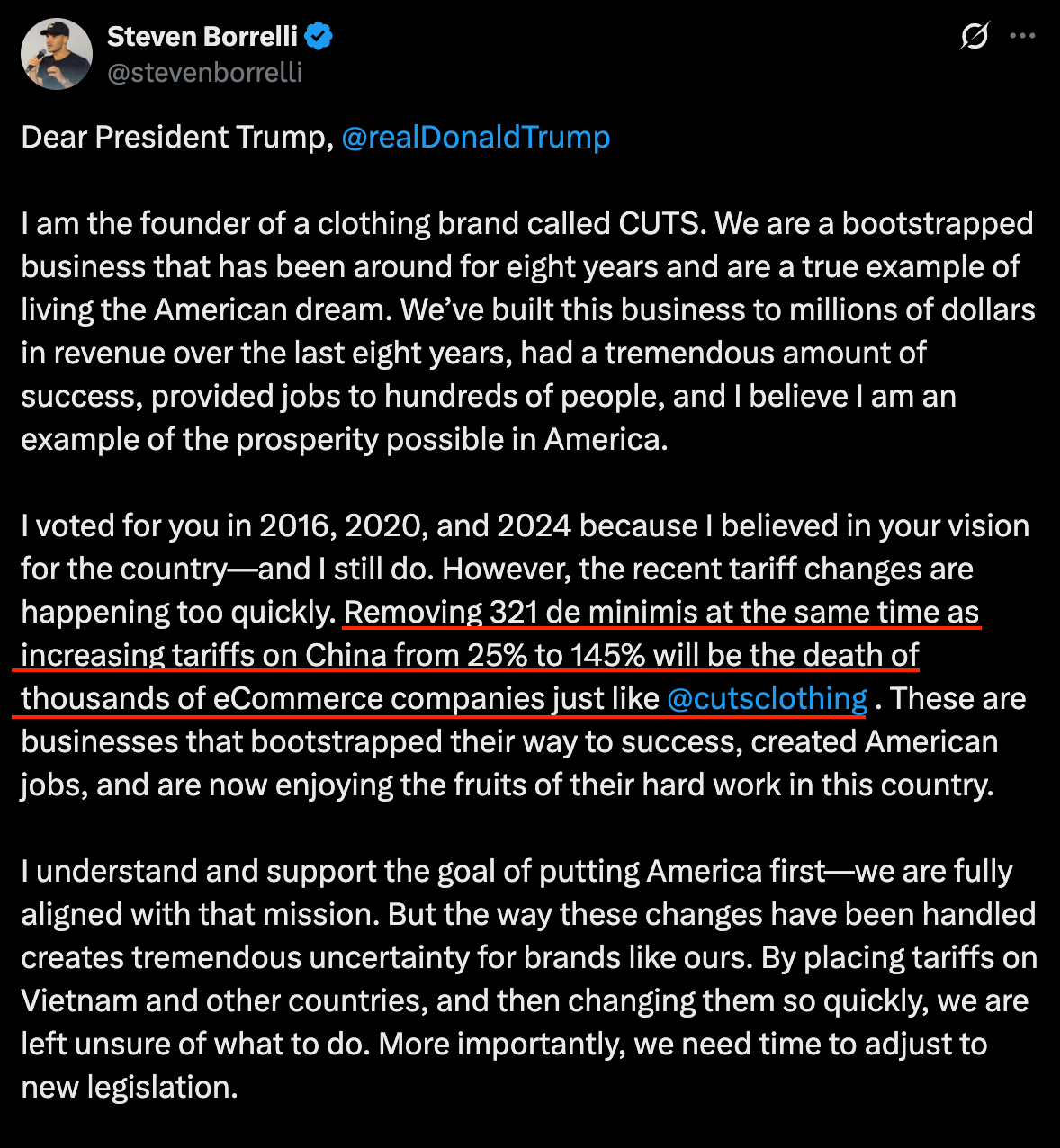

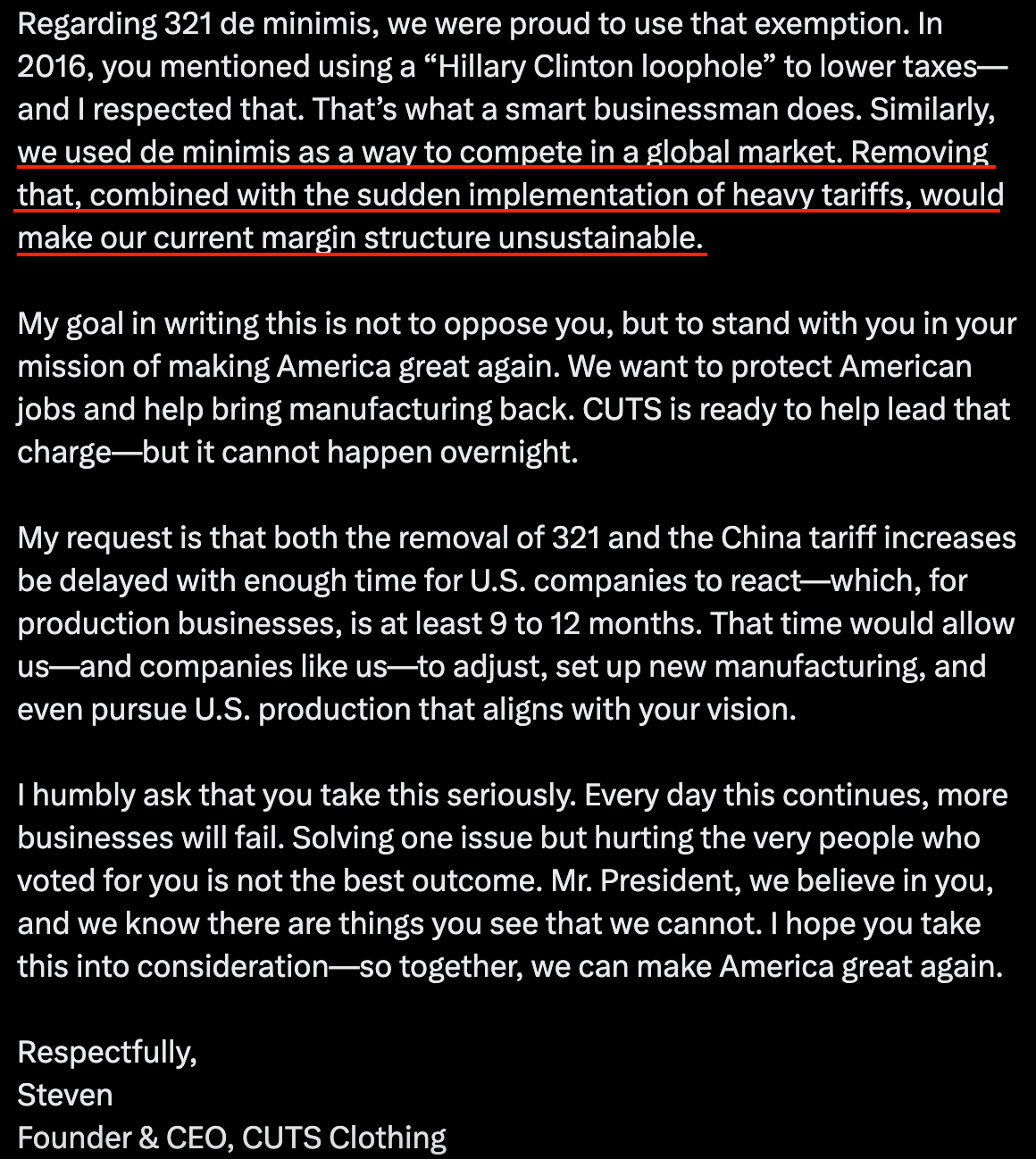

Klaviyo Customer CUTS Clothing: Removing 321 de minimis Will be the Death of Thousands of e-Commerce Companies

This April 16, 2025 X post has over 2.4 million views through May 4, 2024. Source: https://x.com/stevenborrelli/status/1912177179552809119

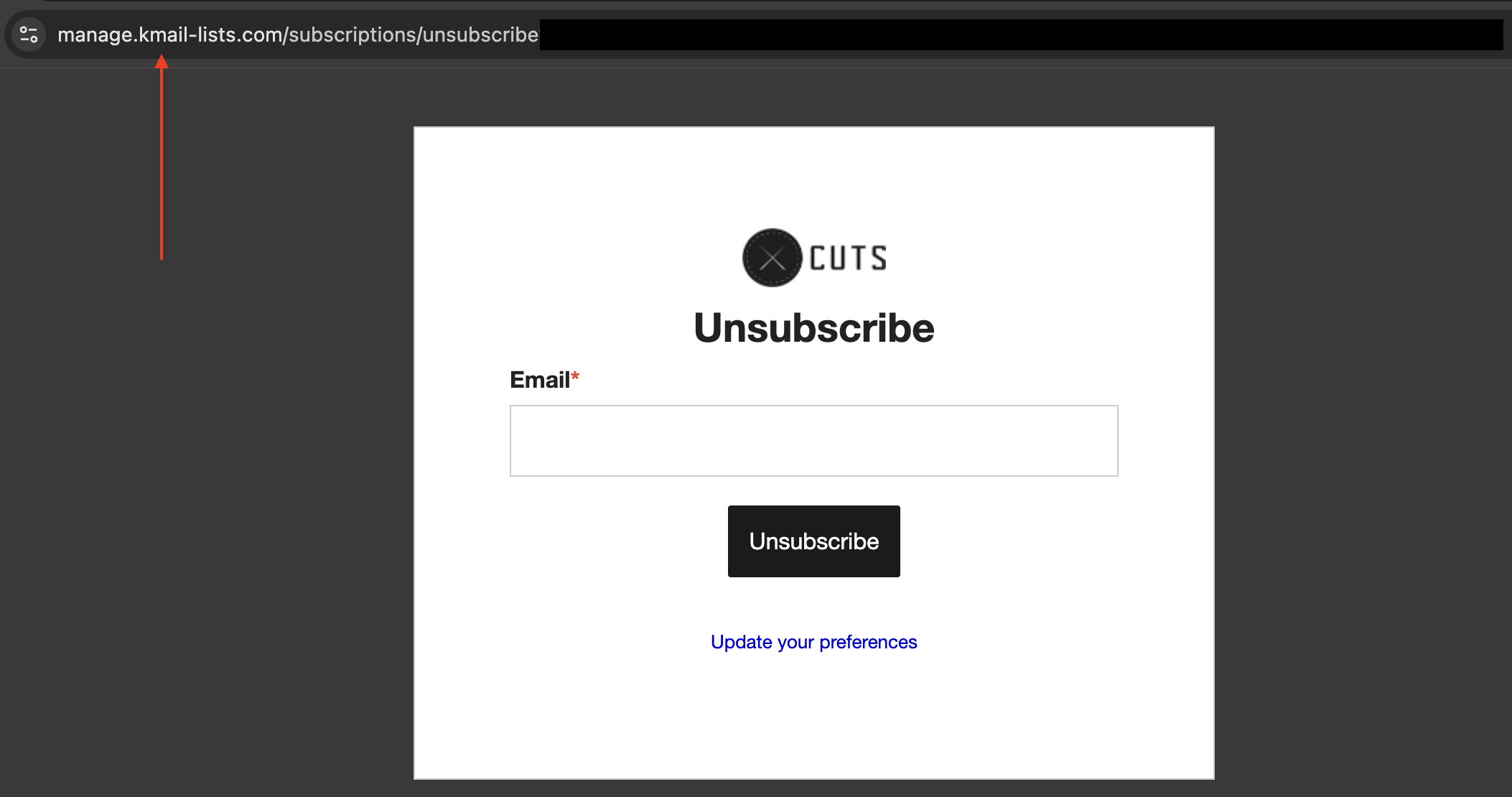

Naturally, CUTS Clothing is a Klaviyo customer, which we can see after signing up for their email marketing offers, then unsubscribing from our email inbox which directs us toward Klaviyo-owned kmail-lists.

Klaviyo Customer Understance: Suspending US Shipments Indefinitely

Canadian lingerie brand Understance has suspended shipments to the US altogether indefinitely until there is more clarity about trade laws. Upon signing up for email marketing on Understance we receive emails directed from Klaviyo's kmail-lists, showing us that Understance is in fact a Klaviyo customer.

Understance is one of the many e-commerce businesses relying on the de minimis loophole staying open to avoid tariffs altogether. It doesn't matter whether tariffs are 25% or 50% or 145% because even at 25% it makes the model unsustainable when shipping is based on loopholes waiving duties under $800 in declared value.

There simply won't be much growth in Understance's customer base and there won't be Klaviyo list growth if this company manages to stay afloat.

Klaviyo Customer Anbernic: Suspending US Shipments Indefinitely

According to The Verge Chinese game console maker Anbernic has suspended US shipments.

Naturally, Anbernic is a Klaviyo customer and they collect emails and grow their Klaviyo list size through coupon offers. That growth is gone indefinitely for the US market.

Klaviyo is Uniquely Exposed vs. Shopify and Similar e-Commerce Software Vendors

While conventional thought may point to Shopify as the best short on Chinese garbage e-commerce, this is incorrect for several reasons.

1) Klaviyo is nearly entirely dependent on Shopify for over 75% of the ARR generated in 2024. Shopify is not as dependent on Klaviyo for anything.

2) Shopify has many revenue streams from licensing, partnerships, merchant services, and subscriptions. Klaviyo is an email service provider that was built on Twilio SendGrid's API network.

3) Shopify is the center of an ecosystem, a hub, while Klaviyo is merely a satellite of Shopify's ecosystem. Klaviyo not only competes with email and messaging competitors like Omnisend, Yotpo, MailChimp, Constant Contact, Braze, and dozens of other services, but Klaviyo also competes with Shopify's own very cheap email service and Klaviyo competes directly with Twilio's SendGrid in larger accounts even as Klaviyo was built using SendGrid under the hood.

4) Klaviyo's recent pricing model changes in Q1 of 2025 was merely a short-term parlor trick to put revenue on the board for Q1 2025...and then tariffs and the end of the de minimis exemption happened.

It's no secret that e-commerce and retail see the highest volumes of digital spend and email/SMS activity during Q4 holiday shopping season. Klaviyo even makes note of this in their disclosures.

Coming into 2025 and facing a flat-to-declining consumer discretionary growth environment independent of US trade policy, Klaviyo decided to enforce a mandatory pricing model change from February 18, 2025 on.

It is very obvious that this pricing change was put in place to boost revenue not only in Q1 2025 but to keep revenue boosted until Q4 2025 by smoothing out some of the Q4 seasonality associated with charging legacy accounts grandfathered in on email sends instead of the new model of charging on active profiles (email list sizes). A Klaviyo customer needs a PhD in Used Car Sales to even understand these pricing changes and retroactive discounts.

Conclusion

You can't be half pregnant or half dead. You are either pregnant or not pregnant and you are either dead or not dead.

It does not actually matter for the majority of Klaviyo whether tariffs applied to China and Asian countries are 145% or 80% or 45% or 30% because these business models fall apart entirely at any rate above around 20% and they fall apart with the de minimis loophole closed. Many of these Klaviyo customers only exist because of this loophole going from $200 to $800 in 2015, which coincided with the growth of the Shopify ecosystem. This business model of extremely high gross margins from Chinese imports offset by thin operating margins and profitability metrics with thousands of vendors running up digital ad and email spend to fight over eyeballs is a relic of the 2010s that would have died by 2022 if not for COVID.

Klaviyo has had ample opportunities to derisk and position itself as a more general purpose email solution with less exposure to Shopify, yet in the nearly 2 years since IPO Klaviyo still does ~78% of its ARR via the Shopify ecosystem.

As Shopify sees increasing pressure, they will likely boost their own email offerings and begin to deprioritize Klaviyo among more customers. As Klaviyo is reliant on Twilio SendGrid, Twilio has strong pricing power in offering services to Klaviyo. Klaviyo gets pressure from sides among the distribution and in the infrastructure supply chain and Shopify and Twilio hold the majority of the negotiating leverage.

Even the typically bullish sell side analysts have cut their headroom on KVYO the past few weeks:

- Klaviyo price target lowered to $31 from $45 at Scotiabank (April 24)

- Klaviyo price target lowered to $37 from $54 at Baird (April 23)

- Klaviyo price target lowered to $26 from $45 at Wells Fargo (April 22)

- Klaviyo price target lowered to $35 from $51 at Barclays (April 21)

The Trump Administration is completely serious about keeping this de minimis loophole closed regardless of how broader tariff rates shake out in the coming months.

This is the end of days for tens of thousands of Klaviyo customers begging for money on GoFundMe or selling cheap Chinese plastic dog washing shower nozzles.

________

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. Lauren Balik does not represent the interests of any fund or of any investor other than herself. Past performance is not indicative of future results. This content speaks only as of the date published. Any projections, estimates, forecasts, targets, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.