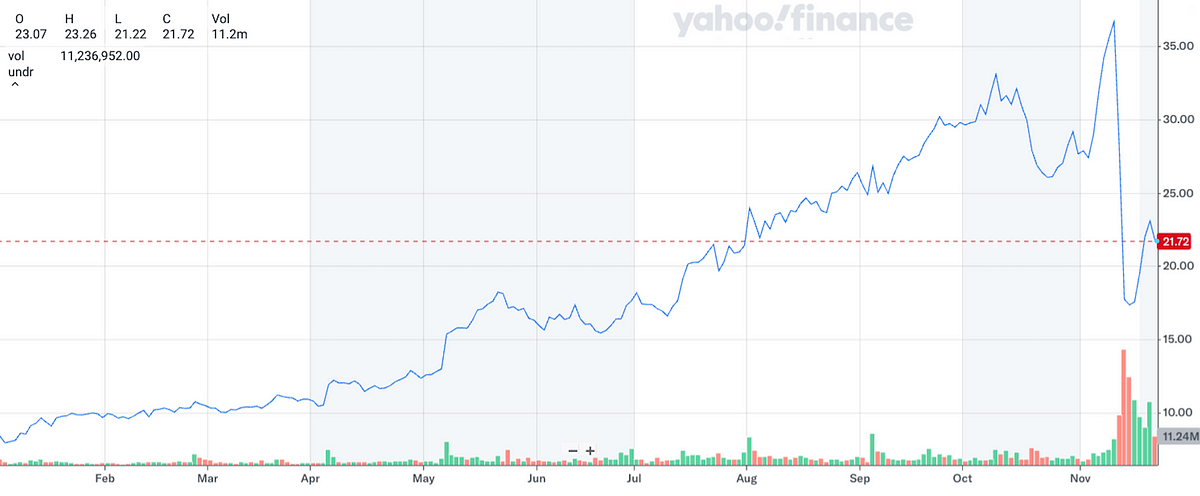

Examining Zeta Global (NYSE: ZETA) Management Lies on Their Recent Media Tour

ZETA is an almost complete scam. Let’s dive in on some outright false statements made by Zeta Global CEO David Steinberg and CFO Chris…

ZETA is an almost complete scam. Let’s dive in on some outright false statements made by Zeta Global CEO David Steinberg and CFO Chris Greiner in the past 10 days. I maintain that ZETA is a Strong Sell.

Background

- On October 11, I discussed how Zeta Global uses low-quality political blogs and election prediction market PredictIt for comments section data collection through the Disqus product and why Zeta Global’s ‘Zeta 2025 Plan’ aligns Zeta equity value to coincide with the 2024 US election cycle.

- On October 15, I discussed how Zeta Global leaked the data of ~15,000 Zeta customers and prospects by failing to secure customer data and leaving it exposed on the open, public internet. We went over how we can use Zeta’s leaked data to proxy which customers are among Zeta’s largest.

- On October 18, Barclays downgraded ZETA, moving the stock rating from Overweight to Equal weight with a price target of $28.00.

- On October 21, I discussed how Zeta Global runs a comically ridiculous business called “Aptroid” and has filled Aptroid’s website with fraudulent marketing claims. We also went over how there is almost nothing at all to Zeta Global’s “AI” story and how Zeta is using Snowflake (NYSE: SNOW) for a white label in addition to reselling Snowflake, thus “double dipping” on customers.

- On October 25, I covered how Zeta Global has been manipulating revenue guidance through creative wordsmithing in order to dupe investors into believing certain election revenue is not cyclical, thus giving a rosier picture of sustainable revenue growth.

Today, we’ll dive into some of the false claims Zeta Global CEO David Steinberg and CFO Chris Greiner have made in the past two weeks on their cover-your-a** tour after ZETA has tanked. I strongly believe they’ve only further incriminated themselves.

Zeta Global Absolutely Operates Sketchy ‘Consent Farms’ To This Day And Here is Proof

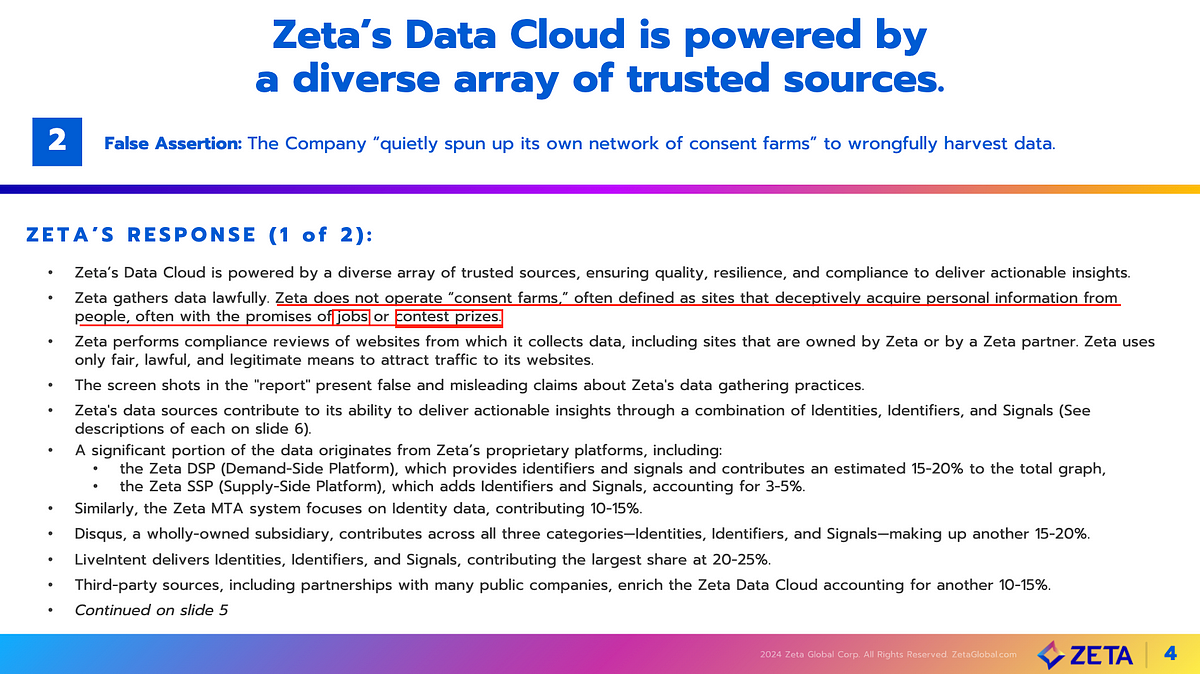

On Wednesday, November 20, Zeta Global published a report on their Investor Relations page titled “Setting the Record Straight” which is filled with outright lies from Zeta Global. This slide deck corresponds with an 8-K filed with the SEC on November 20.

- Zeta Global’s slide deck can be accessed and downloaded here or on Zeta Global’s Investor Relations page here.

- Zeta Global’s November 20 8-K can be accessed directly here or through SEC EDGAR reports.

Pull these up and let’s dive in.

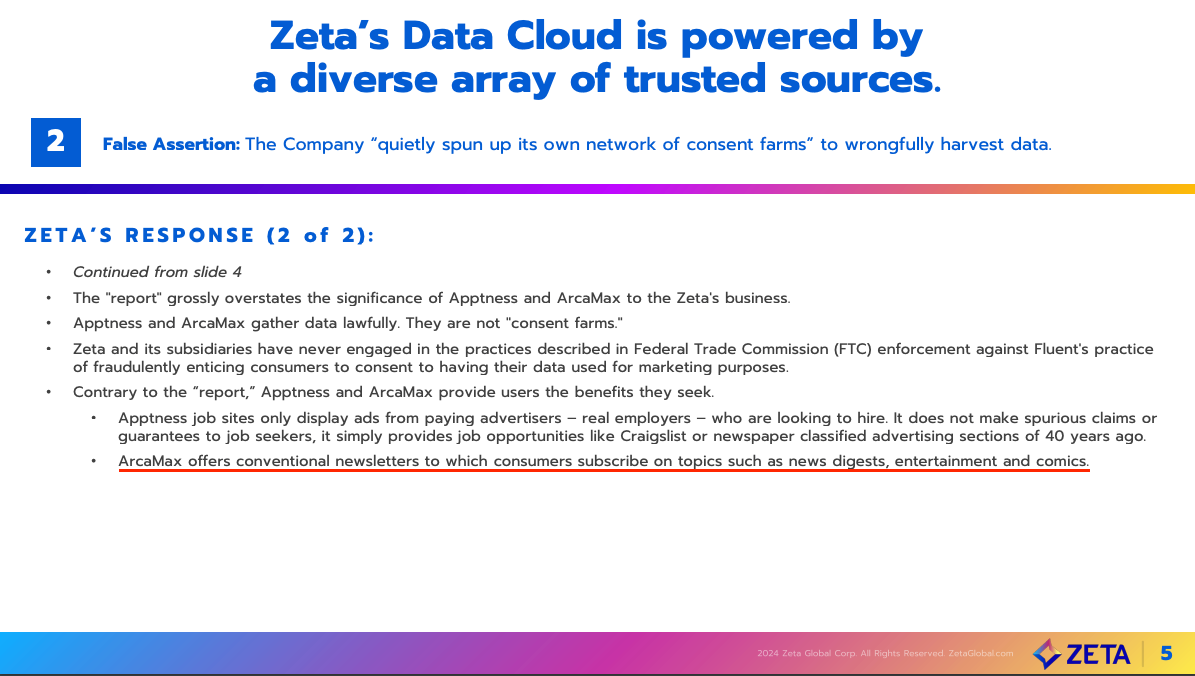

Zeta fraudulently claims on November 20, 2024 that it does not operate “consent farms” which are deceptive sites used to acquire personal information from people, “often with the promises of jobs or contest prizes.”

However, as of November 21, 2024, Zeta does in fact operate sites used to acquire personal information with the promises of jobs or contest prizes.

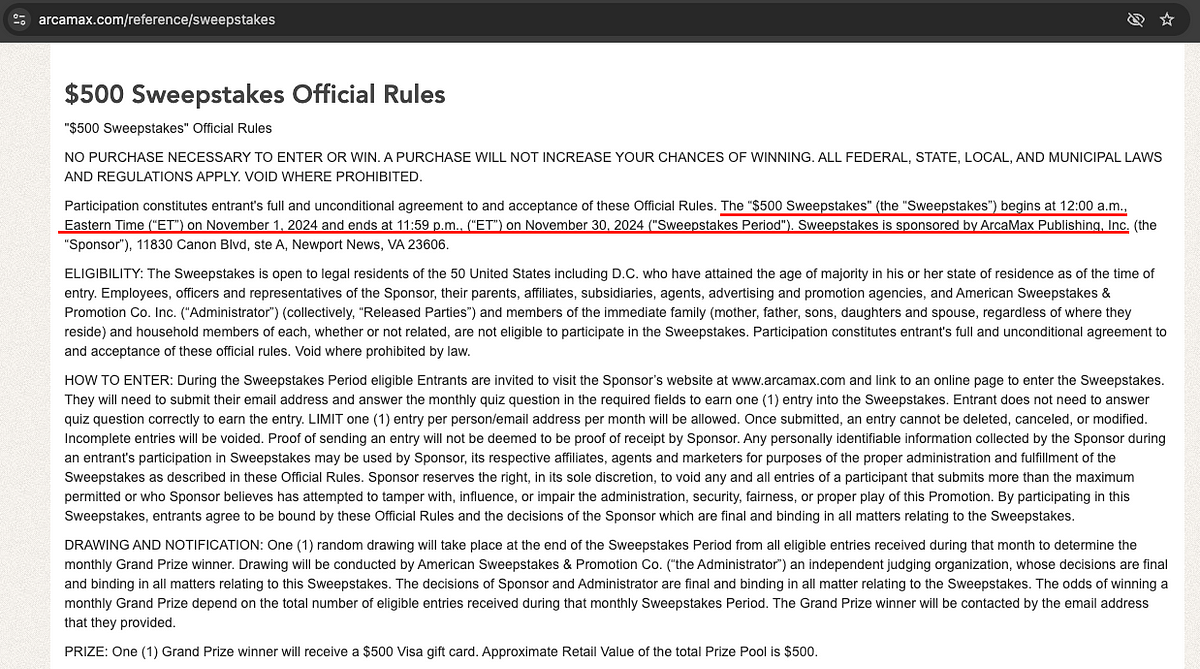

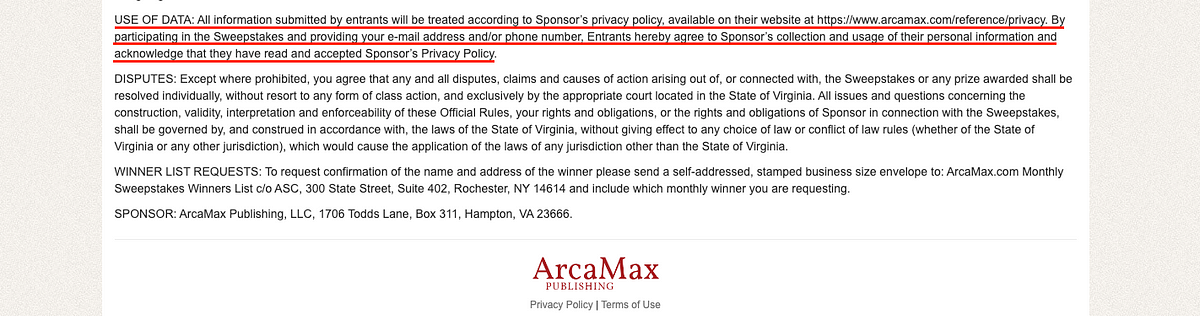

In fact, ArcaMax (owned by Zeta Global) currently has an ongoing $500 Visa card contest prize going on right now, this month for November, and they litter these ads all over the underbelly of the internet.

Simply visit arcamax.com/reference/sweepstakes to see for yourself.

In the event Zeta Global deletes this site, the Wayback Machine Internet Archive has this captured at multiple points in time after Zeta Global’s acquisition of ArcaMax.

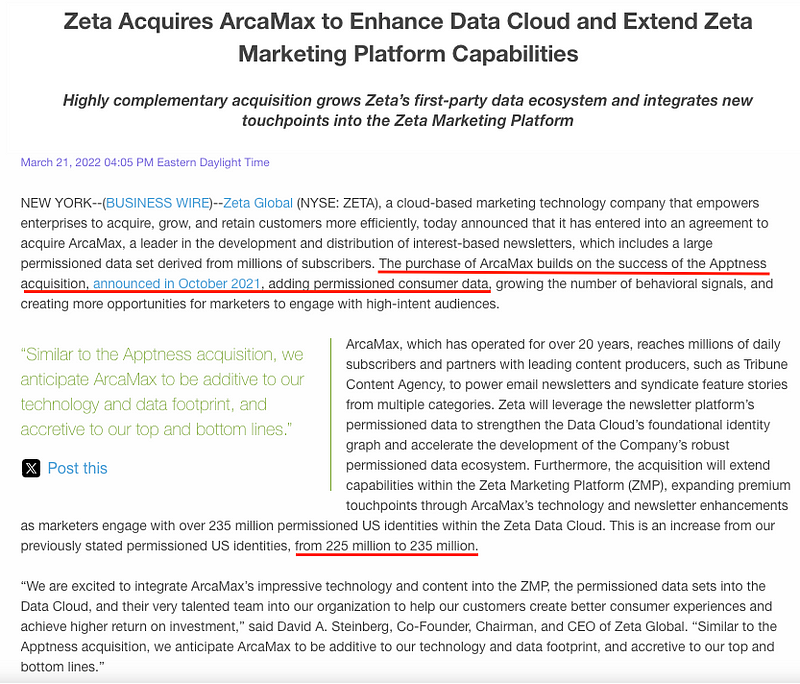

Further, Zeta Global described their acquisition of ArcaMax in 2022 in their press release as an opportunity to add 10 million incremental “permissioned” identities.

Further, Zeta Global’s claims about its company ArcaMax being a newsletter site are false. As seen above, ArcaMax does in fact run contest prizes in addition to operating job boards for hypothetical or non-existent jobs and is used to farm consent into the Zeta Global network.

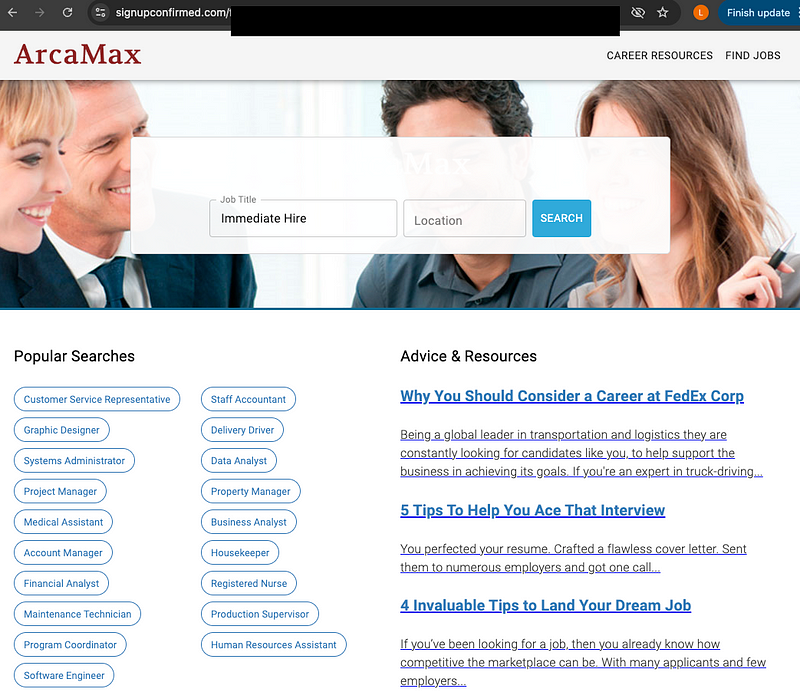

In fact, one of the most egregious examples is signupconfirmed.com which has ArcaMax branding and is hilariously titled in a way that confirms the capture of data — and the actual job site does not even work. The search bar and buttons for jobs do not even work.

There aren’t even advertised jobs — it’s just a sign up confirmation which is why it’s literally called signupconfirmed.com.

Zeta Global’s Lies About Biennial Political ‘Advocacy’ Revenue Guidance on Zeta’s Cover-Your-Butt Tour

One of the core reasons I began posting about ZETA in October, 2024 is because of the discrepancies between “political and advocacy” revenue they release on their annual 10-Ks and the “political candidate” revenue they’ve reported quarterly as a disaggregation all year in 2024, an election year in the US.

The simple fact of the matter is that politicians’ campaigns themselves are only part of the political season spend and in reality all kinds of “advocacy” groups ranging from PACs to special interest groups run ads in political election season.

I wrote about this topic here, published on October 25, 2024.

On Zeta’s quarterly earnings call on November 11, 2024 Morgan Stanley analyst Elizabeth Porter dug into this question about “advocacy” revenue separated from “political candidate” revenue.

You can listen to the call via Zeta’s IR materials or at the YouTube link below, provided by a third party. The question begins at roughly 54:36 in the below video of the November 11, 2024 earnings call.

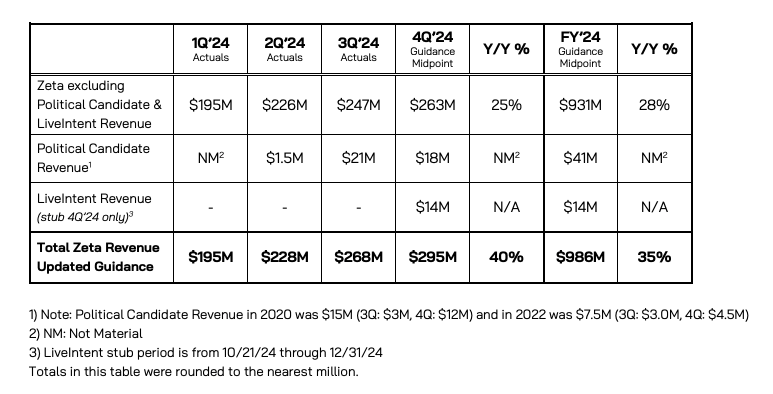

Per Zeta Global CFO Chris Greiner on this call, at roughly 55:30, Zeta “political candidate revenue” in 2024 represents “56% of the total” of political and advocacy revenue, meaning 44% would be left over and represent the “advocacy” portion of this revenue disaggregation.

The question here is how much “advocacy” revenue is being rolled up into the “core” revenue?

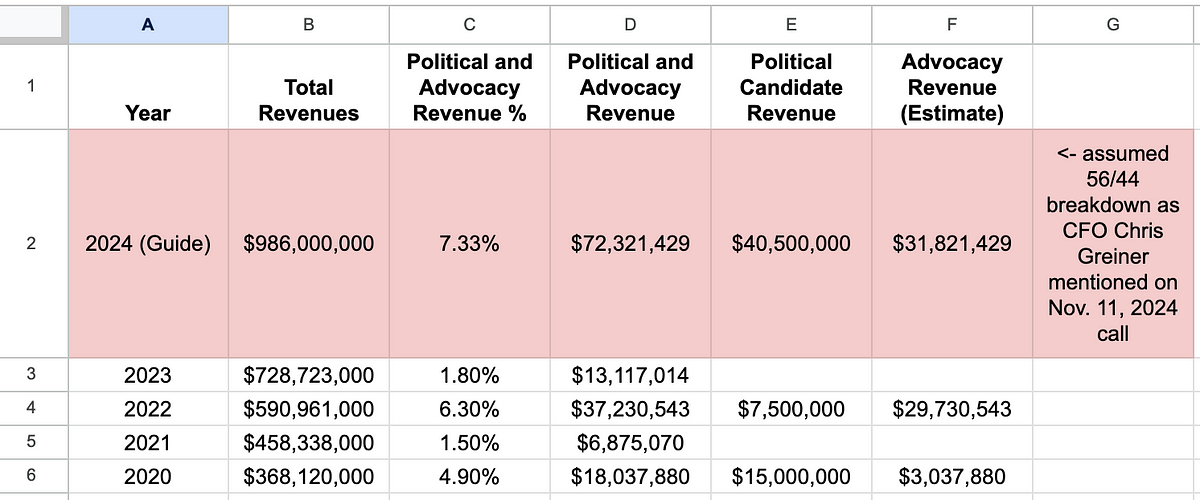

Zeta Global did $22.5M in political candidate revenue through 3Q’24 Actuals which at a 56–44 breakdown corresponds to:

- 2Q’24: About $0.67M in “advocacy” revenue rolled into core

- 3Q’24: About $16–17M in “advocacy” revenue rolled into core

- 4Q’24 Estimate at Guidance: About $14M in “advocacy” revenue rolled into core

We’re looking at about $40.5M in “political candidate” revenue and at a 56–44 breakdown of “political candidate” vs. “advocacy” we’re looking at just over $30M in “advocacy” revenue that’s been rolled up into the core, even though advocacy revenue is as biennial in nature as political candidate revenue.

In fact, historically Zeta Global has done more business with “advocacy” than with “political candidate” revenue.

Let’s break this down. Let’s pull up 3 documents.

- Let’s first pull up the 2023 10-K from SEC EDGAR here which contains “political and advocacy” revenue buried in the NRR calculation.

- Let’s also pull up the 2021 10-K from SEC EDGAR here which contains “political and advocacy” revenue buried in the NRR calculation.

- Let’s also look at the press release from November 11, 2024 corresponding with the 8-K and earnings, available here.

Let’s do a light forensic reconstruction of where ZETA is at.

- Cells B3-B6 are inputs of the reported revenue pulled off the 10-Ks.

- Cells C3-C6 are inputs of the reported “political and advocacy” revenue percentages pulled off the 10-Ks, in the sections mentioning NRR calculations.

- Cells D3-D6 are total revenues * political and advocacy revenue percentages.

- Cells E4 and E6 are inputs of “political candidate” revenue from Zeta’s press release on November 11, 2024.

- Cell F4 is simply D4-E4 and Cell F6 is simply D6-E6, which gives us the “advocacy” revenue part of “political and advocacy” revenue for years 2022 and 2020.

- For Row 2, we’re working off the guidance given from Zeta Global on November 11, 2024 on their earnings and the comment from Zeta CFO Chris Greiner which says 56% of 2024 “political and advocacy” revenue is political candidate revenue.

(Let’s pause here…if you don’t already see the insane amount of “wordsmithing” from Zeta Global management around how they disaggregate revenue as “political candidate” vs. other during the quarterly updates during the year when they disaggregate this as “political and advocacy” vs. other on their annual 10-Ks, I can’t help you.)

On November 14, 2024 Zeta Global CEO David Steinberg and CFO Chris Greiner joined Tom Lee at Fundstrat for a webinar on “recent ZETA price movements” and doubled down on their lies about “advocacy” revenue, in a reference to my earlier post about how they use creative wordsmithing to guide to “political candidate” revenue during the 10-Qs during the year but report on “political and advocacy” on the 10-Ks.

You can watch these Zeta Global lies below.

- At about 27:25 Tom Lee at Fundstrat asks Zeta CEO David Steinberg and CFO Chris Greiner about the nature of political revenue.

- At about 28:15 David Steinberg pretends like he doesn’t know about this “other category” of advocacy revenue (political season revenue not directly from political candidate campaigns).

- At about 29:15 David Steinberg begins stating that advocacy is always on, while political is “one time in nature.”

However, this is a load of baloney from Zeta Global CEO David Steinberg. Above, a few paragraphs up, I just demonstrated how Zeta’s “advocacy” revenue is biennial in nature as it also aligns with election cycles and in fact in 2022 this “advocacy” revenue was apparently more than even the “political candidate” revenue.

It’s all lies and obfuscation from Zeta Global.

You can watch David Steinberg and Chris Greiner on this Tom Lee Fundstrat interview conducted on November 14, 2024 here.

***I encourage you to watch this webinar from November 14, 2024 from about 27:25 on and reconcile David Steinberg and Chris Greiner claims with my above analysis. It is clear they are rolling this “advocacy” revenue from PACs, special interest groups, etc. up into their core revenue even though this revenue is cyclical and “one-time” in nature.***

Conclusion

Zeta Global management has only further dug themselves into a hole long-term by further lying about the things I’ve posted about in October, 2024.

Zeta Global, through its ArcaMax properties, is absolutely a “consent farm” that is not only running a sweepstakes right now at this very moment, but also has fake job posting websites to prey on job-seeking citizens who submit their personal data in hopes of a job, which is then entered into Zeta Global’s identity graph even though there never was a real job in many cases. I’ve proved above that this exists on Zeta Global properties as of November 21, 2024 even as Zeta Global stated in SEC filings and on their IR site that this is not the case as of November 20, 2024.

This is securities fraud from Zeta Global management. Zeta Global has now made false statements associated with filings with the SEC.

Zeta Global purposefully misguides investors to “political candidate” revenue throughout intra-year quarters even though they report on “political and advocacy” revenue on their annual 10-Ks. Zeta has lied about this even as recently as last week.

This is securities fraud from Zeta Global management. They are obfuscating their revenue guidance in order to promote “growth” of revenue on this stock promotion.

I maintain that ZETA is a Strong Sell even as their executives buy back stock and continue on their CYA media tour. This is a near complete scam. This company is merely a lead list generator and they generate leads from the sketchiest possible sources and are now lying about it on SEC filings and in IR materials.

________

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. Lauren Balik does not represent the interests of any fund or of any investor other than herself. Past performance is not indicative of future results. This content speaks only as of the date published. Any projections, estimates, forecasts, targets, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.