NRR Rules Everything Around Me

Lessons from the Last Few Months of NRR Adventures on the Data Cloud

I write this blog post from my bunker in an undisclosed location. NRR in and around Snowflake and the broader Data Cloud world is going bananas, but we have collectively learned some great lessons here in the past few weeks.

Like I said back in May, Snowflake’s waning NRR is going to make everything crazy.

This one single metric of Snowflake NRR tailing off makes all of Snowflake’s partners driving up consumption (“The Modern Data Stack”) go nuts, as they themselves are also facing an exhausted TAM and therefore they themselves need to up prices to meet their revenue expectations, as many are valued in the billions or hundreds of millions without the revenue to justify these valuations.

What we’re learning here as customers is a battle plan, a course of action. We’re sharpening up tactics. We’re learning strategy. The rent-seeking is only going to continue.

The Customer CFO and the VC/Cloud Machine have never been further apart, and it’s up to you to figure out which side you are on.

Lesson 1: Collective Bargaining Against dbt Labs ‘Model-Based’ + Seats NRR Gouge Worked

On August 8th, dbt Labs quietly announced a pricing change in which new dbt Cloud customers would pay for both seats + the number of SQL models successfully built via dbt in a given month, with existing customers transferring to the new pricing in the future.

Then, by Friday, August 11th, another change went out on the website, again changing new pricing to reflect even fewer free models per month than what was communicated the prior few days.

No communications, just changing pricing around late on a Friday evening after an uproar.

Then, as of last week, existing dbt Cloud customers were notified that they would be “grandfathered” into the seats-only pricing model they had been paying all along and would not face additional costs from dbt models built.

Why did dbt Labs renege on their dbt Cloud pricing change?

The answer to this is simple: enough current customers and users of the core product shared their knowledge all over Twitter, LinkedIn, and other social media.

People shared tips about how to move off dbt Cloud and host dbt Core.

People complained about how ridiculous it is that dbt Labs for years has promoted breaking down data schemas into small pieces and now they’d be charged for following dbt Labs’ recommendations.

I made a blog post about how dbt Labs is so far away from any revenue number that makes sense for them to be able to exit the company, and that it is in the best interests of dbt Cloud customers to defect now, as dbt Labs will just raise prices again in the future after this pricing round. They’re just too far away from any number that makes sense.

See, it’s not enough to just say, “I don’t like dbt Labs increasing pricing on me” or “this hurts my feelings” or anything like that.

You need to make them do math.

You need to have current dbt Cloud customers start casually interacting with content that shows that dbt Labs will churn a number of existing customers.

You need former dbt Cloud customers to share content about how it wasn’t that hard to switch off dbt Cloud to dbt Core, and that it’s fairly painless.

You need people to start having distributed community conversations, on Twitter, on LinkedIn, away from “data community” Slack groups which are all run by dbt Labs and various investors.

This shows them how they will bleed out revenue.

We did it, but only because many people moved together.

We forced a hand, at least for now, and dbt Labs is, for now, reneging, at least on their existing customers.

The damage is done, however. What the last 3 weeks showed is how poorly dbt Labs thought about and executed on their pricing change. Customers will and already have made plans to churn off dbt Cloud given the circus and lack of communication and lack of transparency.

dbt Labs didn’t do right by the Customer CFO. The Customer CFO can see right through these pricing games, and now dbt Labs will pay for it, and their attempts to take huge amounts of NRR off existing customers backfired.

They just opened Pandora’s Box. Now, what every dbt Cloud customer should be doing is negotiating down, hard, on renewal. dbt Labs showed how desperate they are. If you have a $50k a year contract, for example, now is the time to renegotiate that to $25k or you’ll walk. Or better yet, just churn anyway.

Again, if everyone does it, then they’ll have to acquiesce to you because their sales org is bleeding out. Any customers left behind will pay even higher costs.

Lesson 2: Fivetran Has Churn Problems, Took Debt, and is Likely Going to Increase Prices Again as Well

The next shoe to drop is likely to be Fivetran. When I say Fivetran here, I mean Fivetran, the company that operates the Fivetran product in addition to HVR, which they acquired.

I’ve churned customers off Fivetran. Other people are churning off Fivetran.

Some people are actually — gasp — going into Fivetran and realizing that of the 500 tables they replicate over to Snowflake from their application engineering team’s Postgres read replica, they only actually use data from 30 tables in any actual outcome, so they are turning Fivetran replication off for 470 tables. Why be charged extra for nothing?

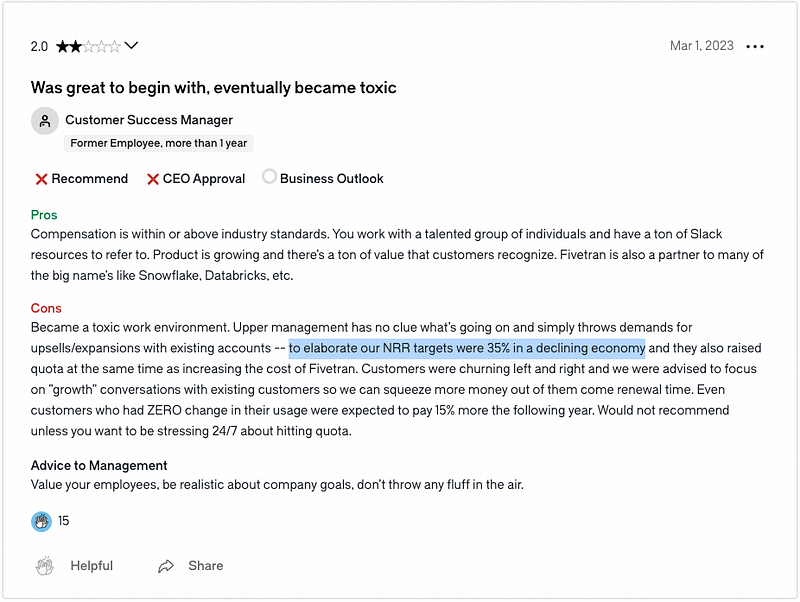

I love talking about NRR with regards to Fivetran simply because of how ostentatious it is that their CEO George Fraser writes blog posts about NRR and how “Positive NRR is equivalent to a higher customer value” when months later after they’ve churned out a bunch of customers, a former employee on Glassdoor talks about 35% NRR targets and squeezing more money out of customers.

I even wrote up my own counter to the Fivetran NRR piece last year.

So, if:

- Customers are churning left and right

- Reps aren’t hitting their 35% NRR quota

- Fivetran is valued at over $5B with annualized revenues in the $200Ms

then what does that mean?

Well, it means they are going to have to raise prices on you, the existing customer, because they aren’t landing new accounts at the same clip they once were as TAM exhausts, and they are churning customers.

What makes this even more fun is that Fivetran announced a debt raise. This means going forward, every customer that churns and every cash flow taken off the books gets Fivetran closer and closer to taking debt and tapping into it.

Once they are bound by debt covenants with Vista, they are going to have to fire employees, raise prices on existing customers, or a combination of the two. It has to happen. They have to kill their burn to preserve capital, increase revenue through gouging current customers, or both.

No equity investor is going to come on after this debt. So there’s no cavalry coming for Fivetran, at least not now. They can no longer keep 1000+ employees and prices where they are, so they’re going to make you pay more.

Just like with dbt Labs, it’s best to get out now. There are ample solutions out there that do exactly what Fivetran does for much cheaper and often better latency, plus there are many solutions that allow the customer to shape and transform data before putting it into the destination.

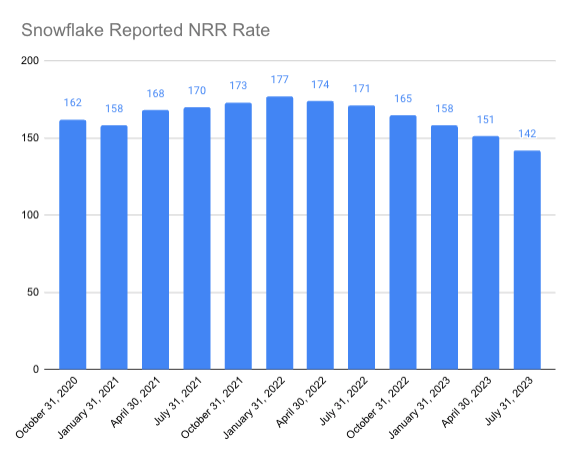

Lesson 3: Snowflake’s NRR is Spiraling Down

What many casual equity investors don’t realize is how Snowflake’s NRR actually works.

- It’s based on consumption revenue, at accounts that have commitments.

- It’s a lagging indicator, especially given the overspend in 2021–2022.

The question here is, where is the trough? In the 130s? 120s? 100?

There is absolutely nothing here that indicates to me that Snowflake’s NRR can’t drop to 125 or 120 by the end of January 31, 2024. There are still so many optimizations and churn that have occurred this year that are not yet fully reflected in NRR Rate as Snowflake reports it.

You’re looking at two windows with Snowflake NRR Rate. The denominator is consumption from 5–8 quarters ago. The numerator is consumption from 1–4 quarters ago, of customers that are in the denominator.

There’s been so much optimization plus churn to Databricks or Google Cloud/BigQuery this calendar year that the NRR Rate metric Snowflake reports is not yet even reflecting the customer savings. The denominator still has the before times of overspend on Snowflake in it, and the numerator is not yet reflecting forward revenue at these accounts due to all of the optimizations.

Why is this Important?

How low Snowflake NRR goes tells you how insane the rest of the data vendors that spin consumption are going to behave. See, when Snowflake NRR gets too low, they rely on all of their vendors that spin lots of consumption to help pick up the slack. This is where we are at now.

Additionally, if NRR is this low, what exactly is Snowflake’s GTM org doing? A number of reps there are compensated on NRR expansion, and if NRR is this bad, it says many reps are going to come in under quota. Some may even be under 100%.

This is important because it’s the dawning of The Age of the Customer CFO on the Data Cloud. See, you’re actually in charge here, even though the vendors put on nice conferences and give you bucket hats and socks and fancy dinners.

There’s too much information out there now about how to negotiate with vendors, how to save money today, how to save money tomorrow. People who didn’t know what partitioning or indexing was in databases yet made 5000 dbt models in 2021–2022 are now learning about partitioning and indexing.

Snowflake is big enough that even as their NRR tails off, they have enough cash to make more bets in the future. Fivetran is about to tap debt, so they’re screwed. dbt Labs can’t even make pricing changes properly in front of some publicly traded and very large customers, so they’re screwed. Nobody has time for the silliness.

The Age of the Customer CFO on the Data Cloud is upon us. Negotiate with vendors like your life depends on it. Cut back on your 5000 dbt models. Reduce sprawl. Maybe consider flat rate vendors, or vendors that charge on real things, not on # of SQL models like dbt Labs or Monthly Active Rows like Fivetran.

The longer you put off containing sprawl, the more you’re going to get price gouged because all of your cohorts at other companies managed sprawl and you didn’t so now you get to pay your vendors markups. It’s not only coming, it’s already here.

Don’t get left behind with the vendor cultists and developer advocates. Let them burn while you enjoy bliss with your CFO.